Ahead Today

G3: US: initial jobless claims, Philadelphia Fed business outlook, leading index; ECB meeting, ECB President Lagarde press conference

Asia: Malaysia trade

Market Highlights

Markets have become more dovish, pricing in a total of 64bps of rate cuts this year, compared to the Fed’s dot plot of just 1 rate cut, with the first one to start in September. This is followed by another 100bps of rate cuts in 2025. This, along with a retracement of the yen, has led to the US dollar index breaking a key technical support level of 104. The index is now down by about 2% so far this month. Seasonal weakness for the US dollar this month could also have a part to play.

In his speech yesterday, Fed Waller said that the current macro data suggests the US economy is on the path to a soft landing and is thus closer to a point where interest rates can be cut. The labour market has become more balanced, though the risk to unemployment is on the upside. The labour market is where Waller said he will be paying close attention. He also added that he would like to see a couple more data to confirm a soft landing.

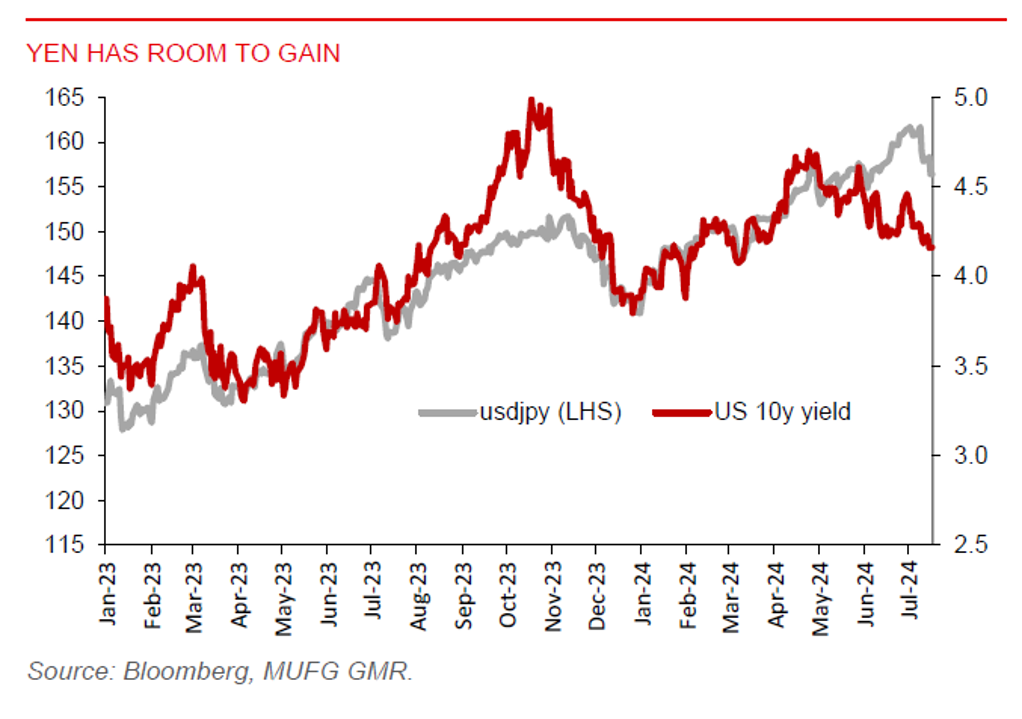

Meanwhile, USDJPY has broken its 50-day moving average at around the 158 level, with the USD 1y swap suggesting there’s scope for the yen to retrace. All eyes will be on Japan’s CPI inflation due on Friday, which could shape market expectations for the pace of rate normalization. Whether this marks an inflection point will depend on BOJ’s policy decision in two weeks’ time.

Regional FX

Asian currencies have strengthened against the US dollar, with JPY, (+1.7%), IDR (+0.5%), THB (+0.6%), and KRW (+0.6%) leading gains in the region. USD 1y swap suggests there’s scope for a stronger yen. Meanwhile, Bank Indonesia held its policy rate at 6.25% yesterday. This, along with dovish expectations for Fed rate cut, has also supported the rupiah for now. But the risk is that market expectations for more than 2 US rate cuts this year may be optimistic. An unwinding of dovish expectations may contain dollar weakness. We also think the rupiah still faces some crosswinds ahead, given domestic fiscal uncertainty. BI sees the Fed cutting rates in November, with a likelihood that it could also ease policy in Q4. But we think BI is in no rush, with growth resilient and inflation manageable. The rupiah outlook will be key to monetary policy. For now, we keep our forecast for BI to cut rates in early 2025.