Ahead Today

G3: US: ADP employment, initial jobless claims, services PMI, ISM services index

Asia: Australia trade balance, CPI data from Philippines, Thailand, and Taiwan, Singapore retail sales, and BNM policy meeting

Market Highlights

Weak JOLTS job openings have added to market risk-off sentiment following the weak US ISM manufacturing data. Indeed, JOLTS job opening fell to 7673k in August from 7910k in July. The layoff rate also ticked up to 1.2%, though still low, while the seasonally adjusted quit rate edged up to 2.1%. The US dollar index has broadly weakened, while the yen has continued to climb against the US dollar so far this week. US large cap tech stocks such as Nvidia have come under heavy selling pressure, MSCI EM equity index was down by about 2%, brent prices fell by more than 6%, and iron ore prices sank below $100/mt. On a positive note, US factory orders rose 5%yoy in August, while durable goods orders grew 9.8%yoy, marking the fastest pace since mid-2020.

Market focus will next turn to the all-important US ISM services index. With US manufacturing activity already shrinking, the services sector has been helping to keep the US economy largely resilient thus far. But any downside surprises in services activity, including services employment, would raise more concerns about US growth, further underpinning market risk-off sentiment.

In terms of recent major central bank actions, the Bank of Canada cut its policy rate again by 25bps to 4.25%, as policymakers seek to engineer a soft economic landing while inflation concerns have faded. ECB board executive member Cipollone has also recently said that there is a risk to growth of keeping rates restrictive for too long.

Regional FX

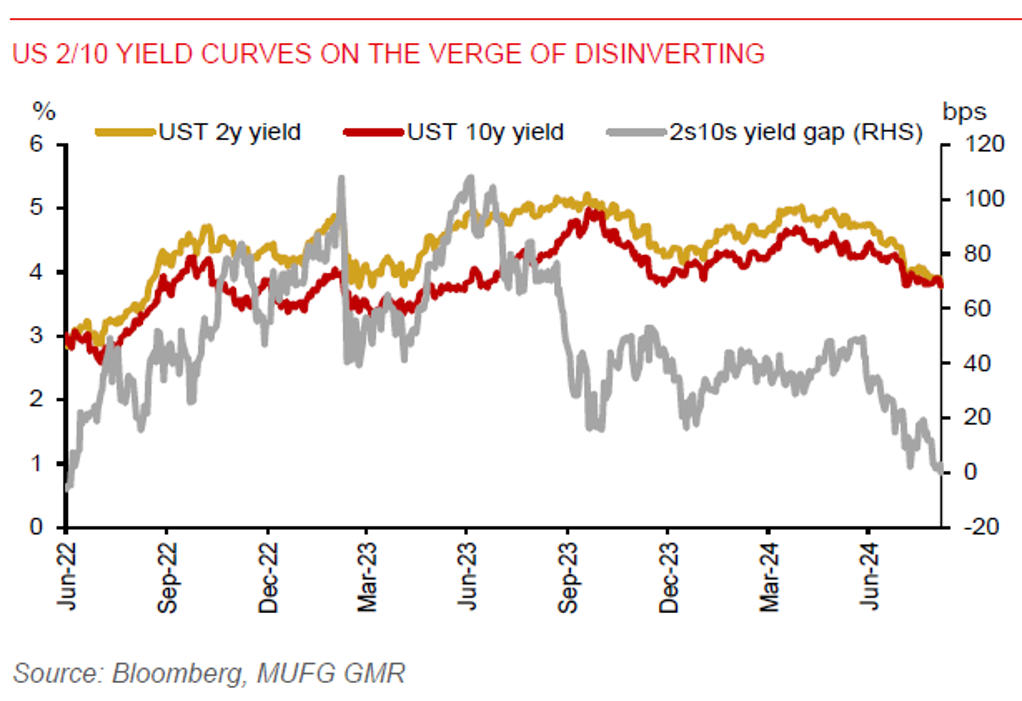

Asian currencies strengthened against the US dollar yesterday, with IDR (+0.3%) and MYR (+0.3%) snapping several days of losses. However, TWD fell 0.4%, dragged down by a sell-off in tech stocks, with the Taiwan Stock Exchange Weighted Index (TAIEX) dropping by 4.5%. Further weaker than expected US economic data could lead to strength in Asian currencies. We also expect BNM to keep its policy rate unchanged at 3.00% later today, as the Malaysian economy finds itself in a ‘sweet spot’, given solid growth and manageable inflation. A narrowing of Malaysia’s yield differentials with the US once the Fed starts cutting rates should help underpin the ringgit.

Meanwhile, China’s Caixin services PMI fell to 51.6 in August from 52.1 in July, presaging a potentially slower pace of growth in services activity in the coming months. Vietnam’s manufacturing PMI also fell to 52.4 from 54.7 in July. But Singapore’s PMI picked up to 57.6 from 57.2 in July, reflecting rising momentum in private sector activity, which bodes well for its growth and the SGD outlook in H2.