Focus on the Fed meeting

FX views: Asian currencies were mixed last week, with the Chinese yuan outperforming regional peers by strengthening 1.0% against the dollar despite persistent net sell-off via Northbound Stock Connect. That followed by respective 0.5% and 0.3% appreciation of KRW and TWD. On the contrary, THB and VND underperformed Asian peers, both deprecating 0.8% with the US dollar.

Week in review: China’s August key macroeconomic data were mixed: industrial production and retail sales rose more than expected while YTD fixed assets investment rose less than expected and YTD property investment fell further. Amid persistent weakness in external demand, exports for India and Indonesia continued to contract this August. Inflationary pressure in India eased in August, with headline CPI inflation falling to 6.83%yoy from 7.44%yoy in July.

Central bank monitor: China's 1-year and 5-year LPR rates likely to remain unchanged at 3.45% and 4.20% this month. Elsewhere, we also expect regional central banks to stand pat this week, with CBC leaving its benchmark interest rate unchanged at 1.875%. We see Bank Indonesia holding its 7-day reverse repo rate steady at 5.75%, and BSP keeping its overnight borrowing rate unchanged at 6.25%.

Week ahead: The key focus will be on the FOMC meeting. Beyond just the actual rate decision, markets will focus on the Fed’s economic projections and also the tone from Chair Powell. Asian calendar features trade data for Taiwan, South Korea, Malaysia and Singapore, inflation for Malaysia, as well as rate decision from PBOC, CBC, BI and BSP.

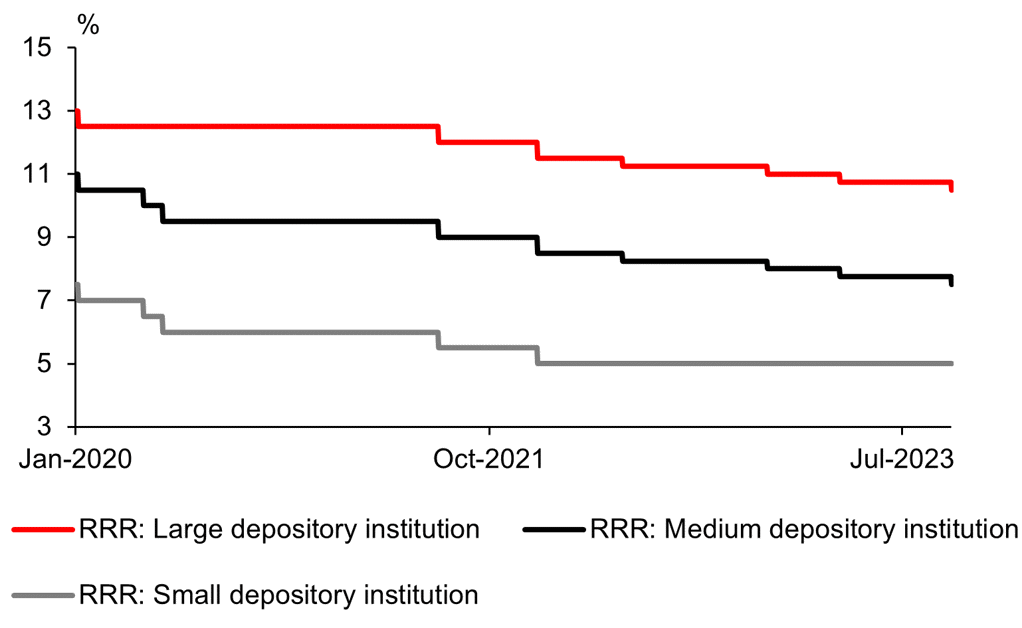

PBOC CUT RRR FOR ALL BANKS, EXCEPT THOSE THAT HAVE IMPLEMENTED A 5% RESERVE RATIO, BY 25 BPS, EFFECTIVE FROM 15TH SEPTEMBER

Sources: Bloomberg, MUFG GMR