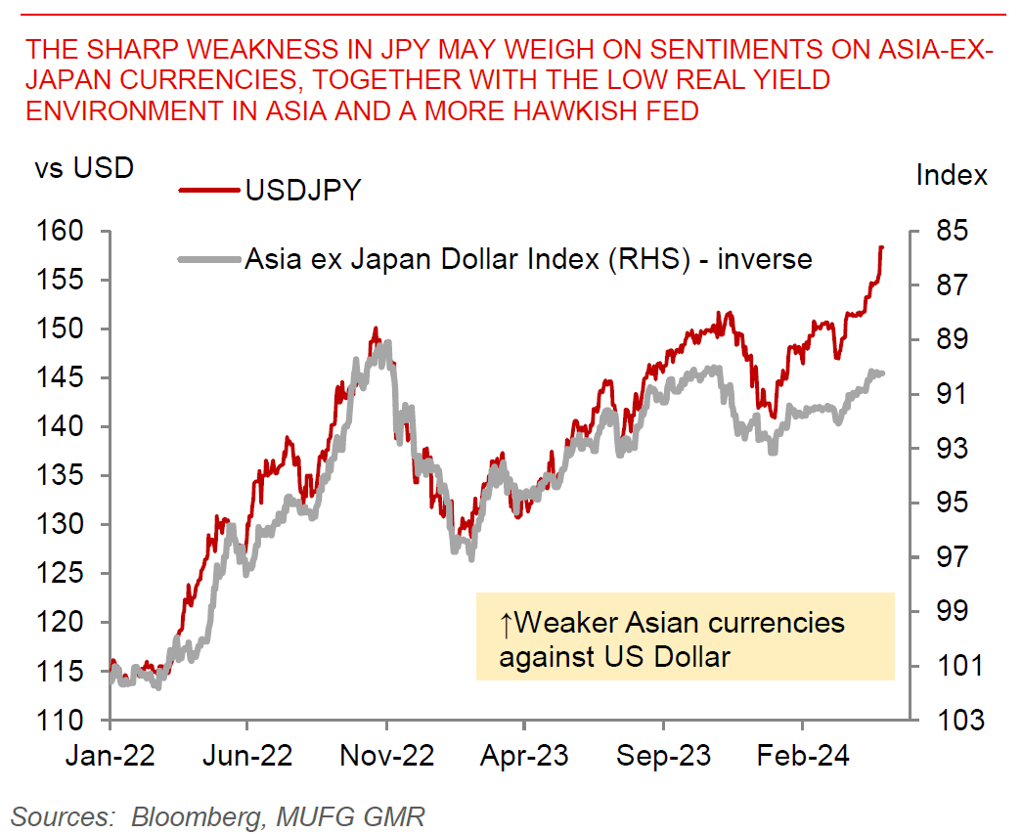

Week Ahead: The key market development last week was certainly the sharp weakness in JPY, with USDJPY breaking above the 158 barrier heading into the weekend - the worst performing currency by far. The Bank of Japan Governor’s reticence to push back against JPY weakness as a meaningful source of inflation pass-through, coupled with continued unclear signals on when (and if) Japan’s Ministry of Finance would actually intervene gave further greenlight to JPY selling (see Global FX Weekly – BOJ offers little help in halting JPY selling and podcast).

While Asian currencies were not impacted so much by the JPY move at least so far, further sharp JPY weakness (or on the flipside meaningful FX intervention to strengthen JPY) could spillover to the likes of KRW, THB and TWD in the weeks and months ahead. Overall, the dominant driver of Asian currencies last week was the better equity market risk sentiment, helped by some ebbing of geopolitical risks, coupled with a slightly weaker Dollar. This was partially reflected in a reversal of capital outflows from Asia, with inflows of more than US$3.5bn into Chinese equity markets in particular, but offset by still weak sentiment in local currency bond markets such as in Indonesia given rising US yields.

It’s an important week for markets this week. We will have the FOMC meeting, where we expect the Fed to send somewhat more hawkish signals over the outlook for rate cuts given the stickiness in US inflation. There will be tier 1 data such as the US non-farm payrolls and ISM Manufacturing. In Asia, the focus will be on China’s official Manufacturing and Non-Manufacturing PMI for April to get a gauge of extent of economic recovery. Meanwhile, South Korea and Vietnam’s export estimates for April will give us a sense of whether the global manufacturing sector recovery has been sustained.

The sharp weakness in JPY may weigh on sentiments on Asia-ex-Japan currencies