Week Ahead FX outlook:

Asian markets were driven in the past week by a combination of mixed US data and in particular the non-farm payrolls, the starting of rate cuts by global central banks including the Bank of Canada and the European Central Bank, and also significant Election driven volatility across Emerging Markets out of Mexico and India. Nonetheless, with risk sentiment generally strong and US yields trending lower, Asian FX had a decent performance heading into the weekend.

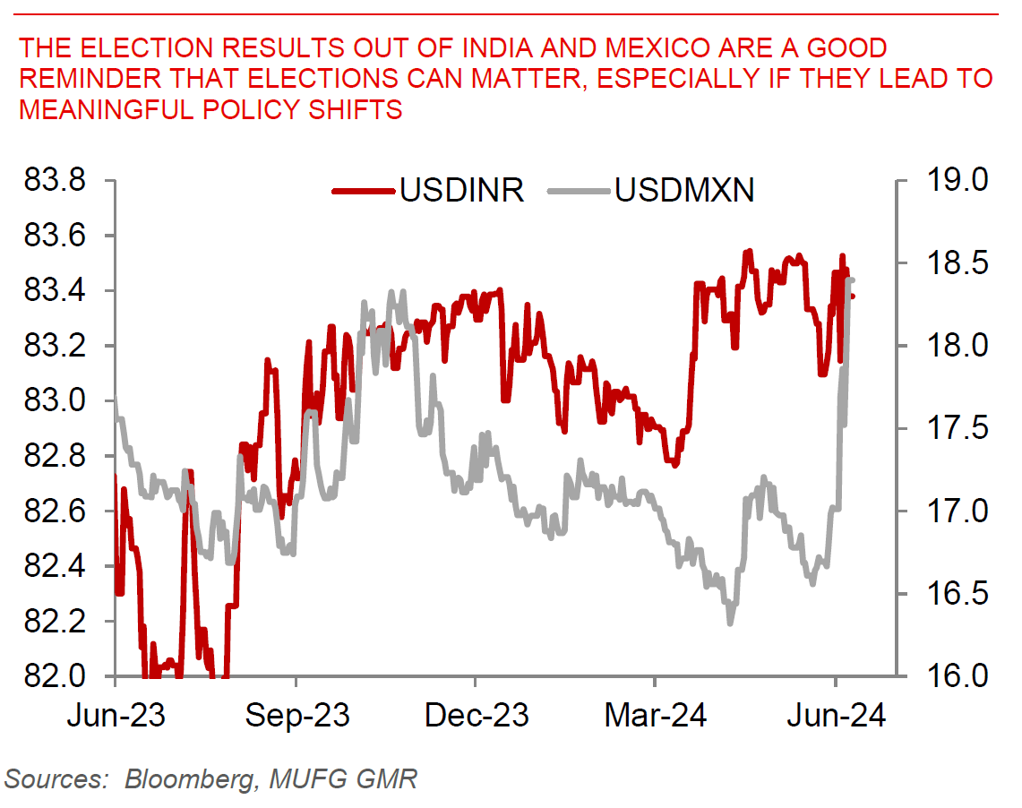

Nonetheless, the key themes driving the past week may perhaps be a harbinger of things to come over the rest of this year. First, the US economy may not be as strong as implied by headline numbers, given the rise in unemployment rates, continued drop in household employment, even as headline payrolls print was at first glance robust. Second, the messages out of the BOC and ECB emphasised a reduction in the level of restrictiveness as a justification of rate cuts, and the Fed may indeed communicate that whenever it starts its own rate cut cycle. Last but not least, the Elections results from India and Mexico remind us that policy shifts can matter for markets, although some more so than others. The most important for markets will certainly be the US Presidential Elections, but in the near-term we will also have Elections from the UK and European Parliament (see report here).

Moving forward, Asian markets will focus on the Fed and Bank of Japan meetings, coupled with US CPI estimates. Our G10 FX team expects a reduction in JGB bond purchases by the Bank of Japan and also a change in tone by BOJ officials, potentially paving a path to further rate hikes in the near-term. The US CPI estimate will be important for setting the tone for the Fed meeting. Assuming that the inflation numbers are in line with the consensus, the Fed should continue to urge patience, data dependency, and to keep policy restrictive for now.

Election results out of India and Mexico are a good reminder that elections can matter, especially if they lead to meaningful policy shifts