Key Asian central bank meetings this week

FX views: Most Asian currencies weakened against the US dollar last week amid the background of a 0.7% rise of dollar index, with the MYR and KRW leading the declines. CNY erased some of its earlier losses after Chinese central bank offered the strongest-than-expected yuan fixing and pledged to adjust and optimise property policies in a timely manner.

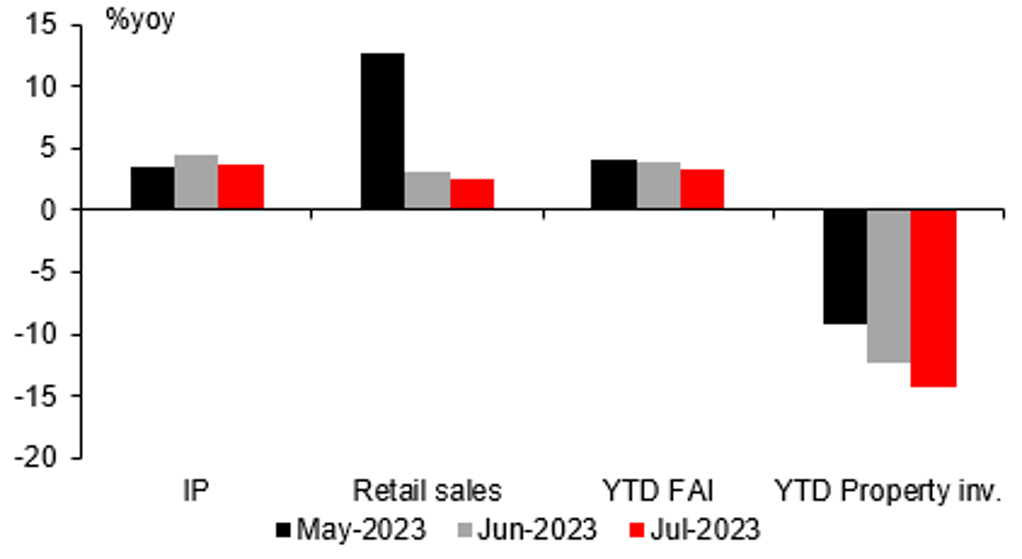

Week in review: China’s July year-on-year growths of major key macroeconomic indicators including IP, retail sales, FAI and property investment decelerated and surprised market to the downside. Exports for Singapore, Malaysia, Indonesia and India’s remained in contraction this July. India’s headline CPI inflation accelerated for the second month and breached the upper end of the RBI’s 2%-6% target range for the first time in five months.

Central bank monitor: PBOC cut rates on 15th August, lowering 1-year medium-term lending facility rate by 15bps to 2.50%, reducing 7-day repo rate by 10bps to 1.80%, and cut overnight, 7-day and 1-month standing lending facility rate by 10bps each to 2.65%, 2.80% and 3.15% respectively. Elsewhere, the BSP left its benchmark interest rate unchanged for a third straight meeting on 17th August, maintaining its overnight borrowing rate at 6.25%, but the governor retained his hawkish stance.

Week ahead: Market will be turning to the Jackson Hole conference in Wyoming this week to gauge Fed sentiment, while still watches development on Chinese developer and related stresses. Asian calendar features 2Q GDP for Thailand, exports data for Taiwan, South Korea, Thailand and Vietnam, industrial production for Taiwan, Singapore and Vietnam, inflation report for Malaysia, Singapore and Vietnam, as well as rate decision from PBOC, BOK and BI.

CHINA’S KEY MACROECONOMIC INDICATORS FOR JULY SURPRISED MARKETS TO THE DOWNSIDE AND DOWN FROM THEIR JUNE’S VALUES

Sources: Bloomberg, MUFG GMR