Regional PMI on focus

FX views: Regional currencies trading mixed against the Dollar. Powell’s speech at Jackson Hole was viewed as neutral to slightly hawkish by markets, but importantly, did not rock the boat by changing guidance on longer-term neutral rates. CNY closed last week largely flat amid a stronger dollar, as China stepped up its efforts to support the yuan even amidst foreign equity outflows. KRW (+1.0%) and THB (+0.7%) led gains on resumption of foreign capital inflows into domestic stock market. In contrast, PHP and VND underperformed regional peers by weakening 1.0% each against the dollar.

Week in review: Thailand’s economy grew less than expected in the second quarter of this year on both month-on-month and year-on-year basis. Taiwan’s export orders fell less than expected in July, while Thailand’s customs exports fell more than expected last month. July’s CPI inflation for Malaysia and Singapore fell more than expected in July.

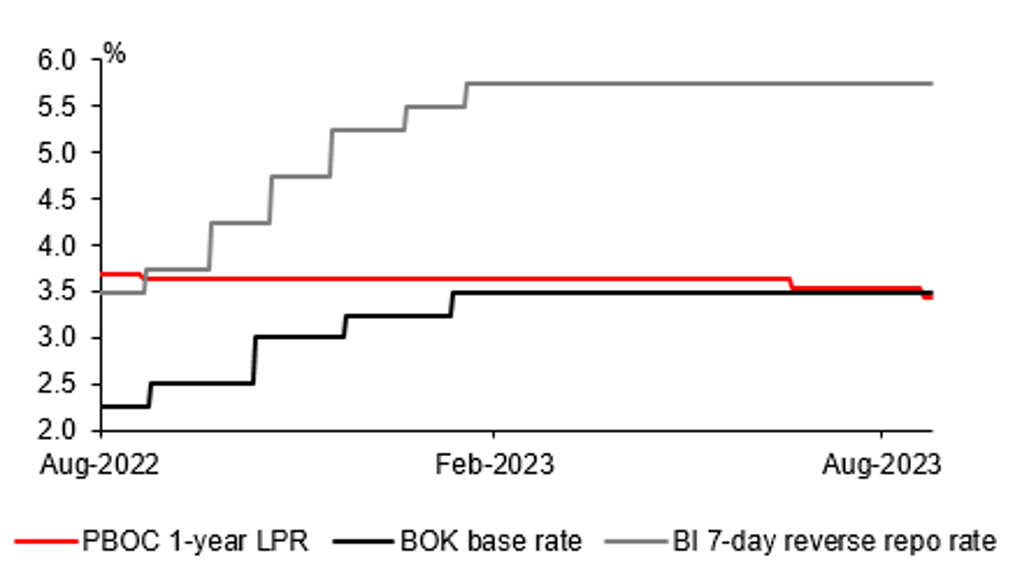

Central bank monitor: PBOC surprised with modest rate cut on 21st August, cutting its 1-year LPR by 10bps to 3.45%, while keeping the 5-year LPR unchanged at 4.20%, after the central bank lowered its 1-year MLF rate by the same margin a week earlier. On 24th August, BOK held its base rate steady for a fifth straight meeting at 3.50%, while BI kept its 7-day reverse repo at 5.75%.

Week ahead: Asia calendar features 2Q GDP for India, August PMI data for most Asia economies, industrial production for South Korea, trade figures for South Korea and Vietnam, inflation report for Indonesia. Meanwhile, US non-farm payrolls for August will be closely watched.

PBOC CUT ITS 1-YEAR LPR ON 21ST AUGUST WHILE BOK AND BI STOOD PAT ON 24TH AUGUST

Sources: Bloomberg, MUFG GMR