Week Ahead FX outlook:

The past week saw a multitude of cross currents for Asian FX which include both global and local factors. On the global front, the Dollar weakened driven to some extent by a possible deal in the Russia-Ukraine war led by Trump, while US inflation data while somewhat sticky still pointed to a modestly benign path for possible Fed rate cuts later this year.

The big uncertainty was also in terms of tariff implementation by Trump 2.0. President Trump signed a measure on reciprocal tariffs, directing the US Commerce Secretary and Trade representative to propose new levies on a country-by-country basis in an effort to help reduce the US trade deficit. According to officials, this study should be completed by 1 April and tariffs could be implemented after that. The interesting part is that these import taxes will be customised not just based on trade tariffs, but also target a whole range of non-trade issues such as unfair subsidies, regulations, value added taxes, exchange rates, together with other factors that limit US trade.

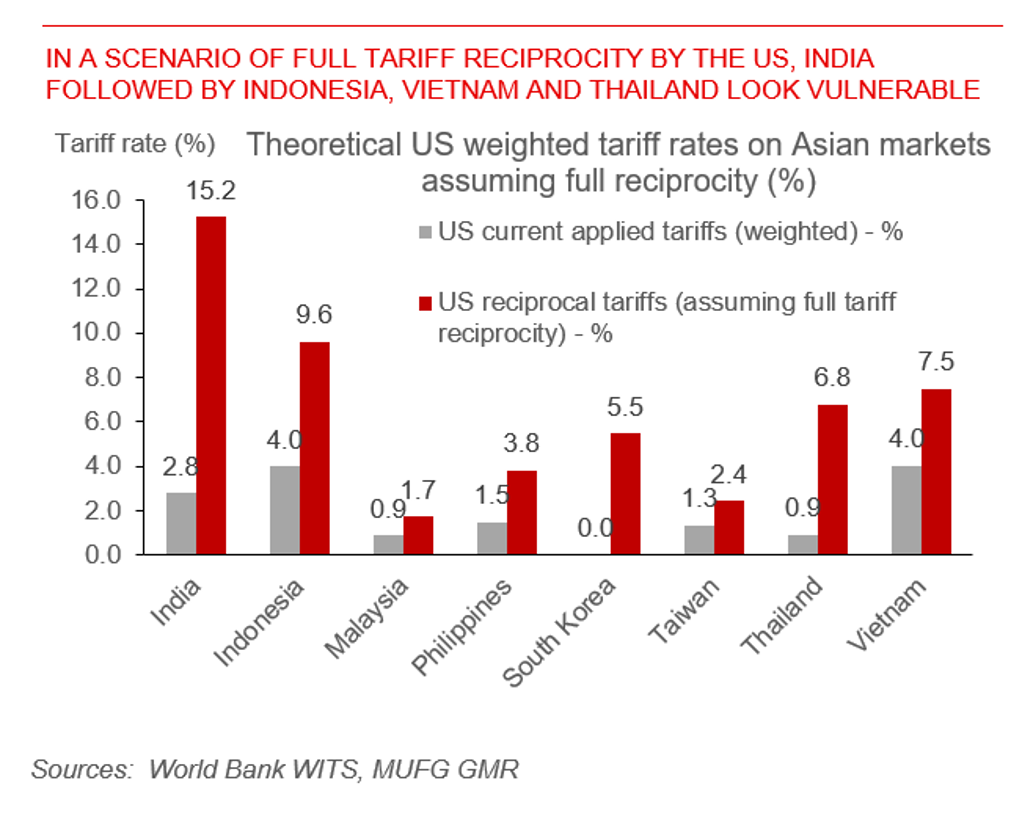

With such a broad scope, it’s difficult to determine exactly how Asian economies will be badly hit at this point, and also raises questions of how much room for negotiations there will be. As a first cut analysis, our study shows that India looks most vulnerable in Asia to full reciprocity in tariffs, followed by Indonesia, Vietnam and Thailand (see Asia FX Talk – Reciprocal tariffs an eye for an eye). Nonetheless, we note that this does not take into account some of the non-tariff barriers and non-trade related factors mentioned. In addition, we think full reciprocity is highly unlikely in practice. For what it’s worth, Asian markets overall seem to have taken the reciprocal tariffs as perhaps another sign of implementation delay, and Asian currencies have also strengthened as a result.

In a scenario of full tariff reciprocity by the US, India followed by Indonesia, Vietnam and Thailand look vulnerable