Ahead Today

G3: US Dallas Manufacturing, Eurozone CPI

Asia: Singapore CPI

Market Highlights

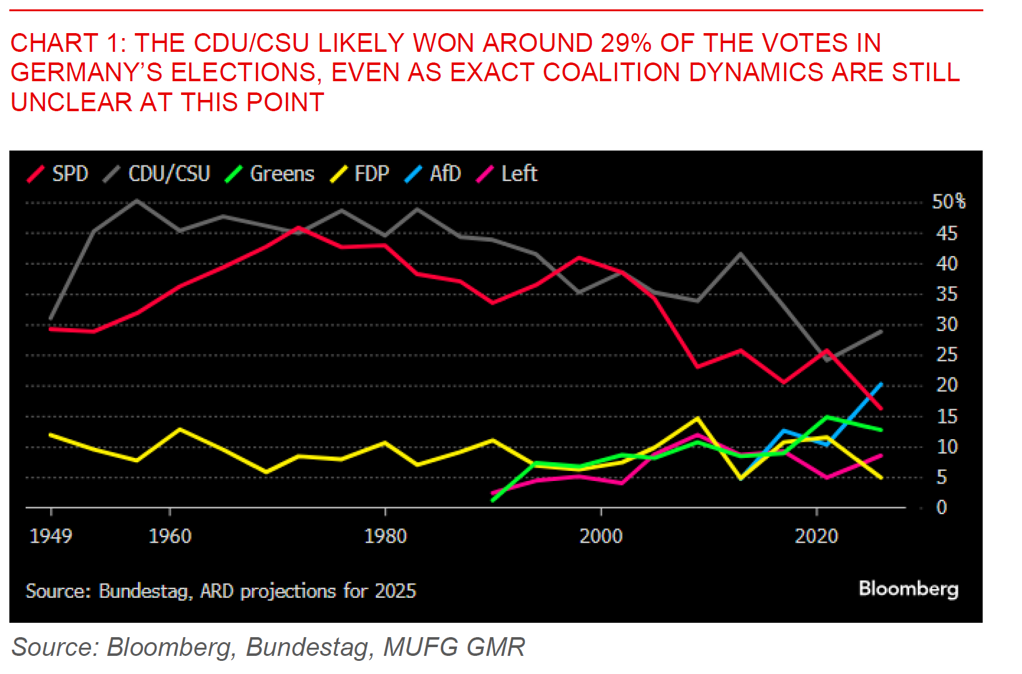

The EUR traded slightly higher in Asia open and the Dollar weaker, as latest projections from Germany’s election results showed Federich Merz’s CDU/CSU winning 29% of the votes, and finishing ahead of the far-right AfD party (20% of votes) and the ruling Social Democrats (16%). Nonetheless, with lack of clarity around whether some of the smaller parties such as FDP and BSW cross the 5% threshold to enter parliament, there remains uncertainty around the specific coalition dynamics. In particular, if these smaller parties enter parliament, the CDU/CSU may need a three-party coalition including the SPD, which could make reforms and policy making more unwieldy. Overall, the direction of travel for Germany is likely for policies to kick start growth in Germany including loosening regulations, lowering corporate and income taxes, and reforming the debt brake to allow more government investment in coming years, even as the pace and likelihood of reforms will also be determined by exact coalition dynamics (see note from our G10 team - Global FX Weekly 7 Feb).

Meanwhile, President Trump signed a memorandum directing the US Trade Representative to renew Digital Service Tax investigations under Section 301 that were initiated under his 1st term. While the memo only pinpointed those in Europe, UK, Turkey, Spain and Canada, it remains to be seen whether Asian countries such as India with Digital Service Taxes will be targeted by Trump.

Regional FX

Asian currencies traded with a stronger bias with USD/CNH falling to 7.249, and with SGD (+0.17%), MYR (+0.13%) and THB (+0.2%) outperforming. In China, equity risk sentiment remained strong on the back of risk-on mood in China tech stocks, while China’s local bond yields continue to climb higher with the 10-year up from their lows to 1.79%. The rise in local bond yields may also be driven by a pickup in local governments issuing more bonds to refinance their debt, with US$233bn of bonds sold by local governments in the 1st two months of 2025.

Meanwhile, the Philippines central bank will reduce the reserve ratio requirement by 200bps for universal and commercial banks to 5% from 7%, in a move that will likely push out PHP280bn of liquidity or around 1.6% of banking system deposits. This was a policy move that was highlighted during the recent BSP meeting although the exact timing was not clear. India announced a US$10bn USD/INR buy/sell swap auction for a tenor of 3 years to help boost liquidity. The recently released minutes from RBI’s policy meeting pointed to some dovish comments from external members from the MPC, while RBI Governor Sanjay Malhotra’s comments seem somewhat more neutral, keeping the door open for rate cuts, while being cognizant of external risks.