Week Ahead FX outlook:

The broad US dollar index (DXY) has found some near-term stability this week, after experiencing one of the worst weeks (-3.5% week-on-week) for the week ending 7 March. Many Asian currencies have also partially given back some gains, with the ringgit set for the biggest weekly loss among regional peers with a 0.7% decline amid equity outflows. However, CNY, THB, and the VND have been relatively stable.

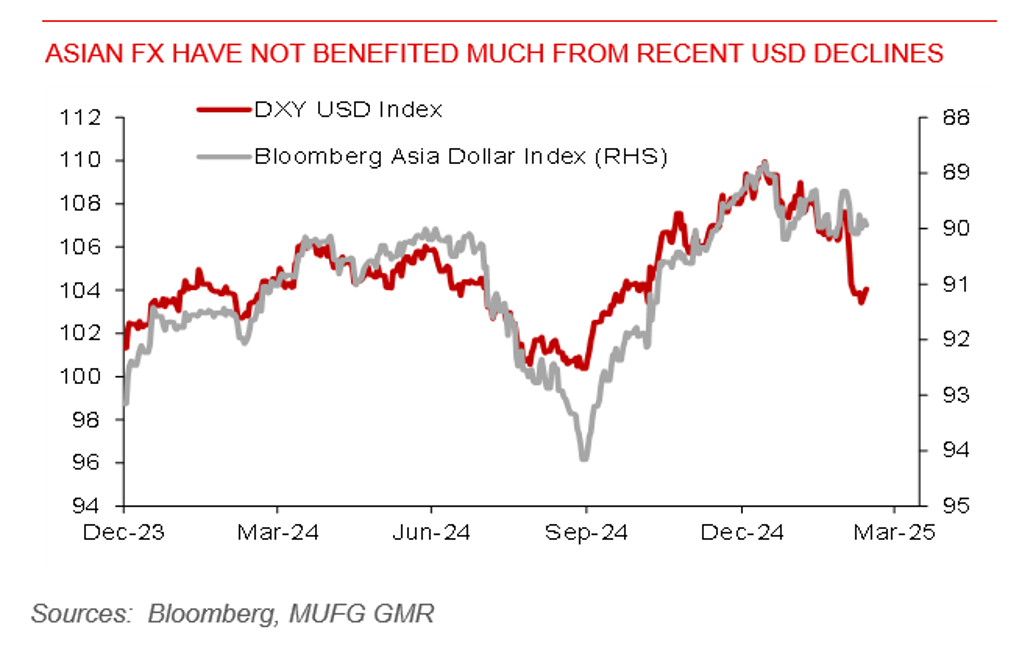

With the US dollar already at oversold levels, we could see a near-term bounce in the US dollar in the week ahead, especially with incoming reciprocal tariff hikes in April. US Commerce Secretary Howard Lutnick has affirmed that there will be more tariff actions in a couple of weeks, suggesting recent reprieve in Asian FX could yet prove to be transient. Moreover, recent US dollar weakness has largely been driven by the euro due to Germany’s plans to boost fiscal spending, while Asian currencies have not really benefited by much (see chart below)

The week ahead also promises to be a more eventful one to watch than this week, given China’s activity data and a flurry of central bank policy meetings, including by the Fed and Taiwan’s central bank on 20 March, as well as the BoJ and Bank Indonesia on 19 March. Despite lower US CPI and PPI prints during the week, the Fed is likely to adopt a wait-and-see policy stance for now. A reduction in market expectations for US rate cuts - currently priced at slightly less than 3 rate cuts in the rest of this year - could provide additional US dollar support at the expense of Asian currencies. Elsewhere, BoJ could stand pat this month, but signal for a potential rate hike in May. This would be a positive for the yen, where policy rates are set to normalise amid rising inflation and wage growth. Bank Indonesia could also hold rates amid rupiah weakness. There’s ongoing policy uncertainty around Indonesia’s fiscal outlook and a lack of clarity about lawmakers’ plans to expand Bank Indonesia’s mandate, which currently already includes supporting growth, containing inflation, and maintaining rupiah stability.

Asian FX have not benefited much from recent USD declines