Ahead Today

G3: US CPI

Asia: India Trade Balance, WPI

Market Highlights

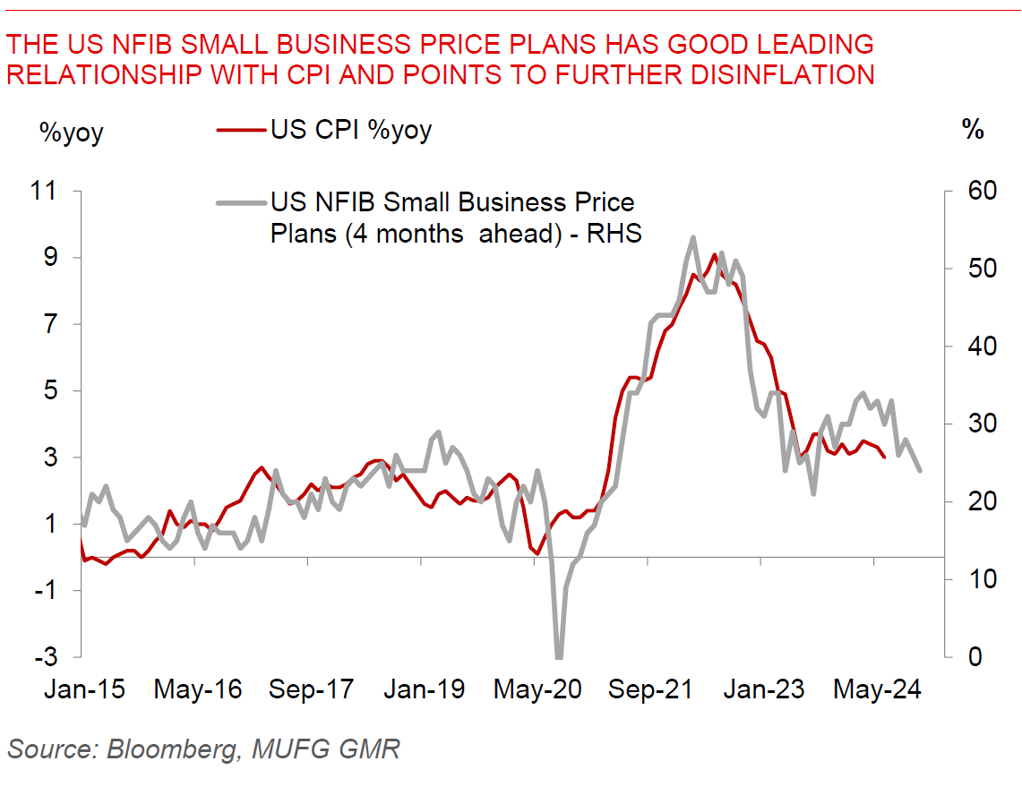

The Dollar weakened sharply, US bond yields fell, and the S&P rose by 1.7%, as US producer prices came in lower than expected, small business sentiment improved, even as credit data out of China was weak. This comes ahead of the important US CPI numbers later today. In particular, PPI for final demand rose 0.1%mom versus consensus for a 0.2%mom rise. The details showed some possible compression in retail and grocery margins, while other components such as healthcare that feed into the Fed’s core PCE measure were generally soft. Meanwhile, the NFIB Small Business index rose to 93.7 in July from 91.5 previously. More importantly, the sub-components with good leading properties with inflation and wage growth indicated further disinflation in the months ahead, with small business price plans in particular moderating further to 24.0 from 33 at its previous peak in March this year.

