Ahead Today

G3: Germany CPI, Eurozone Consumer Confidence

Asia: Bank of Korea rate

Market Highlights

US macro data overnight was mostly in line with expectations, with some slight downward revision to personal consumption for 3Q GDP, softer than expected durable goods orders for October, and stickiness in continuing claims. Meanwhile, the Fed’s preferred measure of inflation the core PCE rose 0.3%mom from the same rate previously. All these likely still implies that the Fed cuts in December but the FOMC may likely communicate a slower pace of easing in 2025 in part to account for the new Trump administration’s policy priorities. On that front, Trump’s pronouncements that he will implement 25% tariffs on Mexico and Canada and 10% tariffs on China on Day 1 has been met by both messages of retaliation and also a PR blitz by Mexico, although far less so in response from China. Mexico’s Economy Minister said the new tariffs will mainly hit US automotive companies active in Mexico including General Motors and Ford, which produce 88% of pickup trucks sold in the US.

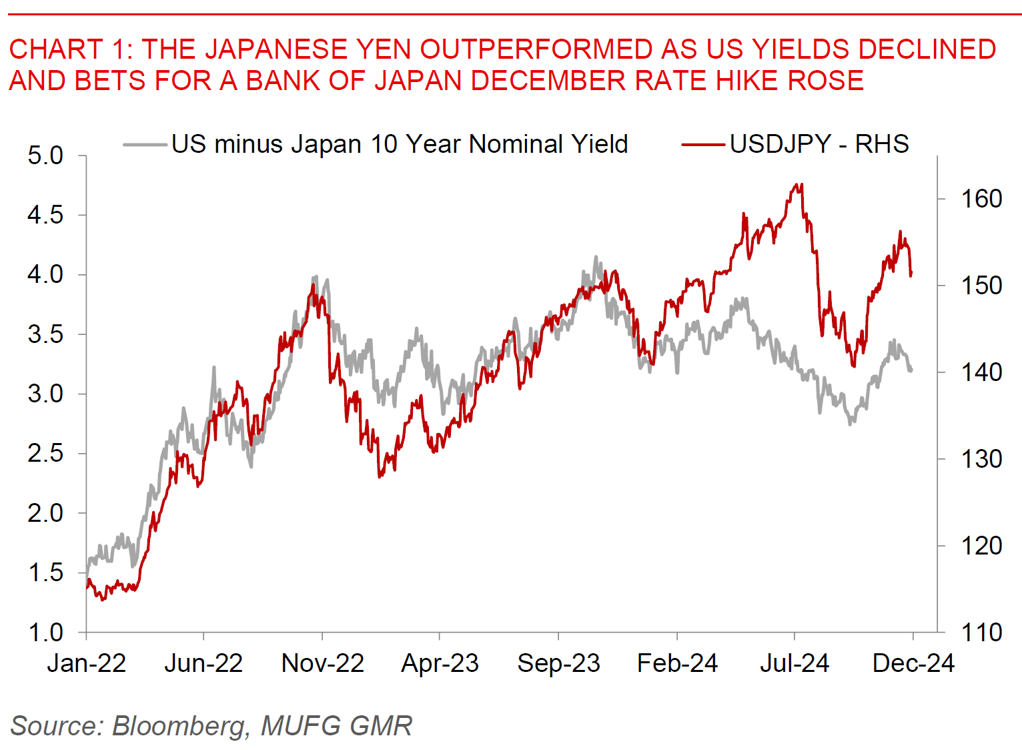

Overall, the Dollar weakened quite substantially by 0.8% and US 10-year yields moderated to 4.26%. It was not just due to Dollar factors. The Japanese Yen outperformed with USD/JPY falling to 151 levels, with the market increasing bets on a December Bank of Japan rate hike given higher services inflation and PM Ishiba urging companies to raise wages. Meanwhile, ECB Council Member Schnabel cautioned around the pace of ECB rate cuts, and this may have supported Euro to some extent.

Regional FX

Asian currencies were stronger overnight on the back of a weaker Dollar, with MYR (+0.37%), PHP (+0.47%), SGD (+0.43%) and KRW (+0.29%) outperforming. The PBOC has kept the onshore USD/CNY fix relatively stable through the gyrations of the Dollar at around 7.1982 levels, indicating Chinese authorities preference for a stable currency for now at least until better clarity on Trump’s tariff policies. Besides China, one key country which could face increased scrutiny in Trump 2.0 could be Vietnam, given its importance in the China +1 manufacturing supply chain and backward linkages to China. On that front, Vietnam’s Deputy Minister of Foreign Affairs told a Hanoi business summit that Vietnam plans to buy more aircraft, LNG and other products such as security equipment or AI chips in Trump 2.0. It’s unclear whether Trump will be as receptive to such deals in the second term, but overall Asian countries are likely to try hedging their bets as much as possible in the lead up to his inauguration. Meanwhile, the Bank of Korea meets today. We expect BOK to keep rates on hold, but to likely resume rates cuts in 1Q2025 to help support a weak domestic economy and as inflation continues to moderate.