Week Ahead FX outlook:

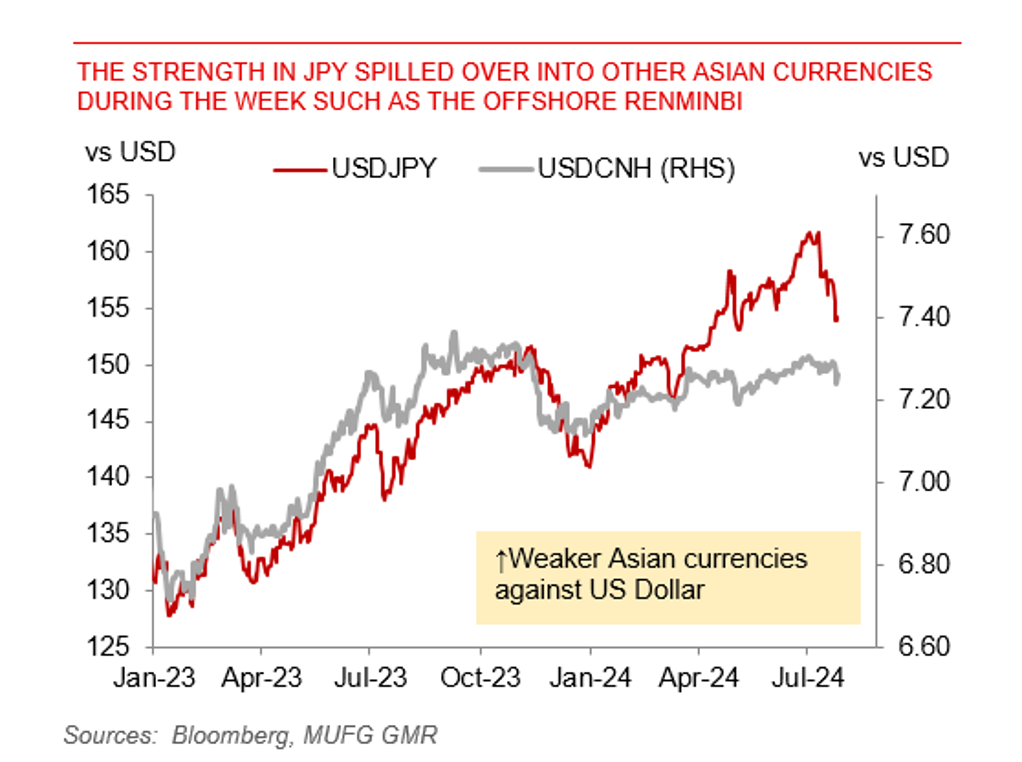

The great unwind in markets continued last week, with risk-off globally leading to sharp correction in equity markets and sell-off in industrial metals, together with somewhat lower bond yields. The moves in FX have been mixed across pairs with carry trade unwinds a dominant theme. The most violent was certainly USDJPY, which has dropped close to 10 big figures since its peak at 162 now down closer to the 153 handle. Higher beta currencies such as AUD have underperformed due to the risk-off sentiment.

In Asia, Chinese equity went south last week, yet, with the unwind of carry trade, CNH strengthened sharply against the Dollar from 7.29 to 7.20 at one point, before reversing to be more reflective of economic fundamental. The PBOC also cut rates across the board unexpectedly, leading to a further rally in CGB bonds. To stimulate economy, government issued notice on the equipment upgrade and consumer goods trade-in program.

Looking ahead, the Bank of Japan, Fed, and China’s Politburo all meet, setting up what could be a crucial week for markets at the crossroads and looking for better clarity on the path ahead. We expect the Fed to keep rates unchanged, maintain optionality for the path forward, and also continue to stress data dependence. However, markets could latch closely on what Chair Powell says in the press conference for any dovish hints. Meanwhile, we expect the Bank of Japan to hike rates by 15bps to 0.25%, while also signalling its plan for bond purchase reductions. We think there will be more specific policies from China’s end-July Politburo meeting to help boost the economy and address the weak property markets, and stimulate consumption and private investment.

The strength in JPY spilled over into other Asian currencies