Ahead Today

G3: US mortgage applications, 2nd preliminary estimate of euro area’s Q4 GDP

Asia: Indonesia election

Market Highlights

Markets have dialed back their expectations for US rate cuts following a higher-than-expected US January inflation. US CPI rose 0.3%mom versus market consensus for a 0.2% increase. Compared to a year ago, US inflation was 3.1%, down from 3.4% in December, but higher than market estimates of 2.9%. Core CPI (ex food and energy) rose 0.4%mom, the fastest pace in eight months. From a year ago, core inflation was 3.9%, unchanged from December but higher than market consensus for a 3.7% rise.

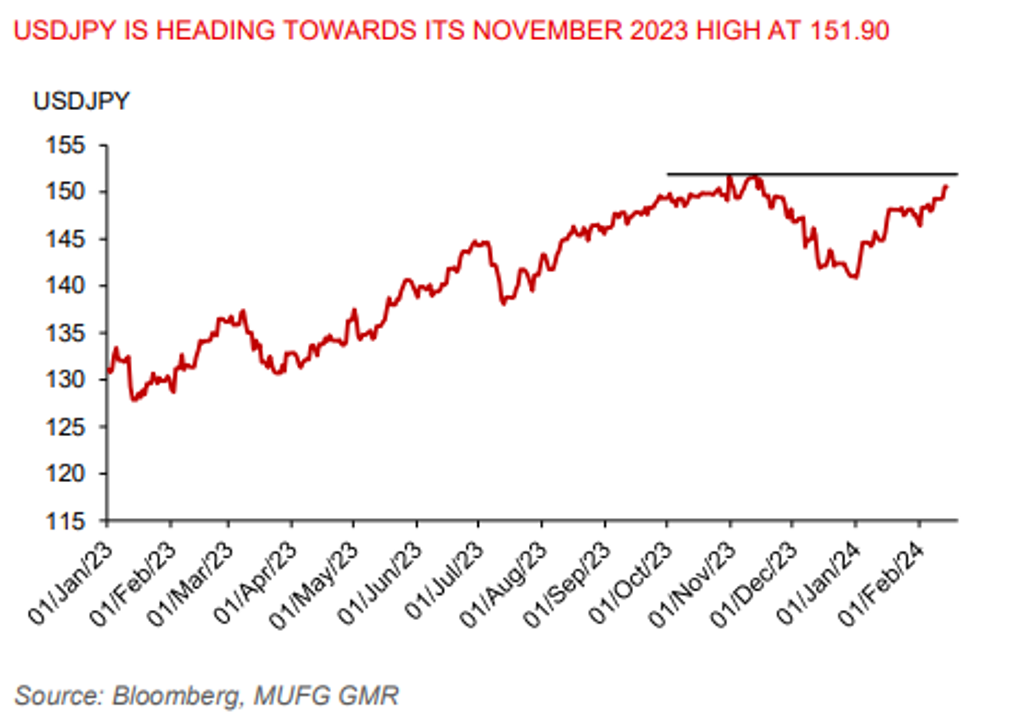

Markets are now pricing for 87bps of US rate cuts in 2024, down from 111bps before the CPI report and 146bps as of end-January. Market expectations have moved closer to the US Fed’s December dot plot, which indicates three rate cuts this year. The broad US dollar index (DXY) strengthened by 0.8%, US 10-year yields have risen about 44bps post the January FOMC meeting, while the USDJPY gained 0.9%, breaking through 150 level and raising the risk of FX intervention by the BOJ.

Meanwhile, ZEW investor expectation for Germany rose to 19.9 in February from 15.2 a month ago, indicating a brighter outlook ahead. Eurozone investor expectation also rose 2.3ppts to 25 in February from a month ago.

Regional FX

USDCNY (+0.2%), USDKRW (+0.8%), USDSGD (+0.5%) and USDMYR (+0.4%) all gained on the back of broad US dollar strength.

The key focus today will be on Indonesia’s presidential election. With President Jokowi constitutionally barred for running a third term, Indonesia will elect a new president. The presidential election will be a three-horse race between Defense Minister Prabowo Subianto (age 72), former Central Java governor Ganjar Pranowo (age 55), and former Jakarta governor Anies Baswedan (age 54). Based on opinion polls, Prabowo, along with his running mate Gibran (President Jokowi’s eldest son), are frontrunners. Political uncertainty could be prolonged if no presidential candidate garners more than 50% of the votes, which would necessitate an election run-off in June.

With markets paring back expectations for the pace and quantity of US rate cuts, coupled with domestic election risks, we stay cautious on the USDIDR. Please see our note previewing Indonesia's election.