Week Ahead FX outlook:

It was a week with major market moves including here in Asia. The most important event was that Fed kicked off its easing cycle with a jumbo 50bps cut in this September meeting. The size of this 50bps cut is in line with our global team’s out-of-consensus call (see Sep 2024 FOMC Recap). The path of least resistance is for continued rate cuts by the Fed, and our global team sees the bias of risks for larger rate cuts than the FOMC is collectively forecasting, and as such also for further Dollar weakness (see FOMC goes big to revert to small).

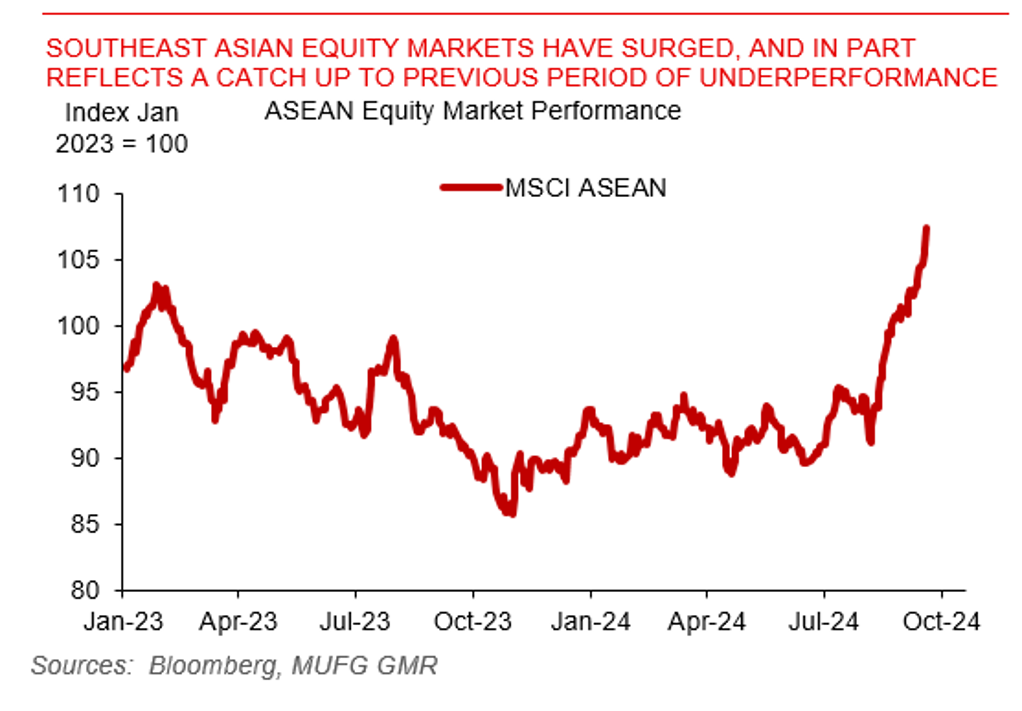

All these developments will continue to have important ramifications to Asian currencies and asset prices more broadly. One key transmission mechanism is through the willingness of Asian central banks to cut rates more aggressively, and over here Bank Indonesia’s surprise 25bps rate cut this week is one key example. We now forecast USD/IDR at 14,900 by 2Q2025, with another 100bps of BI rate cuts over the same period (see Indonesia: BI cuts rates and signals further easing). This week, we also had further dovish signals out of the Philippines central bank. The BSP cut the Reserve Ratio Requirement by 250bps, bringing it to 7% from 9.5% previously, while the Philippines Finance Secretary Ralph Recto said he will back a 50bps rate cut at the BSP’s meeting in October. With expected real rates quite high in both Indonesia and the Philippines, coupled with more stable currencies providing the policy space to support growth, this has also supported equity inflows into ASEAN equity markets more broadly.

The other key factor as the US rate cycle turns is the valuation factor, and the Malaysian Ringgit is emblematic of this. While the currency has been weak for a long-time, the prospects of Fed cuts, robust local growth in Malaysia, continued repatriation of Dollars by residents, coupled with strong foreign equity and bond inflows have all combined to help. We have just revised our USD/MYR forecast to 4.12 by end-2024 and 4.05 by 2Q2025 (see inside full report for details).

Southeast Asian equity markets have surged recently