Big week with BOJ, Fed and payrolls

FX views: Most Asian currencies weakened against the US dollar last week as yield differentials continued to weigh the regional currencies. Indonesia rupiah underperformed regional peers, followed by Taiwan dollar and Korean won. The Chinese yuan was flat against the US dollar last week as an increase in government fiscal spending bolstered the yuan sentiment. In contrast, the Thai baht outperformed regional currencies on the news of the government’s action in addressing market’s fiscal concerns.

Week in review: South Korea’s GDP rose at the same pace as the prior quarter. On a year-on-year basis, the country’s 3Q GDP growth rose more than expected. China’s industrial profits in September delivered a positive year-on-year growth rate for the second straight month. Industrial production continued to fall for Taiwan and Singapore on a year-on-year basis this September. Thailand’s customs exports rose 2.1%yoy in September following a revised 2.75%yoy expansion in the prior month.

Central bank monitor: It’s a big week ahead, with the Fed, Bank of England, and Bank of Japan all announcing policies, together with non-farm payrolls on Friday. We attach a 30% probability to BOJ tweaking its YCC policy, while markets will watch Fed Chair Powell’s tone closely for any hawkish signs. Over in Asia, the Philippines central bank hiked rates by 25bps in an off-cycle rate hike, while keeping the door open for more. Bank Negara Malaysia is expected to keep its OPR rate on hold at 3% this week.

Week ahead: Asian calendar features 3Q GDP for Taiwan, October PMI for regional economies, industrial production for South Korea, retail sales for Singapore, trade figures for South Korea and Thailand, inflation data for South Korea and Singapore, as well as rate decision from BNM.

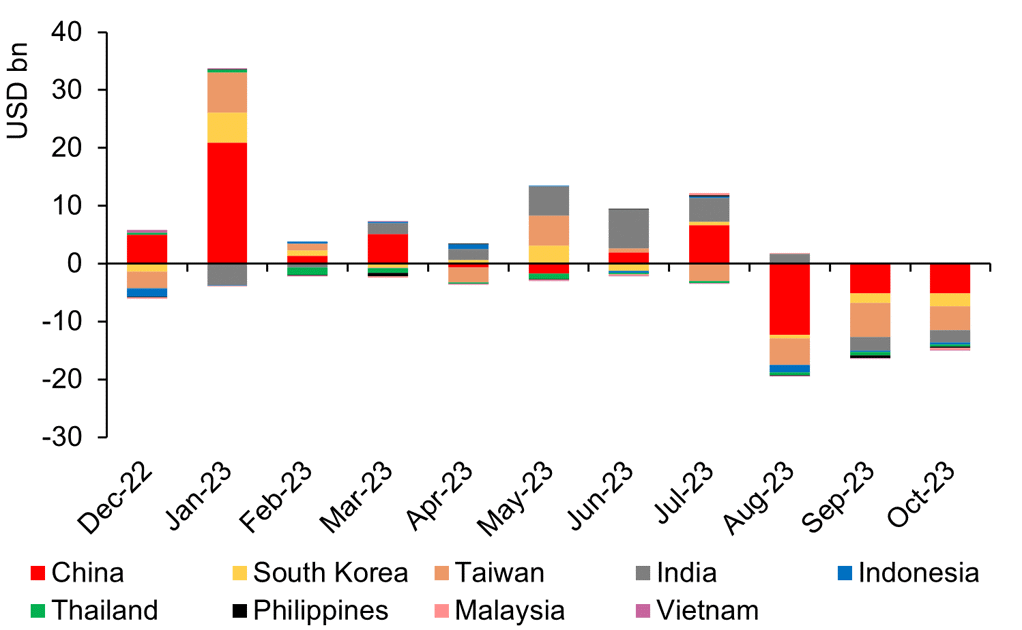

NET FOREIGN SELLING OF ASIAN EQUITIES IN PAST 3 MONTHS

Sources: Bloomberg, MUFG GMR