Week Ahead FX outlook:

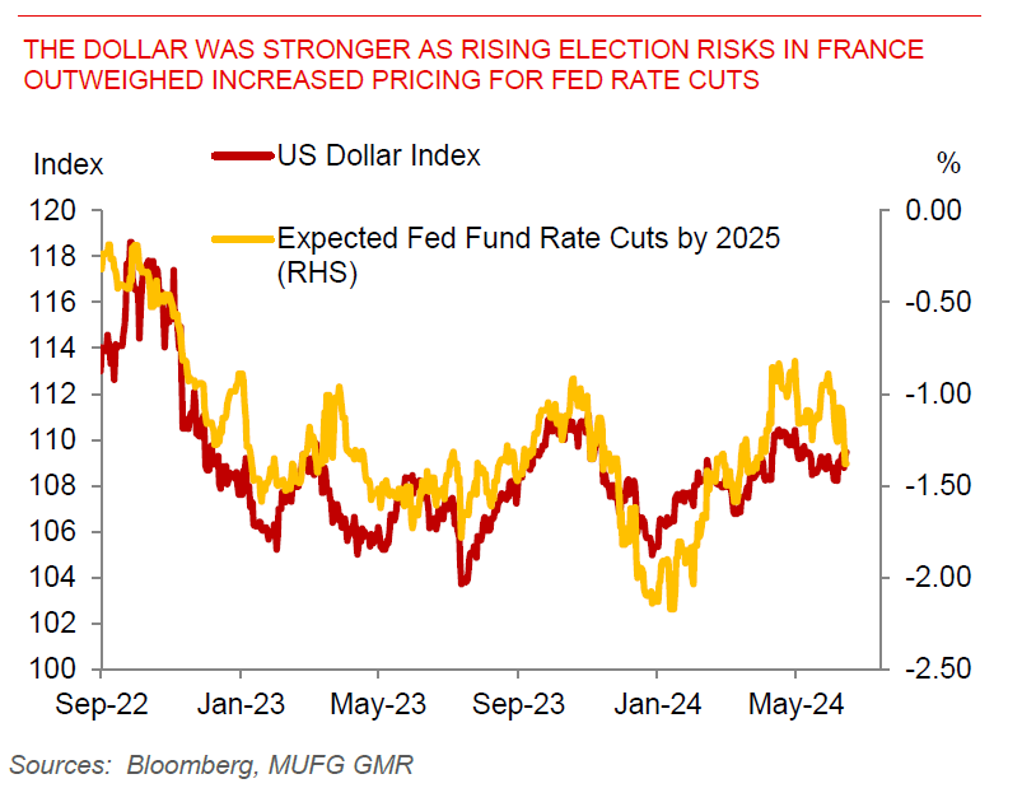

Asian markets were driven in the past week by a macro tug of war of various factors, with softer US inflation prints and lower US yields outweighed by French election risks leading to risk-off sentiment. The weakness in EUR helped supported the broader Dollar Index, which resulted in negative spillovers into Asian markets including FX and equities.

In addition, sentiment in Chinese equities was also weak with underperformance there. This could have been partly driven by the imposition of tariffs by the European Union on Electric Battery Vehicles, and the possible tit-for-tat tariff increases subsequently from China likely in products such as motor vehicles, agriculture and liquor.

There was nonetheless some divergence across Asian currencies. Taiwan and South Korea continued to see strong equity inflows on the back of positive sentiment in AI and tech stocks, together with moves by the Taiwanese central bank to raise the Reserve Ratio Requirement to keep a lid on property price increases. Meanwhile the Indian Rupee had some support from equity inflows on the back of lower inflation data coupled with signs of policy continuity from the incoming government, albeit with policy tilts towards supporting consumption and groups such as farmers and lower income.

Looking ahead, Markets will focus on China’s MLF rate decision next week, together with monthly data such as industrial production and retail sales. There are some expectations in the market that the Chinese central bank may cut rates to support the economy. Meanwhile, there will also be a focus on European PMIs, together with the Bank of England policy decision.

The Dollar was stronger as rising election risks in France outweighed increased pricing for fed rate cuts