Ahead Today

G3: US initial jobless claims, University of Michigan sentiment

Asia: Singapore money supply, Thailand manufacturing production index, Hong Kong money supply

Market Highlights

US Fed governor Waller said there is still no rush for rate cuts. Economic data warrants delaying or reducing the number of cuts this year. Supply chain issues have also faded, while the Baltimore port disaster is not likely to cause much supply side disruption. He also added that the Fed needs a couple more months of data to see inflation heading back to 2%. That said, he still expects disinflation to progress and the Fed to cut rates later this year.

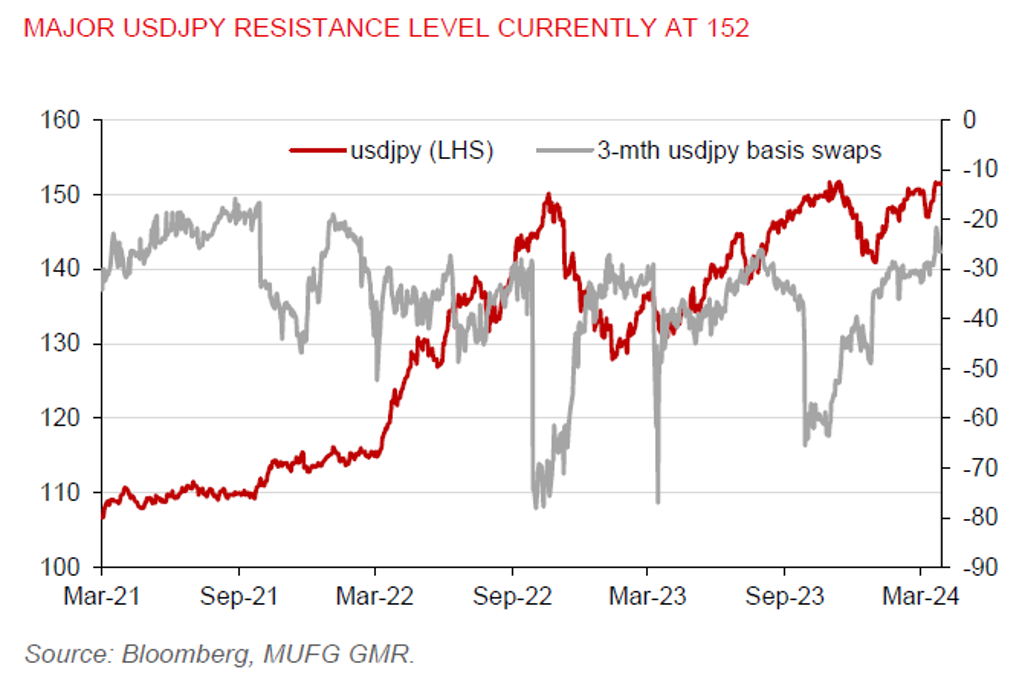

Hedging costs on the yen are falling, suggesting expectations for further yen weakness are becoming entrenched and money managers are increasingly buying overseas assets on an unhedged basis. However, with the yen sliding to its lowest level since 1990, we think the growing risk of FX intervention could keep speculators at bay, with USDJPY at 152 being a major resistance level. Following a joint meeting between the government and central bank, Japan’s top FX official Masato Kanda said the government cannot tolerate speculative yen moves and is prepared to exercise all options to curb excess FX moves. Also, Finance Minister Suzuki vowed to take “decisive steps” against excessive yen weakness.

US 10-year yields remained elevated at 4.2%, the US dollar index stayed firm at 104.3, while Brent prices were at US$86/barrel.

Regional FX

USD/Asia pair have broadly continued to trade higher, with KRW (-0.7%) and IDR (-0.4%) underperforming other regional currencies. Offshore Chinese yuan has retreated from its recent low point of 7.2761 versus the US dollar to trade at 7.2553, following a somewhat stronger daily onshore yuan fixing. Apart from that, there hasn’t been much catalyst of late to spur sustained strengthening of Asian currencies. Meanwhile, China’s President Xi met with key executives from US companies like Blackrock and Qualcomm, saying he would like US firms to invest in China, not decouple from China. But in the lead up to the US presidential election in November, campaign narratives resembling taking a tough stance against China would weigh on sentiment in the Asia region.