Week Ahead FX outlook:

The market began the week with a broad-based risk-off sentiment on Monday, and the continued carry trade unwinding pushed the USD/JPY and USD/CNY once to 1.42 and 7.117 respectively in August 5. Later the week, the positive data surprises including smaller US initial jobless claims for the week of August 3 provided some relief to the market, JPY and CNY gave back some of their recent gains. The dovish signals from the BoJ Deputy Governor also helped alleviate the concern of a continuous rapid unwinding of the short JPY carry trades. Asia equity market experienced a larger disinvestment of foreign investors this week.

Next week, key highlights are China’s activity data (retail sales, industrial production, and urban fixed asset investment), Singapore’s final Q2 GDP data, BSP policy rate decision, trade data from India, Indonesia, Singapore (non-oil domestic exports), and inflation data from India. We expect China’s July activity indicators point to a continued weak economic performance, consistent with the decline in July’s composite PMI and lower core CPI inflation. We expect some positives in Singapore’s Q2 GDP growth. Indonesia’s exports could remain weak, dragged down by falling commodity prices weighing on commodity exports. Outside of Asia, key focuses of the week ahead includes US PPI, US CPI, and consumer sentiment index. US Core CPI inflation could remain sticky especially on the services sides. The balance of risks appears to be shifting towards the labour market, with the unemployment rate rising further to 4.3% in July from 4.1% in June. Overall, next week likely will be another week with divergent performance among Asia currencies.

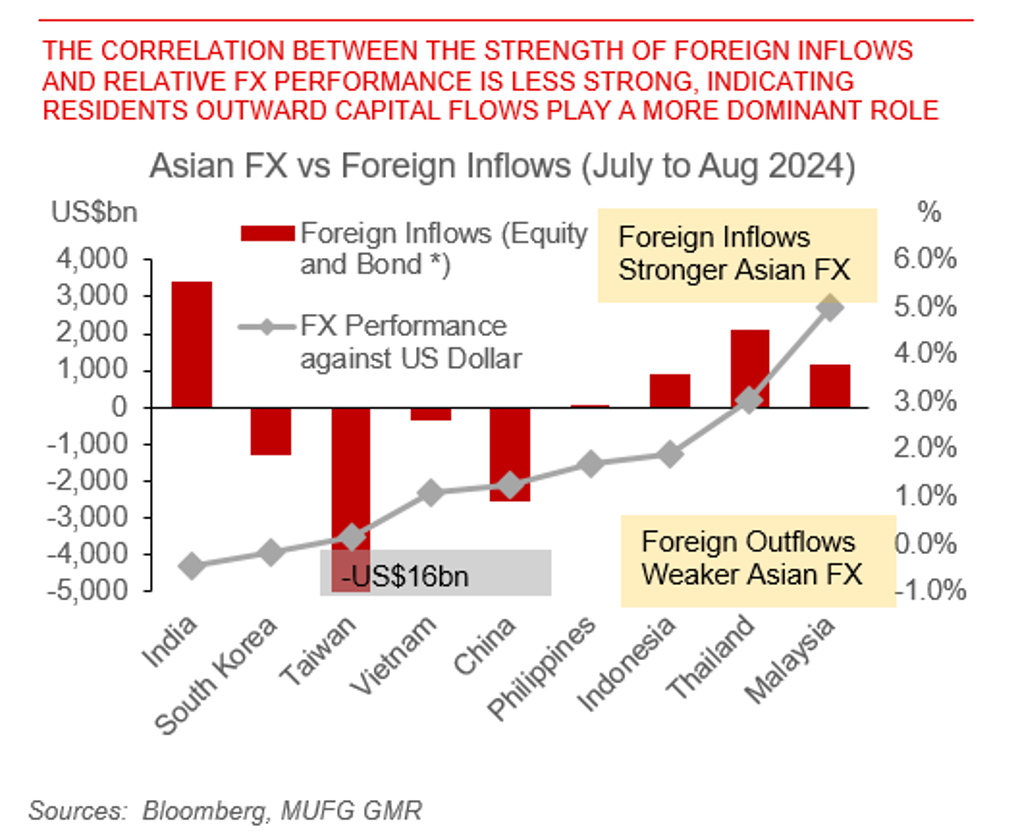

Resident outward capital flows playing a more dominant role