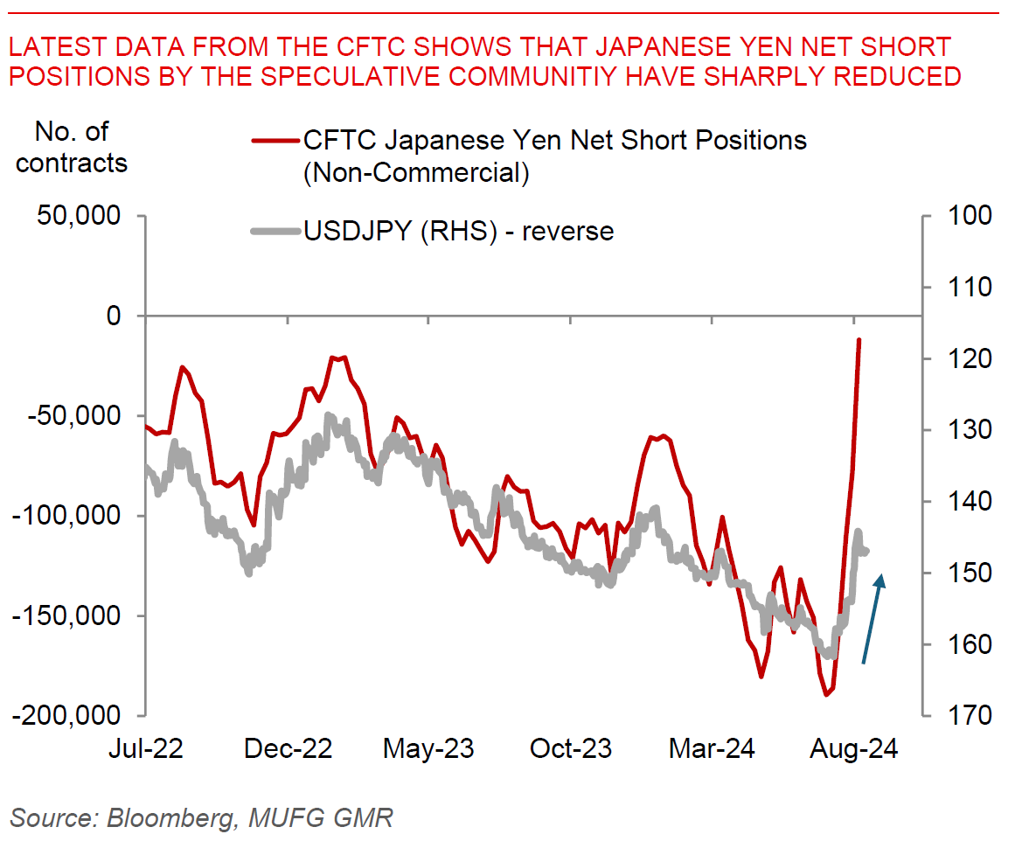

What has also been helpful for risk sentiment and higher beta currencies as well has been a stabilisation in the carry trade unwinds so far. Latest data from the CFTC shows that net JPY shorts by the speculative community have dropped sharply to 12k contracts as of 6 Aug from 190k contracts at its peak in July. Although this is certainly just a small subset of the total JPY carry trade positions, it does potentially signal that positioning in JPY is far more balanced today after the adjustment earlier this month.

Regional FX

Asian FX were mostly meaningfully stronger on the back of the weaker Dollar, with IDR (+0.58%), PHP (+0.55%), and SGD (+0.53%) outperforming, INR underperforming (-0.02%), while USDCNH at 7.151 handle. China’s credit data was weaker than expected with new yuan loans contracting 23%yoy, while yuan-denominated bank loans to households and corporates declined on the month. Nonetheless, the broader total social financing data was better, indicating possible support from other areas such as local government special bonds. We will have China’s monthly data for July released tomorrow and this will be important to gauge the economy’s momentum. The moderation (and subsequent recent stabilization) in industrial metals such as copper, aluminum and iron ore potentially indicates some moderation in global demand perhaps including out of China, and this makes us somewhat cautious about the extent of global growth and risk sentiment rebound even as global central banks are moving towards rate cuts. Meanwhile, Philippines central bank Governor Eli Remolona was non-committal in terms of the timing of rate cuts in comments at a Senate hearing, even as he indicated that the central bank doesn’t want to keep rates high for an unnecessarily long time. The potential delay in rate cuts could partly explain the strength and outperformance in PHP yesterday. The BSP will meet on Thursday, and while the August decision is a close call with a split consensus calling for a 25bps rate cut, we think October will be likely for a BSP cut even if they choose to pause in August.