Higher-for-Longer Fed

FX views: Most EM Asian currencies weakened against the dollar last week on a stronger dollar after the Fed’s dot plot signalled higher-for-longer rates. The KRW outperformed regional currencies, followed by TWD and THB. The CNY tracked losses in its Asian peers, even as the PBOC set the strongest CNY fixings relative to expectations on record last Friday, and the Northbound Stock Connect recorded mild net purchases in the week.

Week in review: Exports for Taiwan, Malaysia and Singapore remained weak last month. Taiwan’s export orders declined more than expected by 15.7%yoy in August after falling 12.0%yoy in July. Malaysia’s exports fell 18.6%yoy this August, down from a 13.1%yoy decline in the prior month, and below Bloomberg consensus of a 16.3%yoy contraction. Singapore’s non-oil domestic exports dropped 20.1%yoy in August, following a revised 20.3%yoy contraction in July, and below Bloomberg consensus of a 17.1%yoy decline. Elsewhere, South Korea’s overall exports rose 9.8%yoy in the first 20 days of September after dropping 16.5%yoy in the same period of August.

Central bank monitor: PBOC kept its 1-year and 5-year LPR rates unchanged at 3.45% and 4.20% respectively on 20th September after keeping the 1-year MLF steady at 2.50% on 15th September. Elsewhere, Taiwan central bank kept its discount rate unchanged at 1.875% for a second quarter as expected on 21st September but struck a hawkish tone, saying rates will likely stay higher for longer. Similarly, BI and BSP extended their interest-rate pause last Thursday, holding policy rates unchanged at 5.75% and 6.25% respectively

Week ahead: Asian calendar features September PMIs for China, industrial production for Singapore and Vietnam, trade figures for Thailand and Vietnam, inflation data for Singapore and Vietnam, as well as rate decision from BOT.

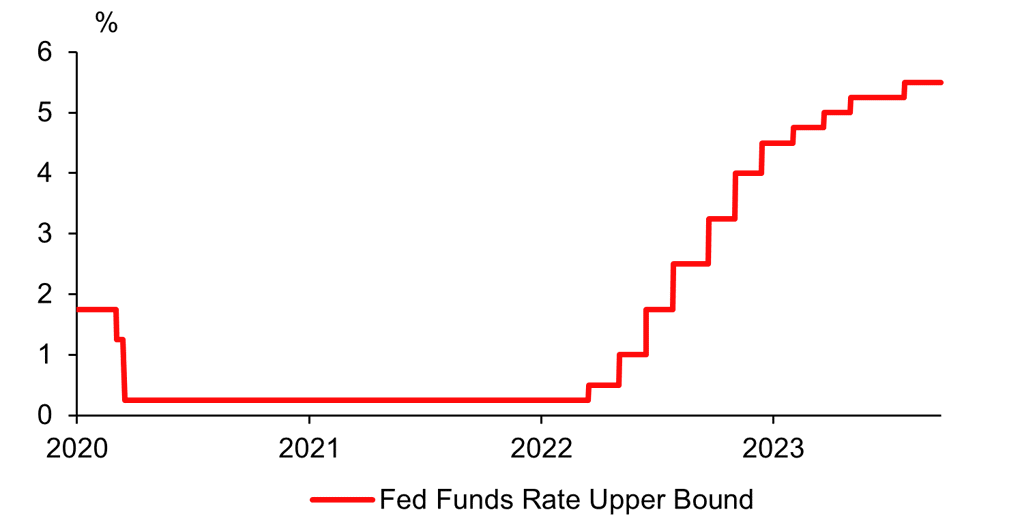

THE FED ON 20TH SEPTEMBER MAINTAINED THE RANGE FOR ITS FEDERAL FUNDS RATE AT 5.25%-5.5% AS EXPECTED

Sources: Bloomberg, MUFG GMR