Ahead Today

G3: US 2024 Presidential and Congressional Elections

Asia: Philippines Trade, Thailand Inflation, Taiwan Inflation, Malaysia BNM Monetary Policy

Market Highlights

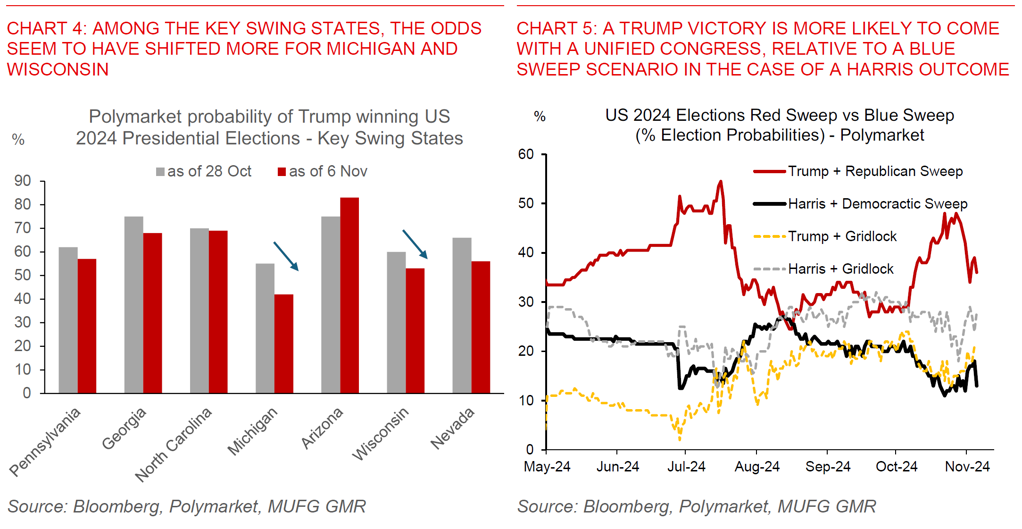

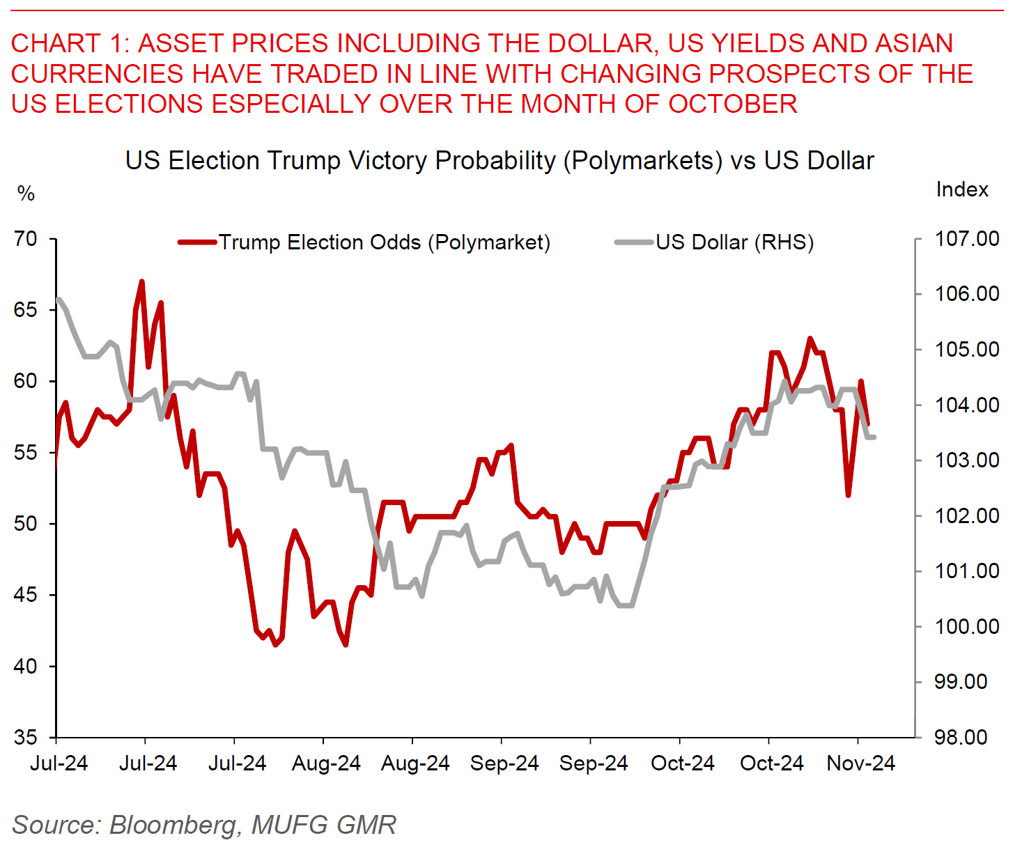

The 2024 US Presidential and Congressional Elections are happening now, with polls starting to close in some states as we write. Heading into the Elections, models based on polling surveys tell us that it is a coin-toss between Kamala Harris and Donald Trump, with a slight but narrowing edge in favour of Trump. Meanwhile, Prediction Markets are more unequivocal, at the moment placing between 54%-60% chance for Trump to win. This lead had nonetheless tightened quite meaningfully over the past week before bouncing back, perhaps accounting for better recent polling data for Harris. Regardless of one’s belief in Prediction Markets, what’s clear is that asset prices including the Dollar, Asian currencies, and US rates have traded in tandem with changing prospects of the US Elections especially in October. As the day progresses and as new information comes in during the Asia trading session and into London open, both Prediction Markets and asset prices will try to price for the changing outlook even before any races are officially called, leading to elevated volatility near-term.

