Ahead Today

G3: US: mortgage applications, ADP employment, trade balance, ISM services index; euro area composite PMI

Asia: Philippines CPI, China Caixin PMI, Indonesia Q4 GDP, Singapore retail sales, India PMI

Market Highlights

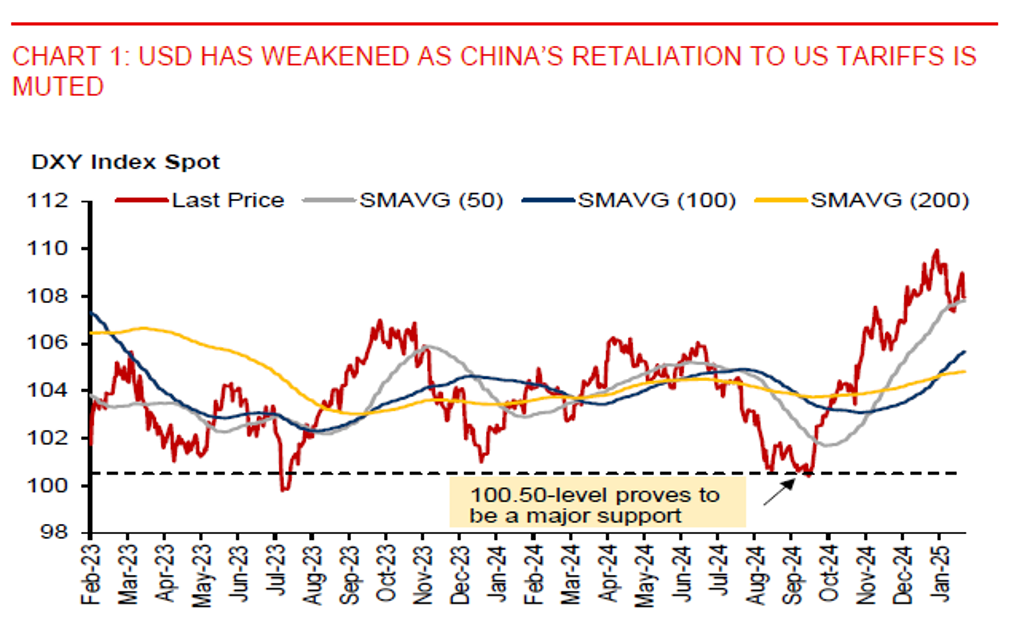

President Donald Trump has flip-flopped on his tariff plans. He had announced 25% tariffs on imports from Mexico and Canada on 1 February, only to pull it back shortly after and to delay its implementation for a month. This, along with a softer JOLTS jobs opening data (7600k in December vs. 8156k in November), have weakened the US dollar (-0.9%). The latest decline in the US dollar index (DXY) marks the second largest daily fall since 21 January, when DXY fell 1.2% as Trump stopped short of imposing tariffs immediately after his inauguration.

However, more tariff actions could still be in the pipeline. Trump’s 10% tariffs on all Chinese imports (worth about $525 billion) have come into effect today. In retaliation, China has imposed targeted tariffs on $14 billion worth of imports from the US. This will take effect on 10 February. The targeted response includes a 15% tariff on coal and LNG imports from the US and a 10% tariff on crude oil, agricultural machinery, tractors, and pickup trucks. Other non-tariff measures from China include launching an anti-trust investigation on Google, tightening export controls on critical metals, and adding Calvin Klein owner PVH Corp and US gene sequencing company Illumina Inc. to its blacklist of unreliable entities.

Regional FX

While there was an initial spike higher in USDCNH right after the 10% US tariff hike comes into effect, the upward move has quickly faded. And so, over the past 2 days, USDCNH fell by about 1.2% from an intraday high of 7.3734 on 3 February. China’s onshore market will also reopen today following the Lunar New Year break. And there could be increased volatility, partly due to the resumption of the trade war with US. The PBOC may maintain its USDCNY daily fixing rate below the 7.2000-level for now to contain depreciation expectation on CNY. Elsewhere, other Asian currencies have also strengthened against the US dollar, with China-linked currencies such as the KRW (+0.8%), MYR (+0.7%), SGD (+0.6%), and THB (+0.6%) leading gains in the region. Moreover, with long US dollar positioning looking stretched, upward momentum in the US dollar has appeared to ease, which will provide some reprieve for regional currencies. A key highlight today is Indonesia’s Q4 GDP data. We expect growth to slow to 4.9%yoy in Q4, due to weaker domestic demand growth, bringing full-year growth to 5.0% in 2024.