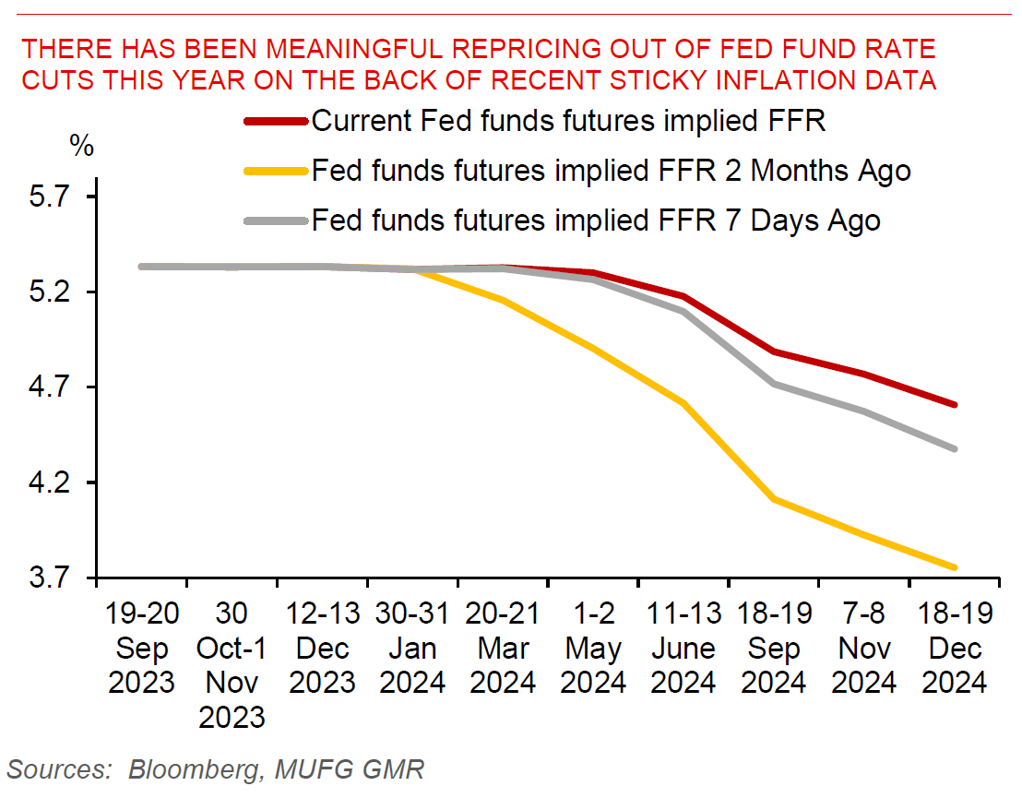

Week In Review: The US Dollar strengthened by 0.7% last week, as data last week showed US inflation being more sticky than expected with the CPI and PPI estimates. Meanwhile, the 1st estimates of wage negotiations in Japan’s labour union showed the strongest wage result in 30 years of 5.28%. Asian currencies weakened, and risk sentiment was mixed even as foreign inflows into China and India’s equity markets picked up. This comes even as the PBOC kept the MLF rate unchanged at 2.5%. The macro data for India was decent, with a further moderation in core inflation trends, together with a pickup in services exports helping to offset the goods trade deficit.

Capital Flows: Capital inflows into Asia’s equity markets continued even amidst a stronger US Dollar, led by more than US$4bn of inflows into China’s stock markets, and to a smaller extent, into India’s equity markets. We saw modest foreign outflows from Korea’s and Taiwan’s equity markets but this comes on the back of strong inflows this year.

Week ahead: This week, the key focus will be the Bank of Japan’s policy decision, the Fed meeting, together with China’s monthly economic data. We expect the Bank of Japan to remove its negative interest rate policy (NIRP) decision this meeting, on the back of data last week showing a strong wage result from the Rengo labour union negotiations. Meanwhile, we expect the Fed to maintain its modestly hawkish tone while acknowledging recent sticky inflation data. Markets will focus on any updates to the Fed’s inflation forecasts and the dot plot. Last but not least, China’s monthly economic data will be important to gauge any signs of economic recovery and possible stimulus measures moving forward.

Meaningful repricing of Fed Fund rate expectations for 2024