Ahead Today

G3: US Durable Goods, US Conference Board Consumer Confidence

Asia: Philippines Agriculture Output

Market Highlights

US tech stocks fell sharply as markets digested the potential impact of China’s AI startup Deepseek’s inexpensive large language model models. Deepseek’s models are gaining significant attention for several reasons. First, the efficiency of its training and also running them relative to other existing frontier models including from the likes of OpenAI, and as such at a fraction of the cost. Second, the quality of its output, with its models outperforming or close to matching the more sophisticated ones from US tech companies. Third, the innovativeness by which Deepseek was able to incorporate so called “Chain of Thought” AI models. This is akin to a human reasoning out its thought and analytical process rather than providing the first intuitive and gut-feeling answer, and in so doing, providing a more efficient process in generating responses.

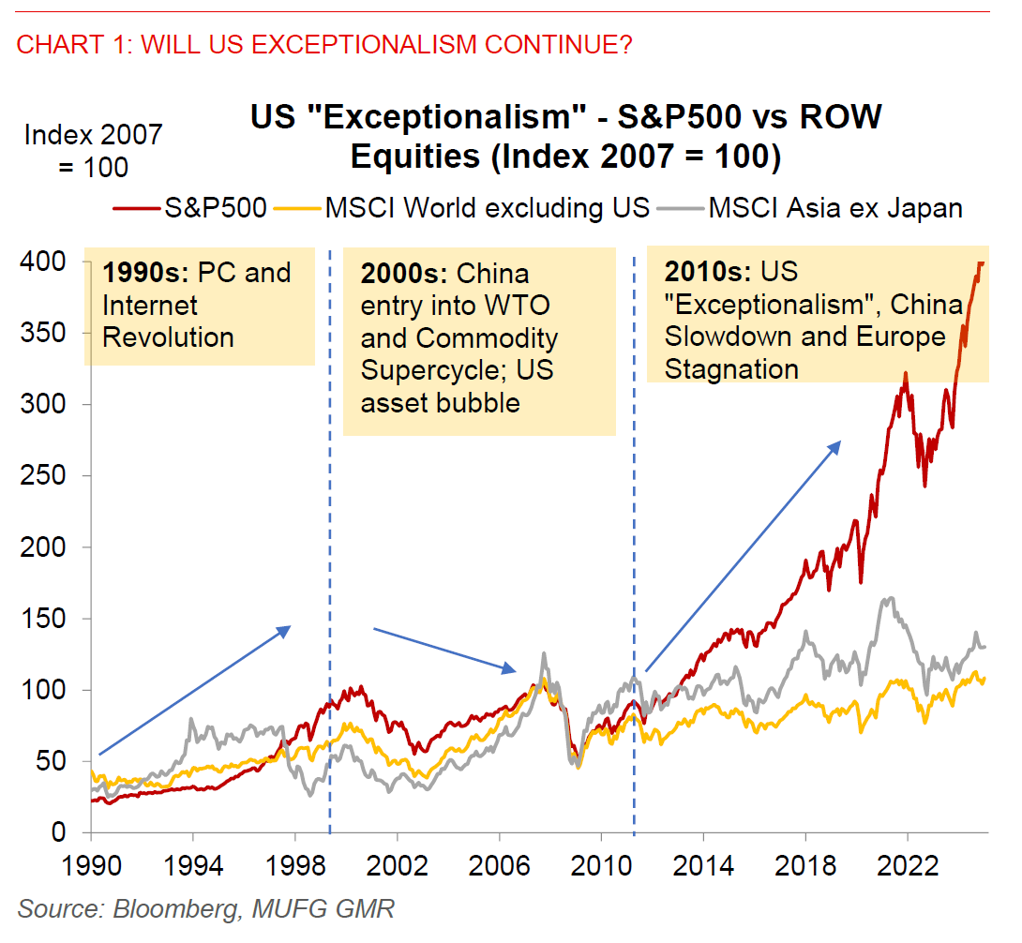

The longer-term implications for US tech stocks, US exceptionalism, and as also the US Dollar by Deepseek are being digested by market participants as we speak. One school of thought points to the so-called “Jevons Paradox”, which posits that there will be increased demand for data centers and GPUs from other use cases even as greater efficiency increases spare capacity. Another school of thought points to a possible commoditisation of AI models, with far lower ability to monetise many of the projected GPU and data center investments moving forward. From an FX perspective, one big driver of the strong US Dollar has been “US exceptionalism” not least in the technology space, and whether this continues could have important impact and in the midst of elevated valuations of the US Real Effective Exchange rate.

Regional FX

Asian currencies were generally weaker not just due to news surrounding Deepseek and the weakness of the US equity markets, but also because of developments on the tariff front. US Treasury Secretary Scott Bessent was confirmed by the Senate, and the Financial Times reported that he is backing universal tariffs on imports to start at 2.5%, with the levies rising month by month in order to give businesses time to adjust. Meanwhile, President Trump said that there will be tariffs in the “near future” on foreign pharmaceuticals, semiconductors, and metals in order to bring production and manufacturing back to the US, even as he called DeepSeek’s progress good and a wake-up call for US industries to compete. Meanwhile, India’s central bank plans to inject nearly US$18bn into the financial system in order to ease a liquidity shortgage in part due to capital outflows and also RBI FX intervention operations to support the Indian Rupee since last year. The RBI announced that it will buy INR600bn worth of bonds via auction purchases in the open market, a US$5bn buy/sell FX swap, and inject another INR500bn via 56-day longer-tenor repo auction. Overall, we continue to think the RBI is pivoting towards supporting growth, even as it is unlikely to completely let INR go. We see RBI intervening less aggressively moving forward, and continue to see RBI cutting rates from the Feb meeting by 25bps and once more in 2H2025 (calendar year).