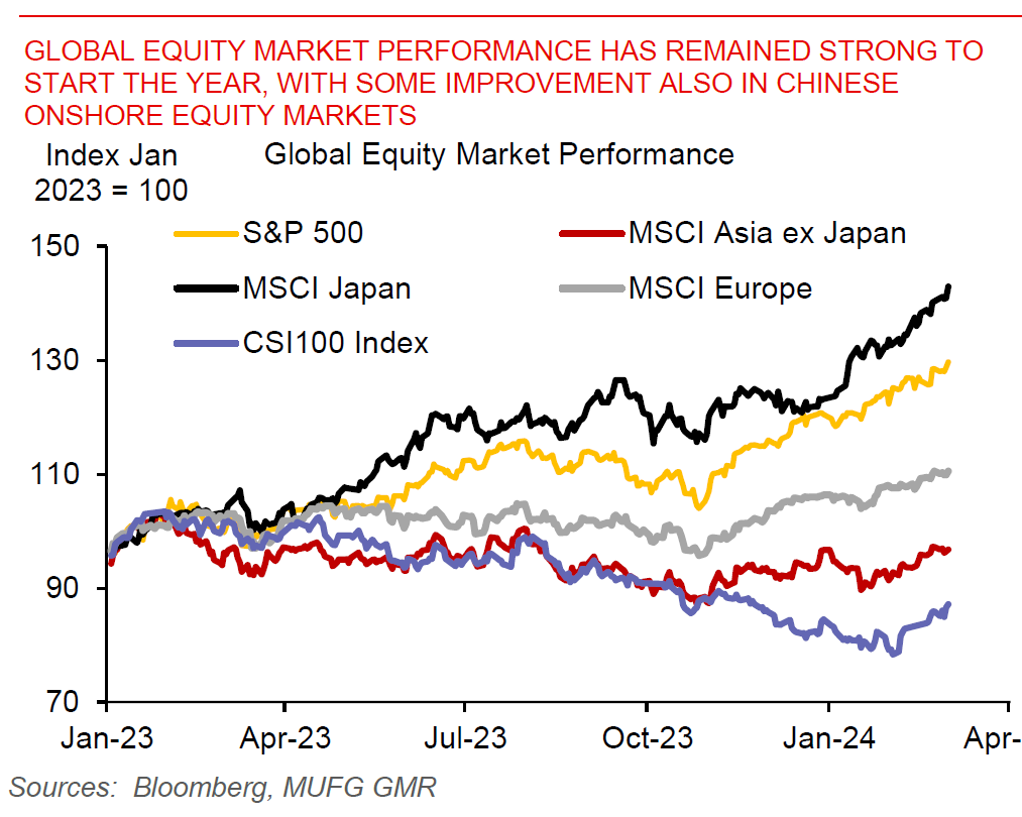

Week In Review: Last week was characterised by decent risk sentiment, with Japan equities rising further, onshore Chinese equities improving with foreign inflows, while US yields declined towards the end of the week on the back of weak US ISM Manufacturing print. With the US Dollar marginally weaker, Asian FX moved to its own drumbeat to an extent. IDR weakened by 0.7% on the back of uncertainty around the new President’s choice of the Finance Minister position and overall policy direction. Meanwhile, MYR and THB gained by the most as US yields declined, while the Bank of Thailand pushed back against emergency rate cuts. The macro data out of Asia were modestly encouraging, with improvements in China’s non-Manufacturing PMIs, coupled with pickup in exports and manufacturing from Vietnam, South Korea and Taiwan.

Capital Flows: Capital inflows into Asia’s equity markets picked up, led by more than US$3bn of Northbound inflows into onshore Chinese markets. We also saw decent foreign inflows into Korea’s equity and bond markets, while India’s bond markets had steady buying of around US$300mn.

Week ahead: In Asia, all eyes will be on China’s upcoming National People’s Congress (NPC) meeting on 5th March. Markets will watch closely for the GDP growth targets and budgeted fiscal deficit, together with policies on the property market, local government debt, attracting foreign investment and demand-side stimulus. We expect authorities to signal more growth support with a GDP target of “around 5%” and a modestly larger fiscal deficit target, but with a continued focus on high-quality development and structural reforms to transform the economy. Outside of China, markets will watch closely on Chair Powell’s semi-annual testimony to Congress and the US non-farm payrolls jobs report.

Global equity market sentiment remained strong