Week Ahead FX outlook:

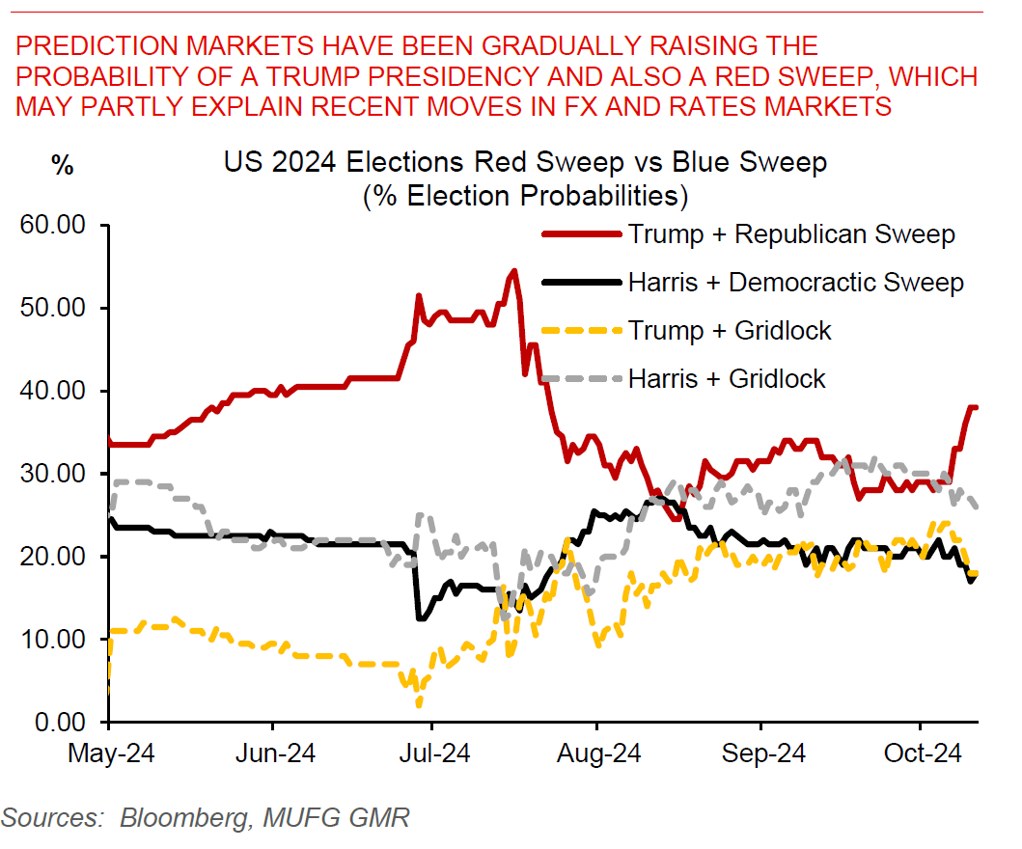

Asian currencies have encountered continued headwinds over the past week, with continued paring back of Fed rate cuts, geopolitical tensions, coupled with uncertainty around the outcome of the 2024 US Elections. Somewhat sticky inflation coupled with a strong US non-farm payrolls print have sprinkled some semblance of doubt around the pace of Fed rate cuts, even as the path of least resistance is still for 25bps for each remaining Fed meeting this year. Meanwhile, Trump’s prospects and just as importantly a Republican sweep has been rising in prediction markets over the past week, and this may partly explain moves higher in US yields and also the stronger Dollar that we have seen.

Amidst these confluence of events, the magnitude and quality of China’s fiscal stimulus measures will be closely watched, with implications not just for itself but also for the rest of Asia and for global growth. China’s Ministry of Finance will hold a briefing over the weekend (12 Oct) on fiscal policy, and we wouldn’t be surprised if a RMB 1-2tn fiscal stimulus package is announced to address short-term cyclical pressures. That said, more sizeable fiscal support from the central government is needed given the significant extent of problems seen in the property sector and local government balance sheets.

A plethora of Asian central banks will also meet next week – Singapore, Thailand, Philippines, and Indonesia. This also comes on the back of two meetings this week where India turned more dovish while the Bank of Korea cut rates by 25bps. We expect BSP to cut by 25bps, while for MAS, BOT and BI to remain on hold.

Prediction markets have been gradually raising the probability of a Trump Presidency and also a Red Sweep