Week Ahead FX outlook:

This past week was another seminal one for the history books including for macro and markets here in Asia. In particular, President Trump announced a 90-day reprieve for countries receiving higher reciprocal tariff rates, in an apparent about-turn just hours after these tariffs supposedly came into effect on 9 April. The baseline uniform tariff rates of 10% nonetheless remained in place. Global and US equity risk sentiment initially staged a phenomenal rebound with the Dollar weakening sharply as well. The tariff pause was no doubt a welcome relief for many lower-income economies in Asia such as Vietnam and Thailand who were supposed to bear a disproportionate brunt of the planned tariff hikes.

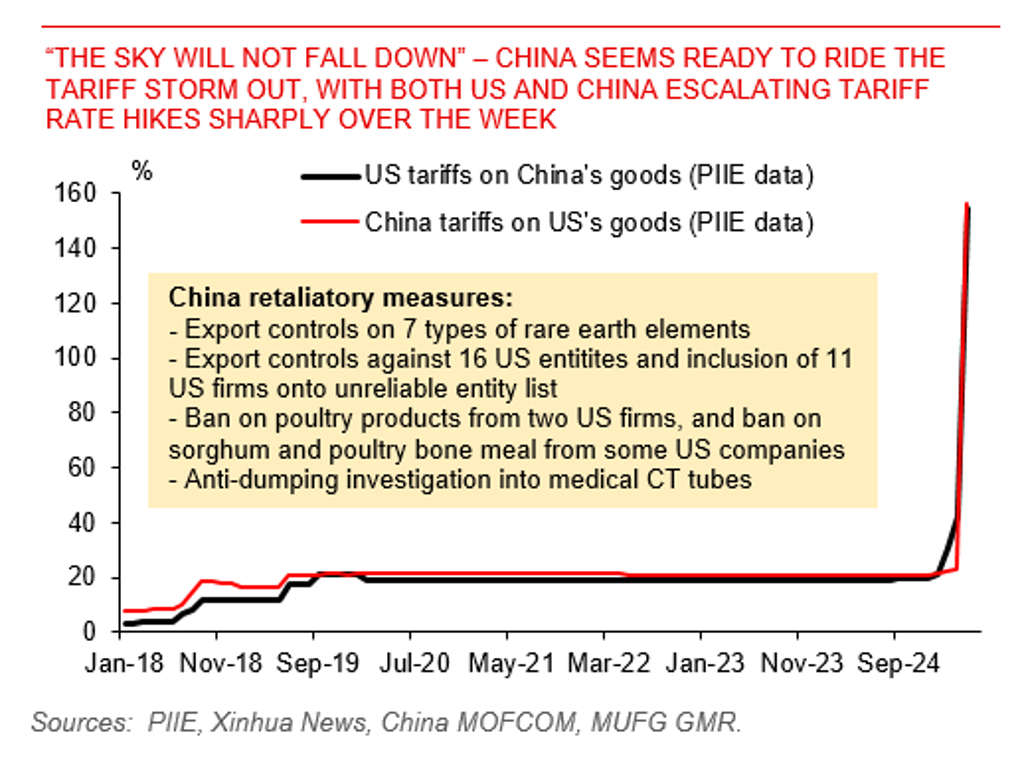

Nonetheless, we think the worst is not over for Asia FX. The most crucial development is the sharp escalation in trade and tariff tensions between the US and China, with US hiking tariff rates by a cumulative 145%, with China responding with a 125% tariff hike together with a whole host of retaliatory measures such as export controls on rare earth minerals.

Late Friday last week, Trump administration exempted techs like smartphones, computers and some other electronic devices from new tariffs. More details are expected to be announced early this week.

Overall, we think EM Asian currencies may receive some initial reprieve from the new change of tariffs on tech to start the week. But with Lutnick and other officials’ comment on Sunday that the exemptions for tech are temporary, before Trump to impose a different and specific levy on the sector, though will likely be lower than the tariffs on China set by Trump last week, we think tech-sensitive currencies like CNY, KRW, TWD, and China sensitive currencies like THB, and IDR are probably vulnerable and volatile, while INR and PHP should be more resilient.

China seems ready to ride the tariff storm out