Data intensive week for Asia FXs

FX views: Majority EM Asian currencies had a muted net change against the USD last week amid a 0.3% appreciation of DXY Index. Indonesia rupiah and Philippines peso were the worst performers with a loss of 1.3% and 0.6% against the dollar respectively, while Taiwan dollar, Chinese yuan and South Korea won edged slightly stronger against the dollar, while India rupee, Malaysia ringgit, Thailand baht and Vietnam dong had a very mild 0.1%-0.3% depreciation.

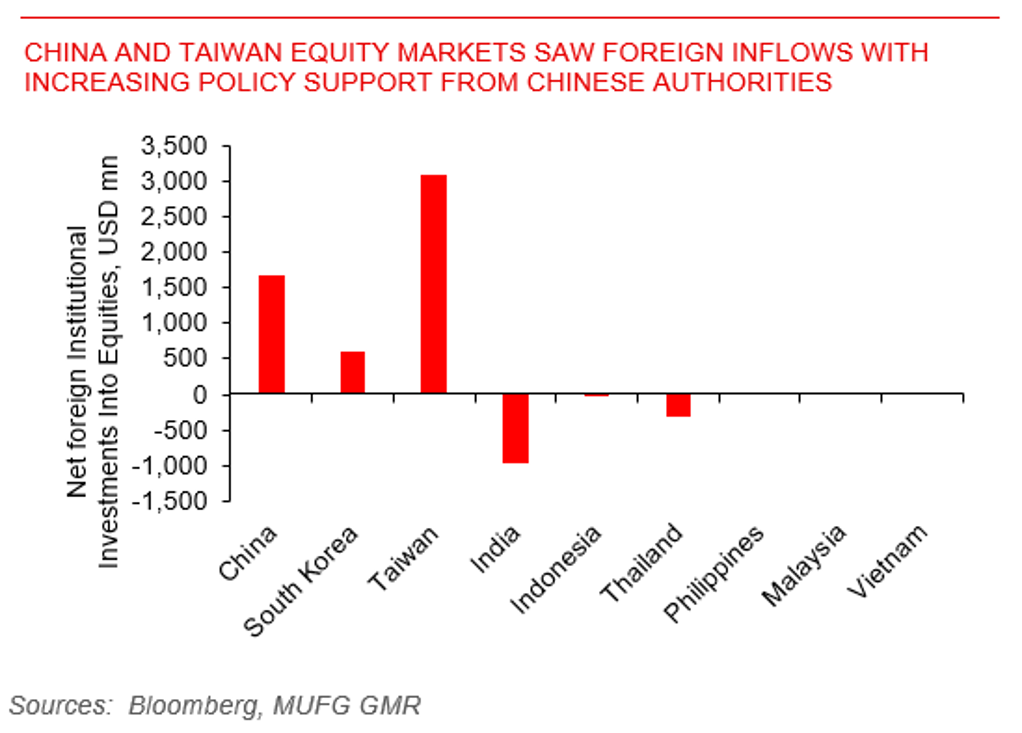

Week in review: Chinese authorities raised expectations for policy support last week, with the PBOC announcing a 0.5pp RRR cut (effective 5th February), and Chinese authorities seeking to mobilise about 2 trillion yuan of funds to support the stock market, on the back of Premier Li’s call for “forceful” steps. Meanwhile, rules for bank loans on commercial property loans were also eased. South Korea’s GDP growth was steady at 0.6%qoq in Q4 on a sequential basis, in line with market consensus. Taiwan export orders in December experienced an unexpectedly drastic decline and Thailand exports growth slowed as well.

Central bank monitor: China’s central bank disappointed markets initially by keeping its key loan prime rate on hold, but more policy support was announced through the week. Meanwhile, Bank Negara Malaysia kept rates on hold and continued to highlight uncertainty around impact of subsidy removals on inflation.

Central bank monitor: The focus this week will be on the FOMC meeting, US non-farm payrolls, coupled with China’s official PMI readings. Markets will watch closely for Fed Chair Powell’s comments for any guidance on rate cuts, together with the trajectory of China’s economic activity. Meanwhile, the Monetary Authority of Singapore (MAS) will kick off its 1st quarterly review of the year. Other important data points include South Korea’s January exports.

China and Taiwan equity markets saw foreign inflows with increasing policy support from Chinese authorities