Ahead Today

G3: US PPI, University of Michigan sentiment index

Asia: Industrial production from Malaysia and India, Thailand foreign reserves

Market Highlights

US inflation slowed to 2.4%yoy in March, from 2.8%yoy in February. This was lower than market expectation of 2.5%yoy. Core CPI inflation (ex-food and energy) moderated to 2.8%yoy from 3.1% in February. Lower energy and core services inflation were the main drag. On a sequential basis, US headline CPI fell 0.1%mom, while core inflation was 0.1%mom, easing from 0.2% in the prior month. Short-term US treasury yields fell, while there’s little change at the far-end, leading to a bull-steepening in the Treasury bond market.

Meanwhile, US initial jobless claims rose 4000 to 223k, staying at historically low level. However, the layoffs done by DOGE have been slow to appear in the data.

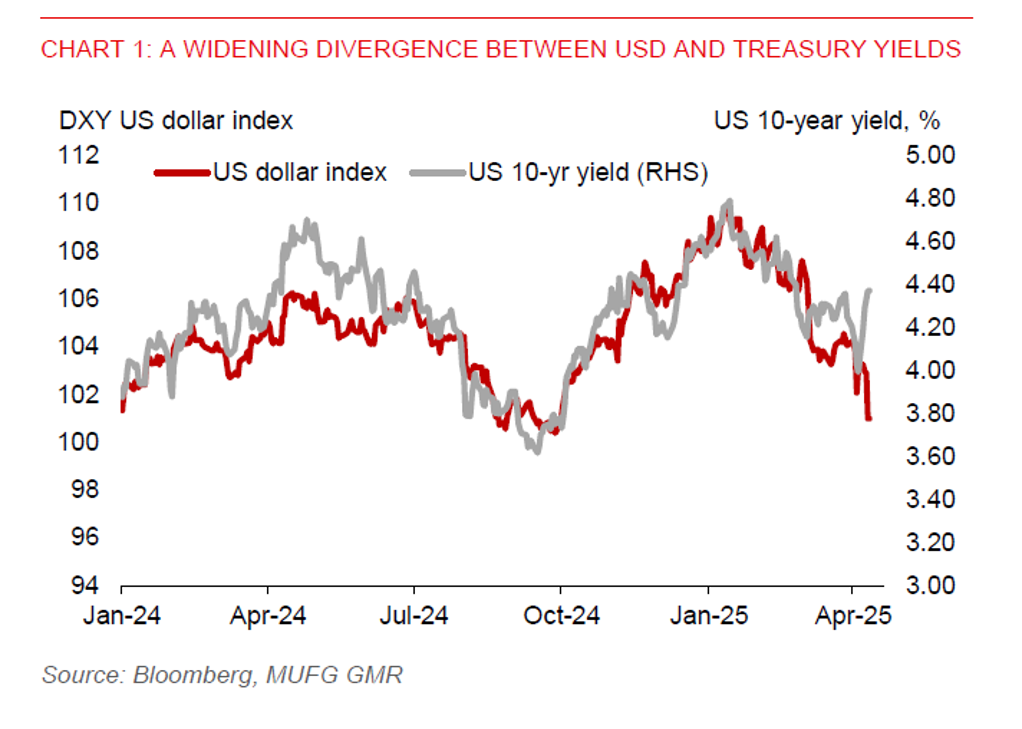

The US dollar has had its worst day since November 2022, falling by 1.9%. USDJPY has also continued to weaken, benefitting from safe-haven flows and narrowing yield spreads with the US. Trump’s tariff relief has also proved to be short-lived for equity markets, as they had resumed their decline, likely driven by worries about the negative impact of tariffs on global growth. Brent prices have also declined on the back of global growth concerns, while gold prices have stayed resilient.

Regional FX

Asian currencies have broadly gained against the US dollar. The KRW (+1.0%) , THB (+1.1%), and VND (+0.9%) led gains in the region, while CNH also strengthened by 0.4%. Markets may be reluctant to price in more tariff related risks, which will provide reprieve for Asian FX in the near term. President Trump has said there will be greater certainty about tariffs in 90 days, and that the first deal on tariffs is close. It will be crucial to see if the deal could help remove the 10% blanket tariff.

BSP cut rates by 25bps to 5.50% yesterday as expected and signalled for further rate cuts to support confidence and growth. A challenging external environment has also led to a lower forecast for inflation at 2.3% this year and 3.1% next. BSP Governor has added that the Philippines is relatively less exposed to trade.

Meanwhile, China’s CPI fell 0.1%yoy in March, from -0.7%yoy. China could further ease monetary policy to support domestic demand amid growing external headwinds.