Ahead Today

G3: Bank of Japan Policy, US PCE Inflation

Asia: Singapore Industrial Production

Market Highlights

The US data overnight brought higher than expected inflation, coupled with weaker than expected growth, leading to a sell-off in risk assets and spike in US yields. The 1st quarter advance GDP estimate grew at 1.6% qoq, driven by a slowdown in private and government consumption, but this was partially offset by strong fixed investment. Meanwhile, the 1Q core PCE price index was higher than expected at 3.7% (vs consensus of 3.4%). These numbers come ahead of the March PCE deflator estimate today, which may show a number above 0.3%mom. How much of this rise is due to new seasonal factors will also matter for the path of inflation moving forward, but for now, this continues to support “high for longer”, with markets now only fully pricing for the 1st Fed cut in the December meeting.

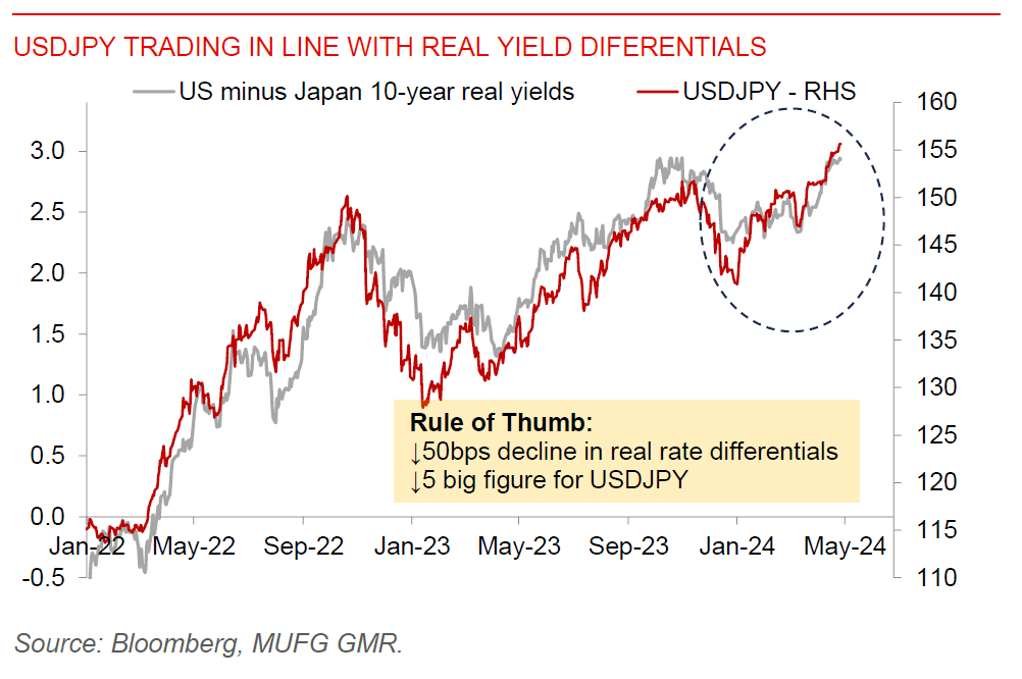

The Bank of Japan meeting is the key event today, and comes amidst USDJPY which keeps defying gravity and a Ministry of Finance which continues to jawbone the weak currency. Markets will watch for the forecasts for FY26 together with guidance on the path ahead for rates, any possible hawkish tones, together with the impact of the weak Yen on policy. Ahead of the meeting, a news report by Jiji reported that BOJ will consider steps to shrink JGB purchases, which may raise JGB yields moving forward. There is also some speculation that Japan’s Ministry of Finance could intervene later today with a historical penchant to conduct such operations on a Friday afternoon.

Regional FX

Asian FX markets traded somewhat stronger with a stable Dollar, with USDCNH at 7.257, USDKRW at 1374, and USDSGD at 1.359. South Korea’s 1Q GDP was much stronger than expected at 3.4%yoy from 2.2%yoy, driven by a good showing from the manufacturing and construction sectors, together with some improvement in private consumption spending. PHP weakened by 0.5% yesterday to 57.80. It wasn’t clear what was the specific driver of this move, but there was some comments by Finance secretary Ralph Recto saying that a rate hike is not being considered for now, with BSP’s next policy move dependent on inflation data. We have revised up our USDPHP forecast but see the risk of FX intervention rising as we move towards to 58 and 59 levels (see PHP: Too fast and furious?).