Focus on US CPI

FX views: Most Asian currencies, except for Malaysian ringgit, weakened against the US dollar amid a rise in dollar index, with KRW depreciating most, followed by THB and PHP. The comparatively mild 0.5% fall of the Chinese yuan was helped by the PBOC’s stronger-than-expected CNY fixings and the continued efforts from the Chinese authorities to roll out stimulus measures.

Week in review: Asian economies’ manufacturing PMIs diverged in July. Meanwhile, South Korea’s exports slumped more than expected by 16.5%yoy last month following a 6.0%yoy fall in June. South Korea’s headline CPI slowed more than expected to 2.3%yoy in July with core inflation sliding to 3.3%yoy. Elsewhere, Indonesia’s headline CPI moderated in line with market expectations to 3.08%yoy in July, and core CPI inflation fell more than expected to 2.43%yoy. Philippines’ headline CPI inflation moderated more than expected to 4.7%yoy in July That was also below Bloomberg consensus.

Central bank monitor: The Bank of Thailand raised rates again by 25bps to 2.25% in a unanimous decision. The post-statement language offered a more balanced tone, with the Committee expressing concerns over inflation upside and risks to growth from potential delay in export recovery and political uncertainties. We see BOT keeping rates on hold for the rest of this year.

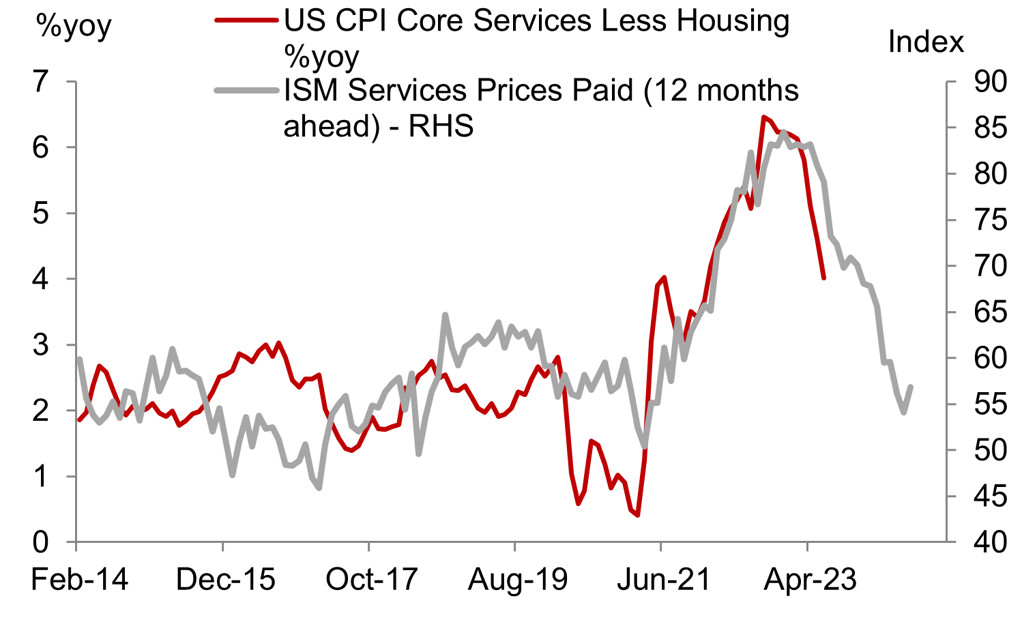

Week ahead: Markets will focus on US CPI numbers releases on 10th August. In Asia, next week features 2Q GDP reports of Indonesia and the Philippines, trade and inflation data of China and Taiwan, inflation reports of Philippines and Thailand. In India, we expect the RBI to maintain a hawkish tone and keep the repo rate on hold at 6.5% on 10th August.

MARKETS WILL FOCUS ON US CPI NUMBERS RELEASED NEXT WEEK. LEAD INDICATORS CONTINUE TO POINT TO A MODERATION

Sources: Bloomberg, MUFG GMR