Await China’s key data for September

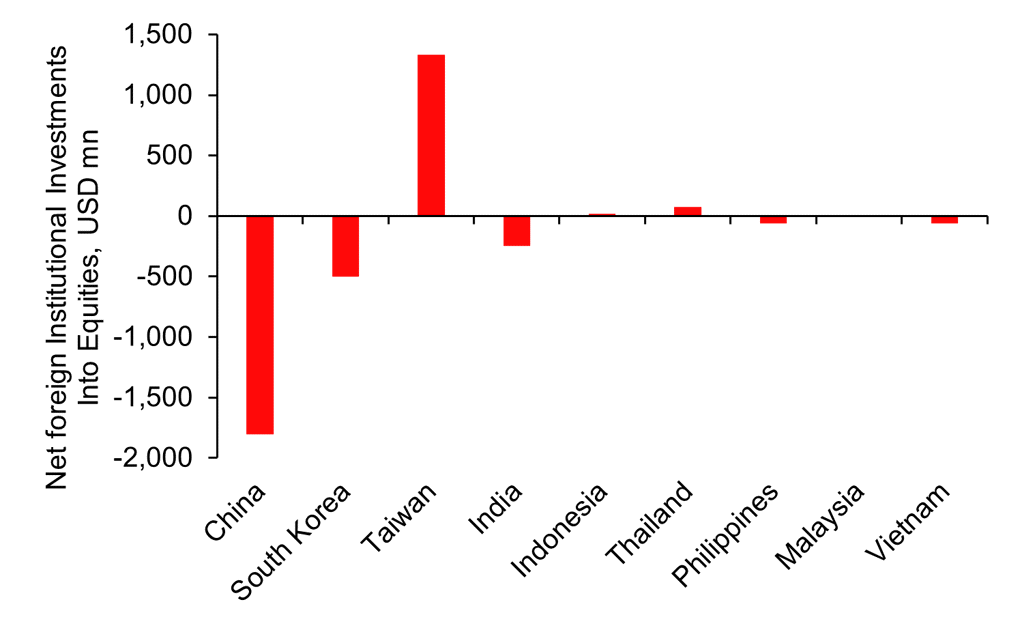

FX views: Most Asian currencies weakened against the US dollar last week amid a stronger dollar. IDR and MYR underperformed regional peers with respective losses of 0.5% and 0.4%, while THB outperformed on the back of returning capital inflows into the country’s stock and bond markets, followed by TWD as foreign investors resumed purchases on Taiwanese shares after three straight weeks of net selloffs. Asian currencies will be driven by US yields, sentiment on China following September data release, coupled with geopolitical uncertainties.

Week in review: Both industrial production for India and Malaysia beat market expectations this August. Last month’s trade figures for Taiwan and Philippines surprised market to the upside with an expansion. China’s headline CPI inflation unexpectedly cooled to 0.0%yoy in September from 0.1%yoy in August, with core inflation remaining unchanged at 0.8%yoy, while India’s headline CPI inflation moderated to 5.02%yoy last month from August 6.83%yoy.

Central bank monitor: The MAS kept its exchange rate policy on hold in its October meeting and was balanced in its post policy statement, while shifting to quarterly statements amidst a more volatile macro environment. PBOC, BOK and Bank Indonesia will announce their monetary policy decisions this week.

Week ahead: Asian calendar features 3Q GDP for China, September key macroeconomic indicators for China, September exports data for Taiwan, Indonesia, Malaysia and Singapore, inflation report for Malaysia, as well as rate decisions from PBOC, BOK and BI. We expect exports data for Taiwan, Indonesia, Malaysia and Singapore to remain in contraction on a year-on-year basis amid weak external demand.

FOREIGN INVESTORS SOLD SHARES IN ASIAN EQUITY MARKETS LAST WEEK, BUT TAIWAN AND THAILAND SAW INFLOWS

Sources: Bloomberg, MUFG GMR