Ahead Today

G3: US mortgage applications and durable goods orders; Japan leading index

Asia: Singapore industrial production

Market Highlights

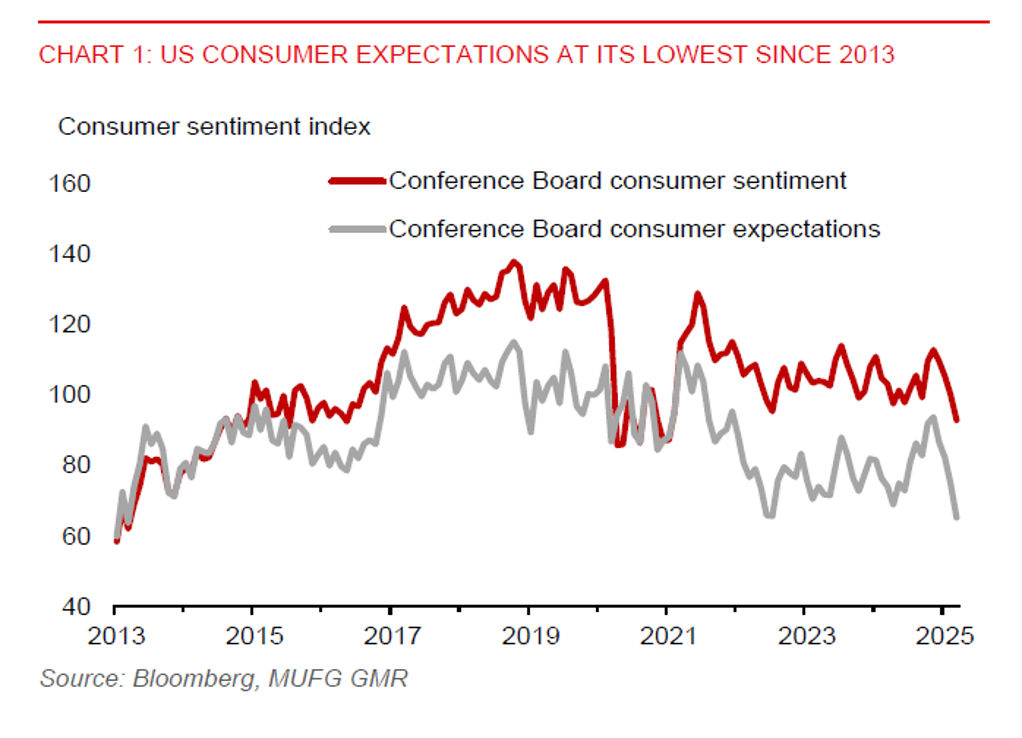

US dollar has weakened by 0.2%, while US Treasury yields have also inched lower, after US consumers show further signs of weakness. The Conference Board consumer sentiment index fell to 92.9 in March from an upward revised 100.1 in February. This is below market expectations of 94.0. Notably, consumer expectations also fell to 65.2 in March from an upward revised 74.8 in February, marking the lowest level since 2013. There could be some moderation in consumer spending in the months ahead, which will slow the US economy.

Notably, USDJPY fell 0.6%, dragging on the broad US dollar index (DXY), amid a further rise in Japan’s 10-year yield by about 4bps to 1.58%. The BoJ minutes show that policymakers have discussed about the pace of future rate hikes. Meanwhile, Prime Minister Ishiba is planning measures to help mitigate the impact of inflation on consumers.

Nonetheless, with President Trump’s tariff policy likely to lead to inflationary pressures in the near term, markets could price out the 3 US rate cuts for this year over time. A relatively modest pace of Fed rate cuts in 2025 could thus be a factor keeping the US dollar strong. Fed’s Kugler said she supports holding rates for some time, amid a move up in some measures of US consumer inflation expectations.

Regional FX

Most major Asian currencies were down against the US dollar in Tuesday’s session. PHP led losses in the Asia region, falling 0.5%, with BSP Governor Remolona saying the central bank has been intervening less while it remains on track to resume rate cuts in April. IDR also fell 0.5% at one point before paring some losses against the US dollar, with Bank Indonesia actively intervening to protect the value of the rupiah. However, JPY (+0.6%), KRW (+0.4%), and SGD (+0.2%) all gained against the US dollar.

Despite a softer US dollar overnight, we still look for the US dollar to bounce back, as we anticipate that a potential slowdown in US economy and tariff hikes could drive concerns about the outlook for growth in the rest of the world. Vietnam, Taiwan, Thailand, and Malaysia have relatively large exports to the US as a share of their respective GDP in the Asia region, and they are therefore more exposed than other regional peers to a slowdown in US import demand.