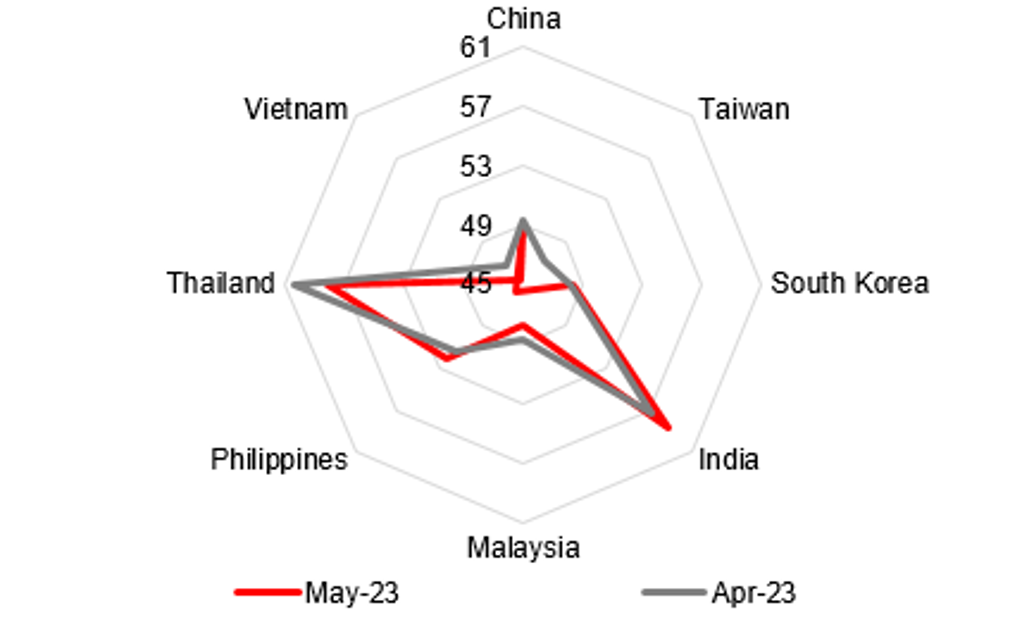

Divergence between manufacturing sectors across Asia

Special focus: Last month, divergence between manufacturing sectors across Asia continued to show, with China, Taiwan, South Korea, Malaysia and Vietnam contracting, while India, Philippines and Thailand expanding.

FX views: Most emerging FXs strengthened against the US dollar amid the background of a 0.2% fall in dollar index. The KRW outperformed regional peers, followed by MYR (+0.5%) and THB (+0.4%). On the contrary, CNY underperformed Asian FXs by weakening 0.5% against the dollar.

Week in review: Asian economies’ manufacturing PMIs continued to diverge last month. Exports for South Korea and Vietnam fell less than expected in May, while Thailand customs exports dropped more than expected in April. Inflationary pressures continued to ease in South Korea and Vietnam.

Central bank monitor: The Reserve Bank of India is expected to keep its key repo rate on hold at 6.5% next week. Markets will watch closely for signs that the RBI is turning less hawkish. Meanwhile, Bank of Thailand raised its policy rate by 25bps last week in a unanimous vote, in line with consensus and our expectation, while keeping a tightening bias.

Week ahead: For the coming week in the US, ISM services are likely the key focus. In April the index expanded with a 51.9 print. The US will also release factory orders on 5 June, April trade balance on 7 June, initial jobless claims data on 8 June and wholesale inventories on 8 June.

THIS MAY, MANUFACTURING PMIS FOR CHINA, TAIWAN, SOUTH KOREA, MALAYSIA AND VIETNAM IN CONTRACTION, WHILE MANUFACTURING FOR INDIA, PHILIPPINES AND THAILAND IN EXPANSION

Sources: Bloomberg, MUFG GMR