Recent trends in India’s current account deficit and balance of payments

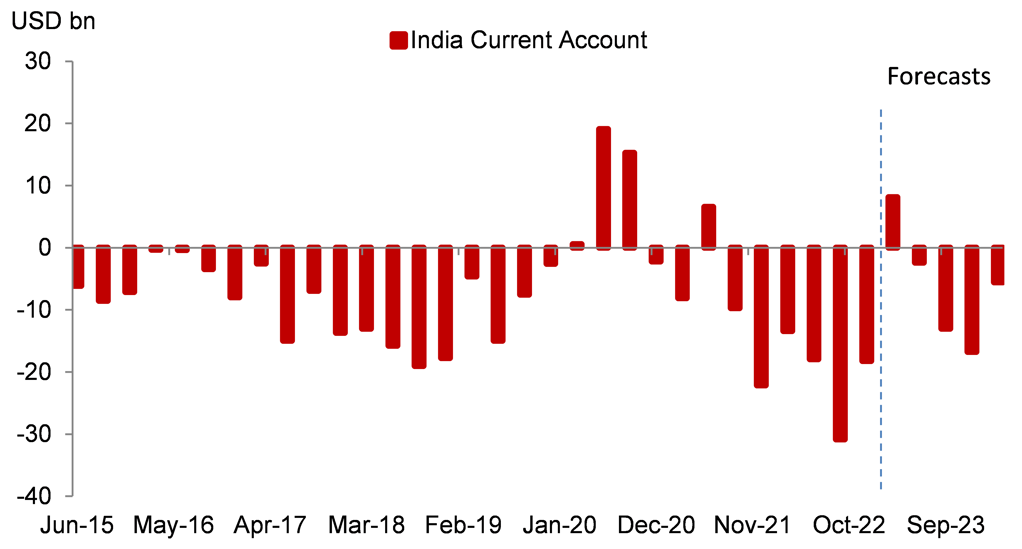

Special focus: India’s current account could be in a small surplus in the March 2023 quarter. The overall deficit should widen from here, but remain manageable at around 1-2% of GDP in FY2023/24. Key risks include a sharp decline in services exports and spikes in commodity prices. On the capital account, FDI and External Commercial Borrowing should pick up from here, even as equity and bond inflows improve further. We remain positive on INR and forecast USDINR at 79.0 in 12 months.

FX views: Amid the background of a 1.3% decline in dollar index last week, most Asian FXs strengthening against the dollar. The KRW outperformed, followed by INR, SGD and PHP. The CNY and TWD only had mild appreciations, weighed by China’s disappointing economic indicators for May. In contrast, IDR underperformed Asian FXs, followed by VND and THB.

Week in review: Disappointment was seen in China May year-over-year growths of key macro indicators. India’s exports fell 10.3%yoy in May after a 12.7%yoy decrease in April. On the contrary, Indonesia’s exports unexpectedly rose 0.96%yoy in May following a 29.42%yoy decline in April. Inflationary pressures continued to ease in India.

Central bank monitor: PBOC cut its 7-day reverse repo rate by 10bps to 1.9% on 13th June and lowered its MLF rate by 10bps on 15th June to 2.65%. elsewhere, Taiwan’s central bank kept its benchmark discount rate unchanged at 1.875% on 15th June.

Week ahead: We do not anticipate that BI will make any changes to its monetary policy decision on 22 June. This is due to the continued moderation in inflation. In May, headline and core inflation reached 4% y/y and 2.66% respectively. These are now within the central bank’s 2-4% inflation target for this year.

WE EXPECT INDIA’S CURRENT ACCOUNT DEFICIT TO WIDEN SLIGHTLY FROM HERE BUT REMAIN MANAGEABLE AT AROUND 1-2% OF GDP

Sources: Bloomberg, MUFG GMR