Ahead Today

G3: US non-farm payrolls

Asia: Thailand International Reserves, Singapore Purchasing Managers Index

Market Highlights

US 10-year yields dropped sharply to below 4%, risk assets including the S&P500 fell, while the Dollar strengthened, as US data and earnings came in weaker overnight with geopolitical tensions rising in the background. In particular, US ISM Manufacturing dropped sharply to 46.8 from 48.5, while the employment sub-component saw a sharp decline to 43.4 from 49.3. Meanwhile, initial jobless claims and continuing claims both rose, adding to further signs that the labour market is softening. The colour from the ISM report suggests that “consumers are starting to pull back on spending”, “business is experiencing the sharpest decline in order levels in a year”, while “elevated financing costs have dampened demand for residential investment”. All these also comes as US earnings results have been mixed with Intel the latest to disappoint the market.

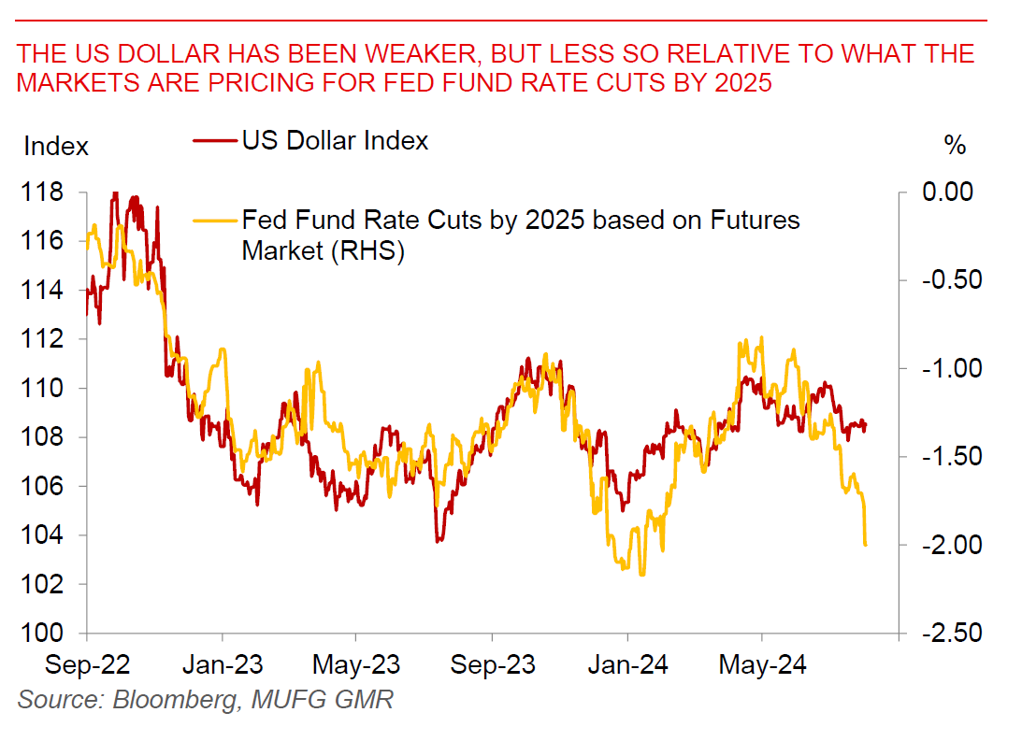

Tonight’s non-farm payrolls print will be important, and this comes on the back of dovish signaling from the Fed meeting. Beyond the headline NFP print, markets and the Fed will watch very closely for the unemployment rate. The so-called Sahm rule –a key recession leading indicator the Fed looks at - is a 4.2% print away from breaching the recession threshold. While there are good reasons to believe that this cycle is somewhat different given the unusual rise in labour supply and normalization from the Covid boom, the Sahm rule still argues for a cut (and one pretty soon). Fed Fund futures markets are now pricing for close to 200bps of cuts by end-2025.

Regional FX

Asian FX markets generally saw some strength but also importantly meaningful divergence, with USDJPY staying below the 150 handle keeping an anchor on Asian currencies. The Japanese Yen was supported by the hawkish shift from the Bank of Japan, but likely also from its safe haven status with geopolitical tensions given that CHF also outperformed overnight. The likes of MYR and KRW strengthened by 1.2% and 0.78% respectively, while CNH and INR underperformed by -0.3% and -0.1% respectively. China’s Caixin Manufacturing PMI came in much weaker than expected at 49.8 from 51.8, and this also comes on the back of the official PMIs which were generally softer. All these add up to a picture of a China economy that is slowing down and requires more stimulus to support it, and all these spilled over to USDCNH to some extent rising to 7.248 level, diverging from USDJPY to some extent. Meanwhile, South Korea’s exports grew by 14%yoy up from 5.1%yoy previously, which nonetheless disappointed the consensus. Overall, we still lean towards a softish landing for the global economy, but the fact that industrial metal prices have declined (perhaps partly reflecting a weak China), economic surprises are negative not just in the US but also elsewhere, while tail risks including geopolitics and Trump are lurking suggest that the Dollar should be modestly weaker but perhaps not overly so moving forward.