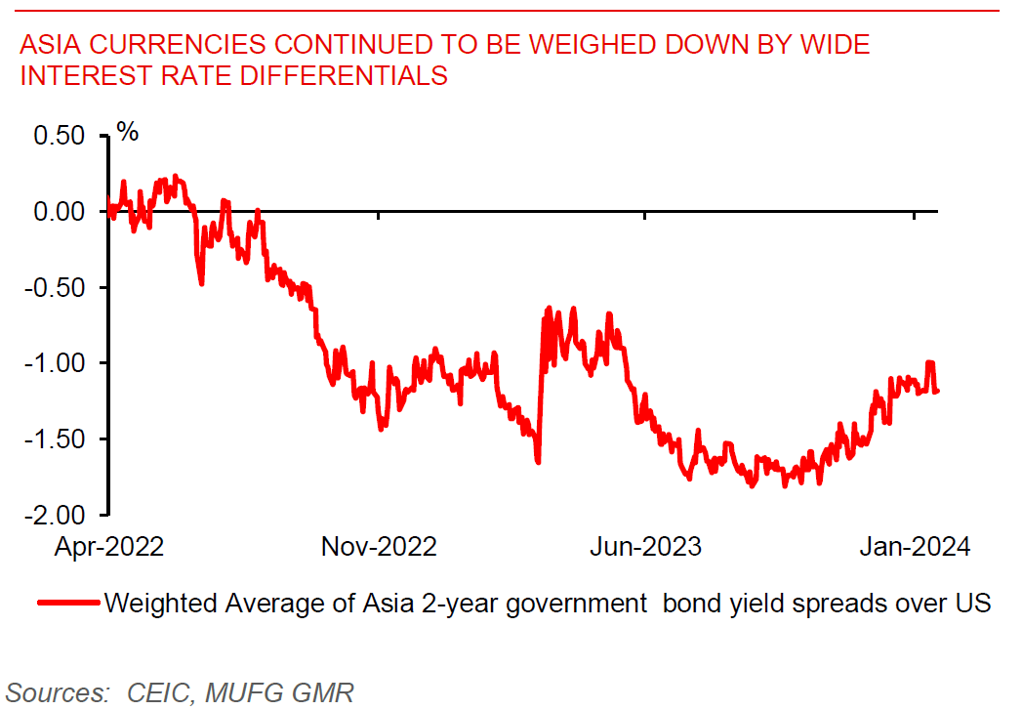

Worsened yield spreads and stronger dollar weighted on Asian currencies

FX views: EM Asian currencies weakened last week amid a 1% US dollar’s appreciation and worsened yield spread. Comparatively, net changes of Philippines peso and Vietnam dong against the dollar were muted, while won, ringgit and baht depreciated more noticeably.

Week in review: China’s GDP growth in 2023 largely met the target, but December’s key macroeconomic numbers showed the persistent weakness in the economy, especially the property sector. Chinese equity markets were sold off by both domestic and foreign investors. In other EM Asian economies, Malaysian GDP growth missed market expectation with a 3.4%yoy growth in Q4, while December exports growth of Singapore and Malaysia surprised market to the downside. India December exports growth turned positive while Indonesia and Malaysia’s still were in year-over-year contraction.

Central bank monitor: China’s central bank disappointed markets by keeping its key 1-year MLF rate on hold, and this came on the back of recent deposit rate cuts by banks. Bank Indonesia kept rates on hold and said that rate cuts, while likely at some point in 2024, will require greater confidence around IDR stability and moderate inflation.

Week ahead: Markets will focus on ECB, BOJ and PBOC policy decisions this week. We expect all 3 central banks to keep rates on hold, with ECB likely to keep a hawkish tone while the BOJ is likely to keep optionality for a policy change later this year. We think it’s a matter of time before PBOC cuts rates given still disappointing growth momentum out of China. In Asia, markets will focus on industrial production numbers out of Taiwan and Singapore to gauge extent of trade recovery in Asia, together with 4Q GDP data from Korea.

Asia currencies continued to be weighed down by wide interest rate differentials