Week Ahead FX outlook:

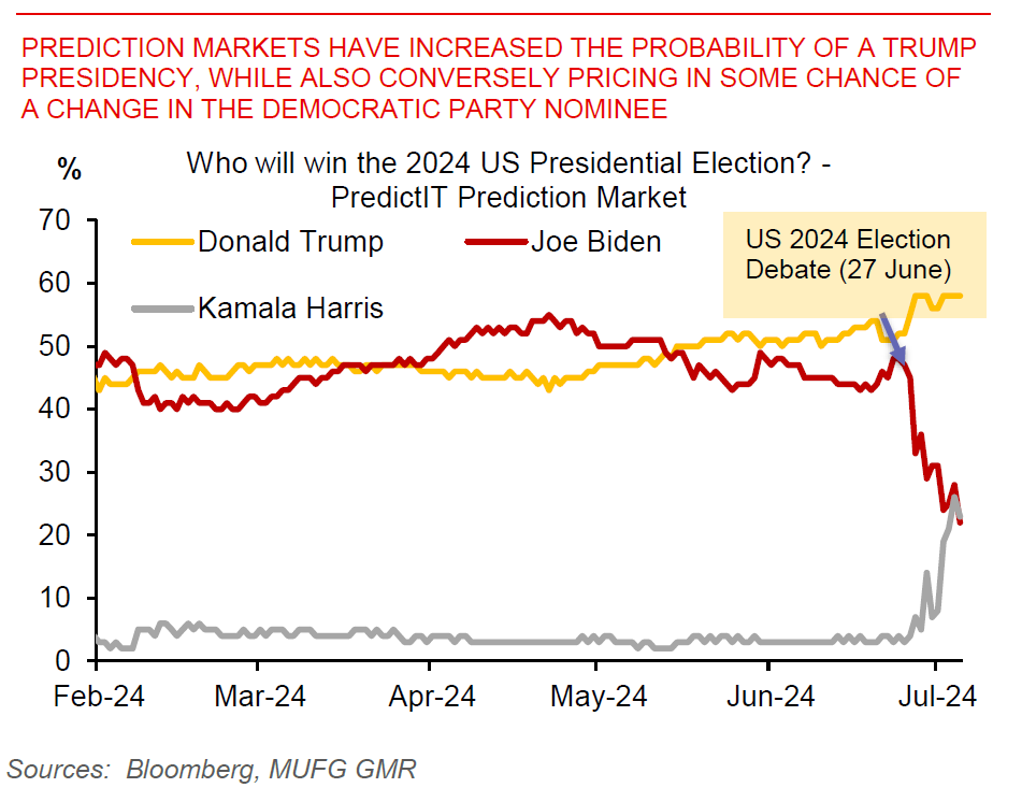

Asian FX markets continue to navigate a multitude of cross-currents. One major driving force is certainly Elections across the globe, and the 1st US Presidential debate held on 27 June has increased the salience of a potential Trump Presidency and with that a Republican sweep. The market moves immediately post the debate have been reasonably modest, but were a familiar combination of higher US yields, stronger equity performance, with mixed trends in the Dollar, and understandably pricing in some inflationary impact of policies such as tariffs and immigration changes. The results of the 2nd round of the French Elections out on 8 June Asia morning will also be important for the direction of Asian FX. On that front, markets have taken positively latest polls suggesting the far-right National Rally party will fall well short of an absolute majority.

Overall, the Dollar has entered a soft patch helped by softer US data (ahead of non-farm payrolls) coupled with optimism around the French Elections, and this has also helped Asian FX and equity markets recovery into the weekend. The currencies that have lagged previously such as Indonesia and Thailand outperformed to some extent, while Philippines bond yields fell on the back of softer CPI. Nonetheless, risk sentiment in China remains weak, with net outflows in onshore equity markets during the week, while authorities have been gradually raising the fixing to relieve some depreciation pressure.

Looking to the week ahead, markets will focus on US CPI, Fed Chair Powell’s testimony to Congress, coupled with the Bank of Korea policy meeting for any possible dovish policy tilts given the softer inflation trends. There will also be trade data out of Taiwan, China and the Philippines, Bank Negara Malaysia monetary policy meeting, together with inflation data from China and India.

Prediction markets have increased the probability of a Trump presidency