Ahead Today

G3: US: mortgage applications, trade balance, JOLTS job openings, factory orders, durable goods orders, Fed’s beige book; eurozone services PMI

Asia: Australia Q2 GDP, China Caixin services PMI

Market Highlights

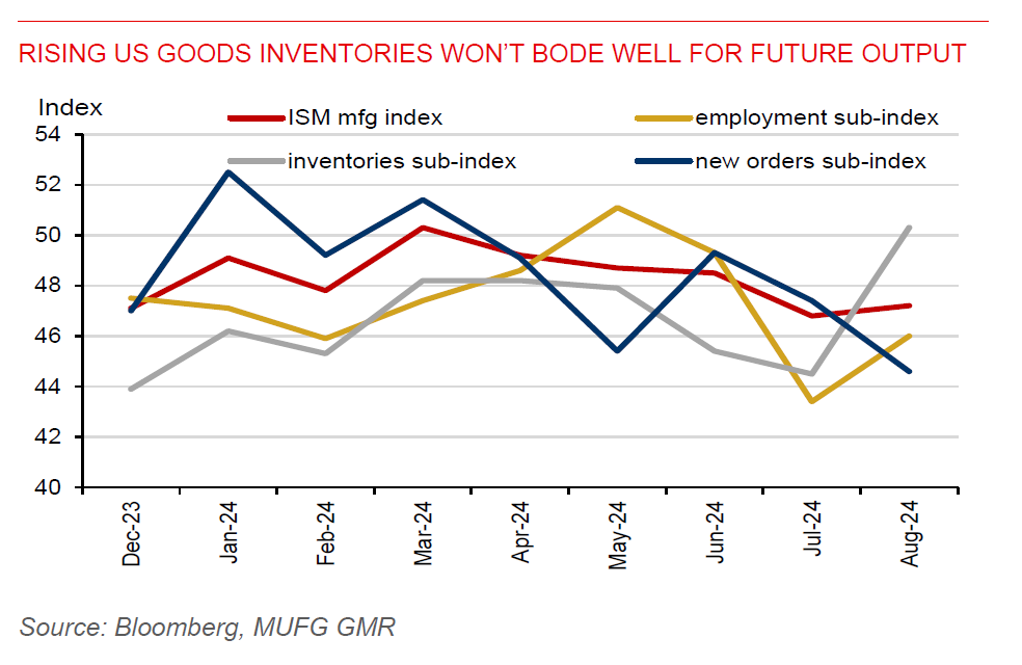

This is a week filled with crucial US economic data, which will determine whether the Fed is going to cut rates by just 25bps or opt for a 50bps cut at the 17-18 September FOMC meeting. First up is the US ISM manufacturing PMI data that was released yesterday. The headline ISM manufacturing index picked up to 47.2 in August from 46.8 in July, staying in contraction and was below market expectations of 47.5. The pickup was mainly due to a jump in goods inventories. Along with shrinking new orders, manufacturing output could weaken in the coming months. Meanwhile, the employment sub-index rose to 46 from 43.4 in July. Nonetheless, it remained in contraction, albeit the pace of declines had become smaller. The disappointing ISM data has led to a sell-off in risk assets, while yen climbed 0.8% against the US dollar and US Treasury yields fell.

The upcoming catalysts for USDJPY movement will include Japan’s wage data, ISM services PMI, and US initial jobless claims on 5 September, followed by the all-important nonfarm payroll report to conclude the week. This will be the last available NFP report before the September FOMC meeting. Markets estimate a 165k gain in August nonfarm payroll, higher than the 114k seen in July. And unexpected labour market weakness could dampen the US dollar. Meanwhile, BoJ governor Ueda reiterated yesterday that the central bank will continue to normalize its policy rate should the economy and inflation move in line with its expectation. Diverging policies between the BoJ and the Fed could lead to increased market volatility ahead.

Regional FX

Asia ex-Japan currencies have weakened against the US dollar, as they have been overbought through August while China’s economic growth is flagging. Notably, recent regional outperforming currencies like the MYR (-1.1%) and THB (-1.1) have led losses against the US dollar so far this week, followed by the PHP (-0.8%). CNH was also weaker by 0.5% against the US dollar. Meanwhile, South Korea’s CPI inflation has finally returned to the BoK’s 2% target in August. With domestic demand facing headwinds, we think the stage is set for the BoK to start cutting its policy rate by 25bps in October. The pace of rate cuts, however, will likely be gradual, as high household debt levels remain a key policy concern. BoK’s governor Rhee has said it’s time to think of an interest-rate cut as inflation cools.