FX views: Last week, most EM Asian currencies had a muted net change against the dollar, amid US dollar’s 0.2%wow change. China was on break last week, during the period, HSI index increased by nearly 4% - this, with market’s expectation of 10bps cut on 5-year LPR by PBOC this Tuesday, could imply some catch ups of A shares and CNY today, but lasting effect will depend on PBOC’s LPR decision tomorrow. This week, what also matter for Asia FX include the Jan30-31 FOMC meeting minutes and ECB’s Account of January Meeting, BI and BOK policy meetings, Thailand’s 4Q GDP, India’s manufacturing and services PMIs, trade data for Malaysia and Thailand, CPI data for Malaysia and Singapore

Week in review: Data last week sparked significant volatility in the Dollar and US yields, with higher-than-expected CPI and PPI in particular raising concerns around the path forward for US inflation, and as a consequence, for the Fed. In Asia, Chinese online platform data suggests some improvement in consumer spending during the holidays, while the central bank-backed Financial News reported that the 5-year loan prime rate may be cut this month. Meanwhile, India’s core inflation moderated further while the trade deficit remained manageable.

Central bank monitor: Foreign inflows into Asian equity markets picked up to around US$3.3bn in what was a shortened week, from US$2.6bn inflows previously. This was mainly concentrated in North Asia and comes on the back of tentative signs of consumer spending pickup in China during the Chinese New Year holidays, with markets such as South Korea and Taiwan also benefiting from a continuation of the AI chip boom theme. Meanwhile, Indonesia’s equity markets saw a relief rally after a stronger than expected win by Prabowo in the Elections.

Week ahead: Markets will focus on the Fed minutes, speeches by Fed speakers such as Governor Waller. Several key central banks in Asia will announce their policy decisions, including the PBOC, Bank Indonesia, and the Bank of Korea. Consensus is calling for a 10bps cut in the 5-year loan prime rate, while markets will watch closely for the tone of policy statements out of BI and BOK.

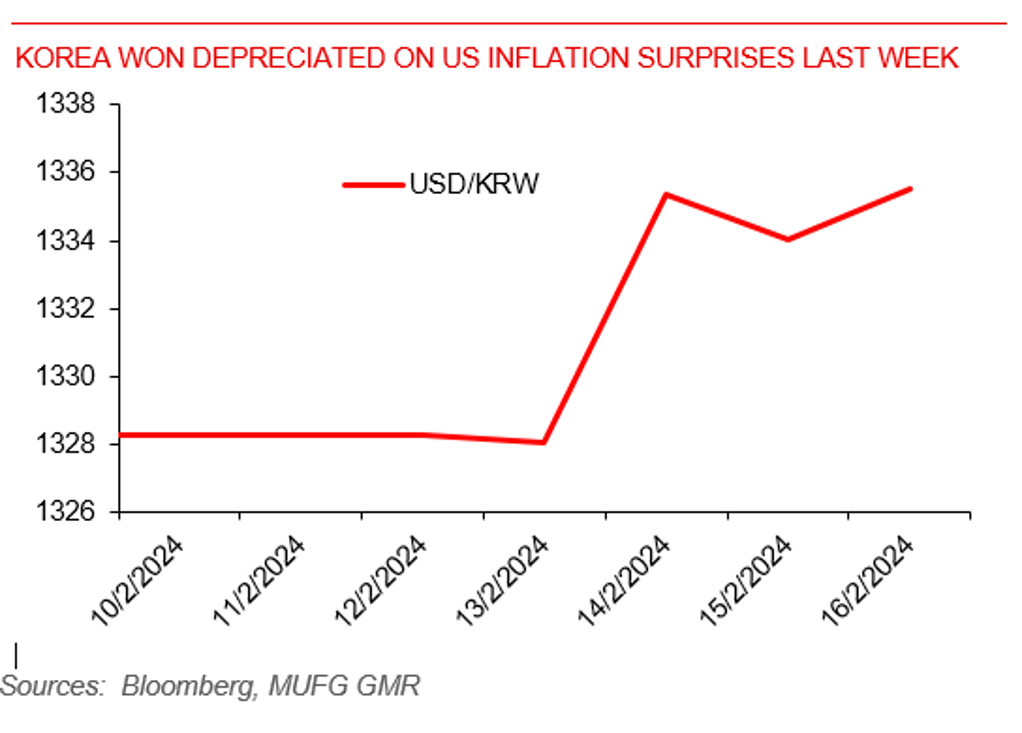

Won depreciated most last week, despite the release of better-than-expected unemployment rate in January