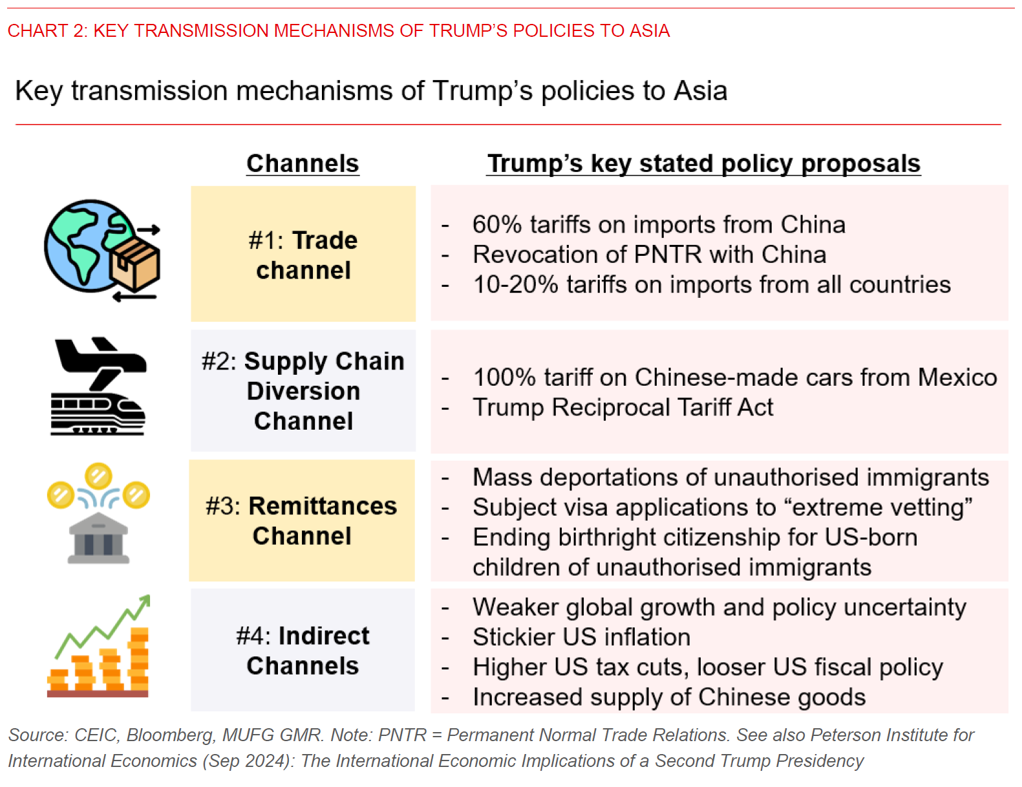

This intense scrutiny is for good reasons. The policy shifts which will accompany the US Presidential Election results are consequential not just for the US, but also for the rest of the world including here in Asia. A 2nd Trump Presidency will likely bring more disruptive changes relative to the status quo, with stated policies such as 60% tariffs on imports from China, 10-20% tariffs on imports from all countries, greater scrutiny on manufacturing supply chains, stricter immigration policies, among many others. In addition, if a 2nd Trump Presidency were to come with a Republican controlled Congress, the chance of expansionary fiscal policy through the extension of tax cuts beyond 2025 will be materially more likely. Conversely, a Harris Presidency should be more akin to the status quo, with additional policy focus on supporting home buyers, helping the lower income and parents, and shifting the balance away from capital towards labour including through price controls and corporate tax increases. It is however important to note that several of Harris’ proposals require legislation and thus whether the Democrats control Congress is just as important as the Presidency (see MUFG Capital Markets Strategy – Road to 270).

We expect further Dollar strength, higher US yields and weaker Asian currencies in a 2nd Trump Presidency. The gamut of Trump’s policies including tariffs and immigration rollbacks generally boosts inflation in the US with negative spillover impact for Asian economies. In our latest Global FX Monthly, we have laid out our scenario for the Dollar to be roughly 7-8% stronger in the event of a Trump Presidency, and relative to our baseline assumption of a Harris victory (see Nov 2024 Global FX Monthly). In addition, we think the Fed will likely slow its rate cutting cycle by around 100bps relative to our baseline. While there is some pricing of Trump in markets, this is likely more so in the US rates markets, and relatively less so in FX so far.

For Asia, we think the likes of CNY, KRW, THB, MYR and SGD will be relatively more negatively impacted in a 2nd Trump Presidency, while INR and PHP should be less impacted. This is not just because of their export-orientation and linkages to the US economy, but also because many of these markets are leveraged and sensitive to a potential slowdown in China’s growth. Conversely, the likes of INR and PHP should be relatively more insulated, both because they are more domestically-oriented economies to begin with, but also because they are not as leveraged to Chinese end-demand (see Asia FX – US tariffs would hurt growth but may benefit ASEAN over the medium-term).

If Harris were to win, we would expect some meaningful reversal of Trump trades with the Dollar weakening, export-oriented and lower-yielding Asian currencies strengthening, and US yields coming down.

The likes of JPY, KRW, THB, MYR (and to some extent IDR given its sensitivity to US yields) may outperform in a Harris victory, although for CNY Chinese authorities may not want too sharp an appreciation over a short span of time and so there may be some near-term floor to USD/CNY. INR should conversely underperform as the RBI likely steps in to re-accumulate FX reserves and as such also continue to cap USD/INR FX volatility.

It’s nonetheless important to stress that there are various shades of grey here for the US Elections, and given the tight polling and possible coin-toss nature of the Election, we could find ourselves not having a clear idea of who wins even after today. While this is not our base case, the Dollar will likely still weaken with some partial reversal of Trump trades in this scenario at least in the near-term.