Week Ahead FX outlook:

Market risk sentiment was far better this week, and following the tumultuous start to August and the “great unwind”. This was certainly helped by better-than-expected US data such as the retail sales numbers, which have allayed some fears of a US hard-landing. Meanwhile, the more dovish guidance from the Bank of Japan’s Deputy Governor Uchida has also helped stabilise USD/JPY.

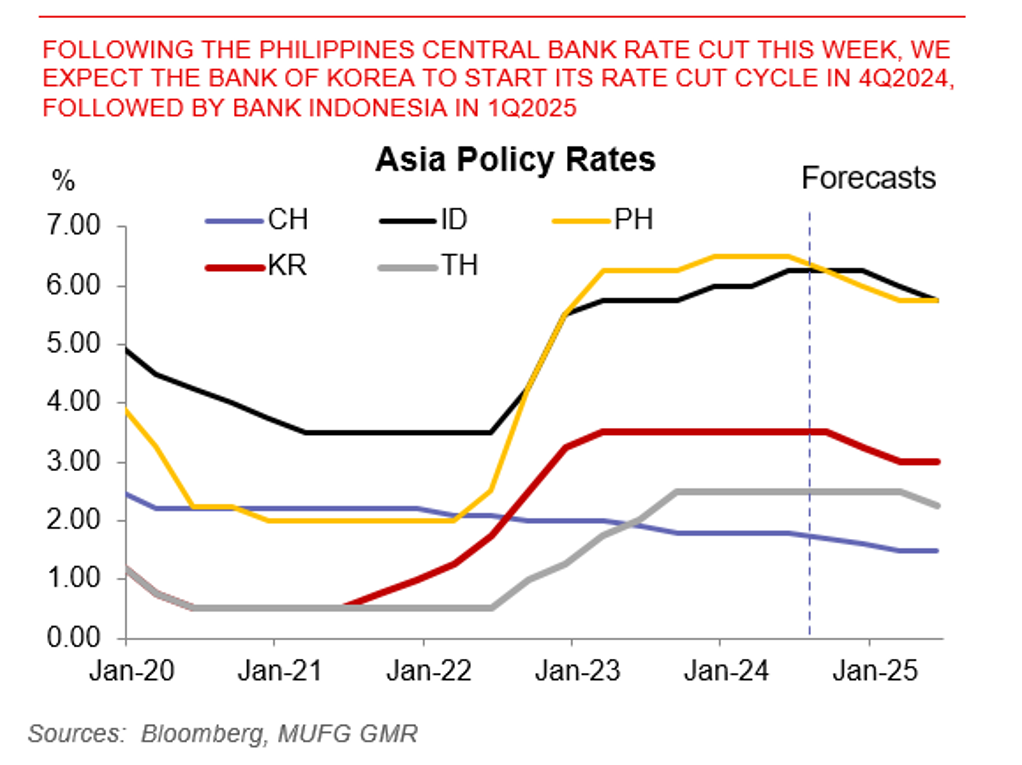

All these global trends have spilled over into Asian FX, with lower-yielding and/or “cheap” currencies such as IDR, THB, and KRW outperforming, while INR continued to underperform on the back of strong import demand, near-term foreign portfolio selling, coupled with likely unwind in carry trades. Nonetheless, two key developments in Asia make us think that the path forward may not be a simple linear extrapolation of trends seen so far. For one, China’s data continued to be weak and mixed, with a slowdown in IP and weak property activity offsetting some mild improvement in retail sales. The weakness (but subsequent recent stabilisation) of industrial metals point to the tentativeness of global economic recovery. Second, the Philippines central bank cut rates by 25bps in its August policy meeting, which indicates that the Fed is not the only central bank in town looking to reduce the restrictiveness of policy rates.

On that front, we will have four key central banks in Asia meeting next week – the Bank of Thailand, Bank of Korea, Bank Indonesia, coupled with China’s loan prime rate decision. While we do not expect any Asian central banks to change their policy rates officially, markets will watch closely for any signs of dovish shifts, be it in their statements or post-policy question and answer session. On global events, we will also have the Fed’s Jackson Hole symposium from 22-24 Aug, where Fed Chair Powell will speak on 23 Aug, together with Bank of Japan Governor Ueda’s testimony to Parliament on 23 Aug.

BoK likely to start its rate cut cycle in 4Q2024, followed by BI in 1Q2025