Ahead Today

G3: US Job Openings and Vacancy Rate, Eurozone CPI, French Elections 2nd round candidates deadline

Asia: Singapore PMI, Hong Kong Retail Sales

Market Highlights

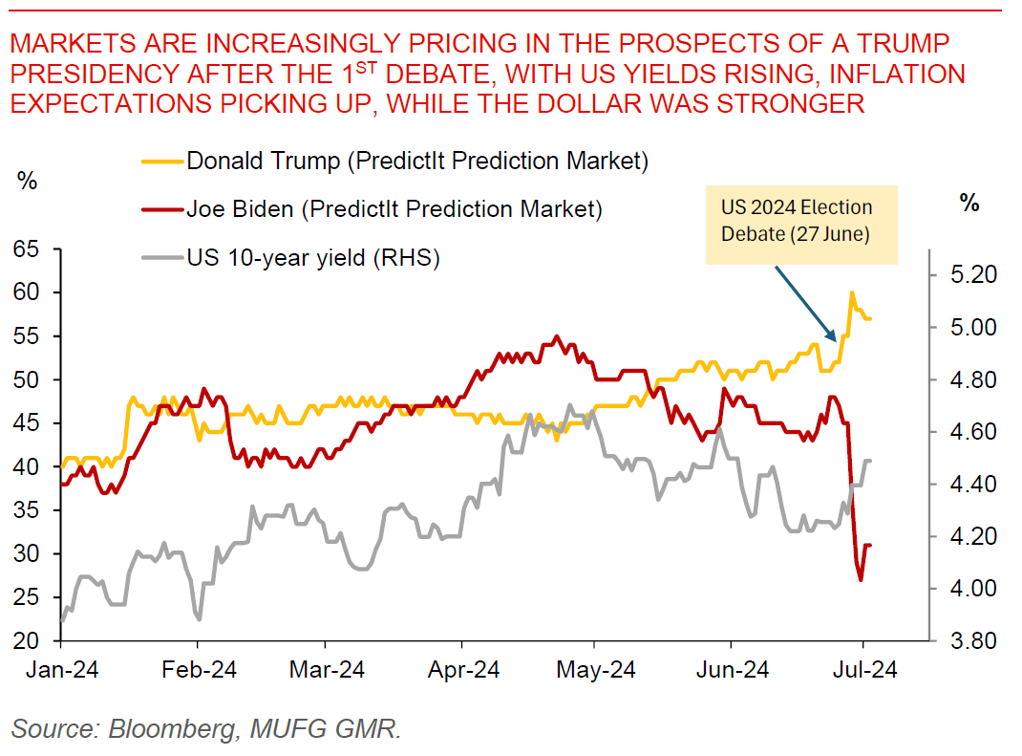

Markets seems to be increasingly pricing in the prospects of a Trump Presidency after the 1st US Presidential debate, potentially building in the inflationary consequences of policies such as immigration and tariffs, while ignoring weak US data. US nominal yields have risen to 4.45% from below 4.3% before the debate, market-based expectations of inflation have risen with 10-year breakevens rising to 2.32%, while the US Dollar was stronger with low-yielders such as JPY and CHF underperforming. The impact to equity risk sentiment has been more mixed, but from a micro-perspective perceived beneficiaries of a Trump presidency such as prison and energy stocks have done well, while renewables such as solar stocks have understandably lagged.

To be clear, there continue to be many crosswinds affecting markets, and the US ISM Manufacturing numbers overnight pointed to continued softening in some parts of the US economy with the headline rate surprising to the downside at 48.5 from 48.7, coupled with weaker employment trends with the employment sub-index falling to 49.3. Inflation pressures may also have eased further with the ISM Manufacturing prices paid component moderating further to 52.1 from 57.0 previously. Looking forward, markets will focus today on the US job openings data, together with developments in the French Elections, where the deadline for 2nd candidate selection is coming up.

Regional FX

Regional FX

Asian FX markets started the week on a mixed note, with currencies such as KRW (-0.6%) underperforming while USDCNH rose above 7.30 levels. Conversely, IDR and PHP outperformed rising 0.47% and 0.18% respectively. Beyond global uncertainties, the data continued to point to a reasonably unbalanced economic trajectory in China, with Caixin China Manufacturing PMI surprising on the upside at 51.8, but juxtaposed by softer numbers out of the official PMI data. The People’s Bank of China said it will borrow government bonds from some primary dealers, with markets thinking this may signal some liquidity tightening measures to help cool down the bond rally that we see in China. Meanwhile, Manufacturing PMIs out of export oriented Asian economies such as Vietnam, Taiwan, and Korea were stronger than expected, and this is in line with the lead indicators we track such as industrial metals. Last but not least, inflation prints out of Indonesia and Korea were softer than expected, possibly increasing the chance of a rate cut in the latter, while helping to soothe some concerns around a weaker Rupiah from the former.