Week Ahead FX outlook:

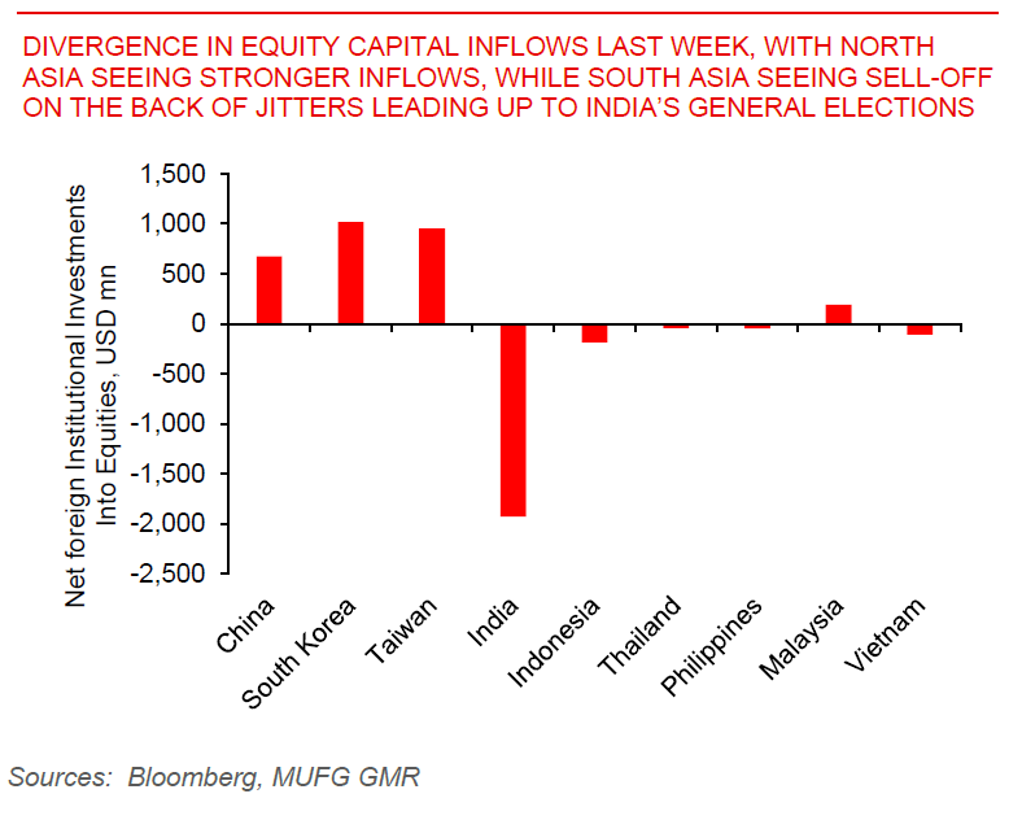

It was a calm week last week for Asian FXs, amid stable US yields and better global risk sentiment. Nonetheless, there were also important divergences beneath the surface in terms of underlying capital flows. North Asian equity markets, particularly China and Hong Kong, were seeing strong performance on the back of foreign inflows. Positive newsflow on property market relaxation measures from local governments in China helped, together with possible scrapping of dividend taxes on Hong Kong stocks bought via Stock Connect. Foreign buying of Korea’s bonds slowed last week as Korea’s government bonds yield fell, causing the underperformance of KRW relative to peers. Meanwhile, South Asia and in particular India’s equity markets saw foreign selling, in the midst of market participant’s jitters in the leadup to the General Elections. RBI’s FX intervention has continued to cap INR weakness even in the midst of these outflows.

The key events to watch for this week are the US CPI print, monthly April Chinese economic data, together with central bank policy decisions from China and the Philippines. The inflation numbers will be important to gauge whether the stickiness in US CPI seen in 1Q has continued, and with that the policy space the Fed has to possibly cut rates this year. This comes as lead indicators on the labour market continue to point to moderation in wage growth and softening in demand in the quarters ahead. Meanwhile, China’s April monthly data will be important to gauge extent of economic recovery and also possibly validate the better equity sentiment seen thus far. While PBOC could keep the loan prime rate unchanged this week, we continue to think that there should be more interest rate cuts through this year to help support the economy and lower bank funding costs, especially after seeing a negative new increase of total social finance in April.

Divergence in equity capital inflows last week