Ahead Today

G3: UK Retail Sales, Germany PPI

Asia: China 5-year Loan Prime rate, 1-year Loan Prime Rate, Taiwan Export Orders

Market Highlights

US 10-year Treasury yields whipsawed before ending higher on the day at 4.99%, as Fed Chair Powell signalled a pause in the upcoming meeting, while leaving open the possibility of further hikes. In particular, Chair Powell said that “additional evidence of persistently above-trend growth, or that tightness in the labour market is no longer easing, could… warrant further tightening of monetary policy”. In addition, he said that the evidence suggests policy is not too tight now, and that rise in long-end yields, if persistent, could lessen need for further hikes “at the margin”.

Meanwhile, Bloomberg news reported that Israel is shifting its approach to how to conduct its ground invasion, with US President exerting influence on Israel to reduce the chance of the war spreading to other fronts across the Middle East. An Egyptian broadcaster reported Egypt’s border crossing with Gaza will open potentially allowing aid. Moody’s put Israel’s debt rating on review for a downgrade, even as Israel’s Finance Minister announced a “larger and wider” wartime stimulus than COVID.

Risk assets fell, Brent oil prices rose to US$91/bbl, while the Dollar was weaker.

Regional FX

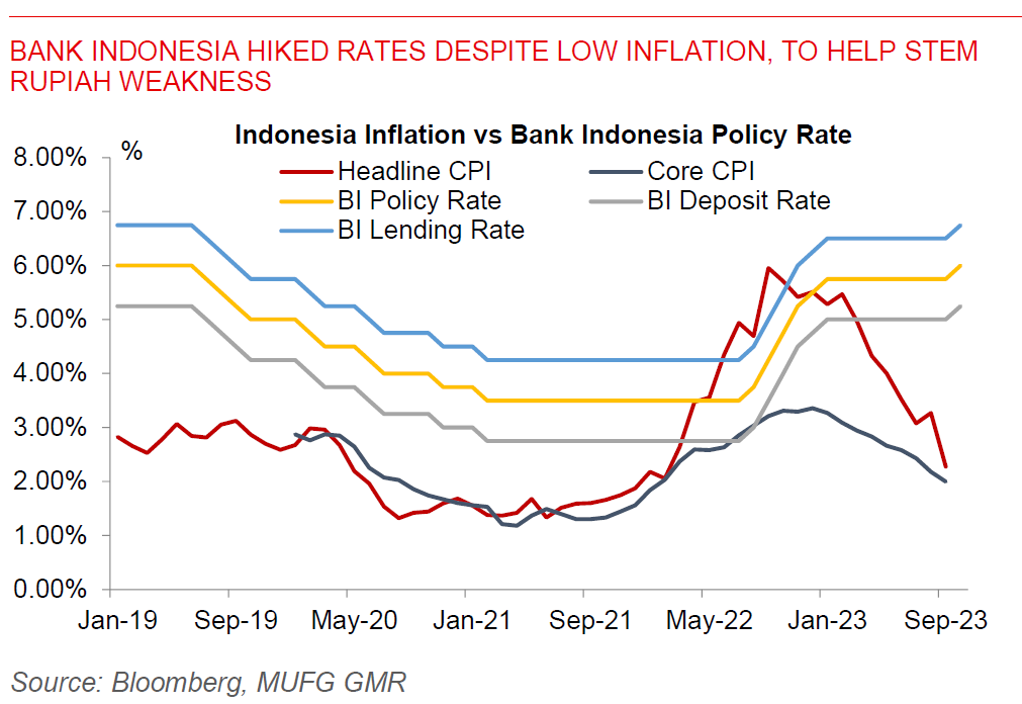

Asian FX markets were generally weaker against the Dollar, with IDR (-0.6%), MYR (-0.8%), and THB (-0.5%) underperforming. IDR pared losses as Bank Indonesia surprised markets by hiking rates by 25bps, bringing its key rate to 6% from 5.75% currently. The post policy-statements suggest that the rate hike was a pre-emptive and forward-looking move to strengthen the central bank’s ability to stabilise the Rupiah, and as such to also mitigate potential imported inflation. BI also said that the current financial market uncertainty required a stronger policy response. Meanwhile, Bank of Korea kept rates on hold at 3.5% as expected, but with one board member raising the possibility of a rate cut. BOK Governor Rhee warned of the potential negative spillovers from the Middle East conflict, even as the central bank is monitoring developments in inflation and household debt. Markets will watch for China’s loan prime rate decision out later today.