Week Ahead FX outlook:

It’s been a volatile week to say the least and a tale of two halves to some extent, with global equity markets turning risk-off towards the latter half, coupled with a pick-up in the VIX index and sell-off in metals. With that, the US Dollar ultimately ended the week stronger, with North Asian currencies such as KRW and TWD underperforming, while the safe-havens such as JPY and CHF outperformed.

There were potentially three major catalysts for the turn in sentiment. First, the lack of specific policy direction from China’s Third Plenum could have disappointed markets, even as the meeting pointed to more stimulus to support the economy together with a focus on raising innovation. Second, news reports suggest the Biden administration is mulling whether to impose more severe trade restrictions on the semiconductor industry. Third, former President Trump in a wide-ranging interview reiterated plans for tariffs on China anywhere from 60% to 100%, together with a 10% tariff across all countries.

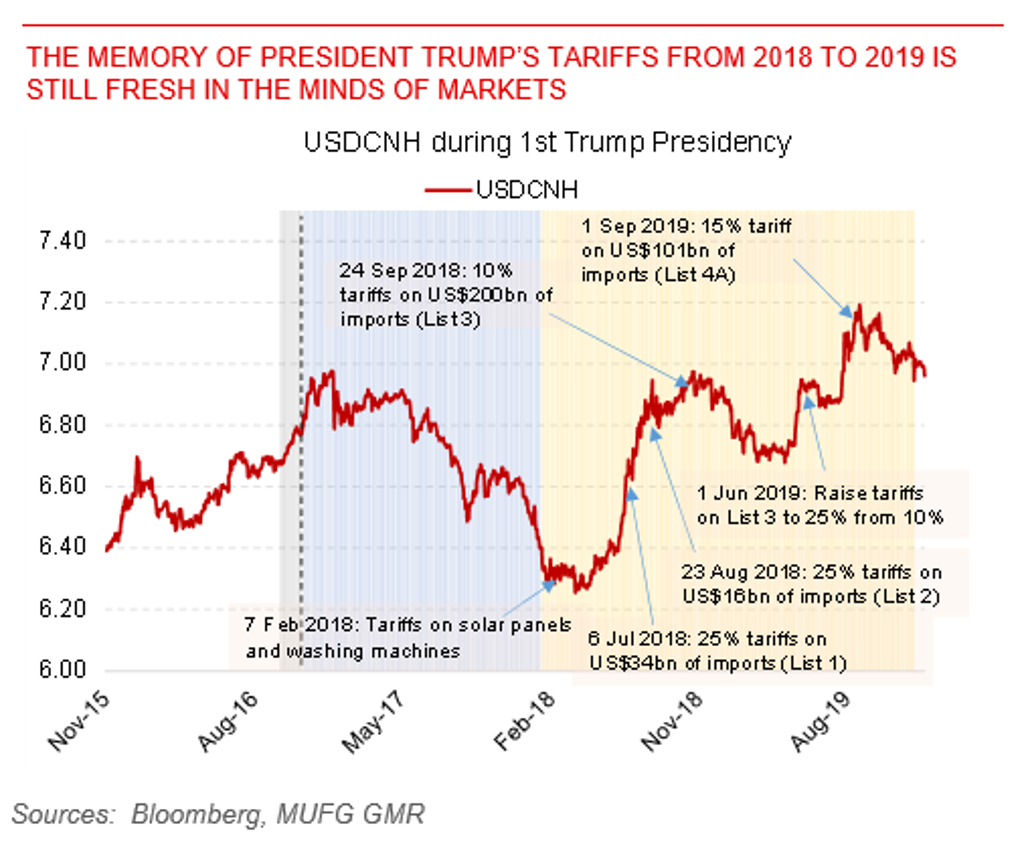

There are of course many phases of Trump that markets are trying to parse and price for, and the recent price action reminds us that markets continue to be in a massive tug of war between expectations of central bank rate cuts, Trump’s growth boosting agenda through de-regulation and tax cuts, and juxtaposed against the negative global growth implications of tariffs.

Looking ahead, Asian FX markets will focus on the full report from China’s Third Plenum to gauge for policy direction, India’s Full Budget for FY2024/25 to be announced on 23 July, coupled with Singapore’s central bank’s policy decision on 26 July. On the global front, US 2Q GDP data coupled with PCE inflation will help shape expectations ahead of the key Fed meeting at the end of this month.

The memory of President trump’s tariffs from 2018 to 2019 is still fresh in the minds of markets