Week Ahead FX outlook:

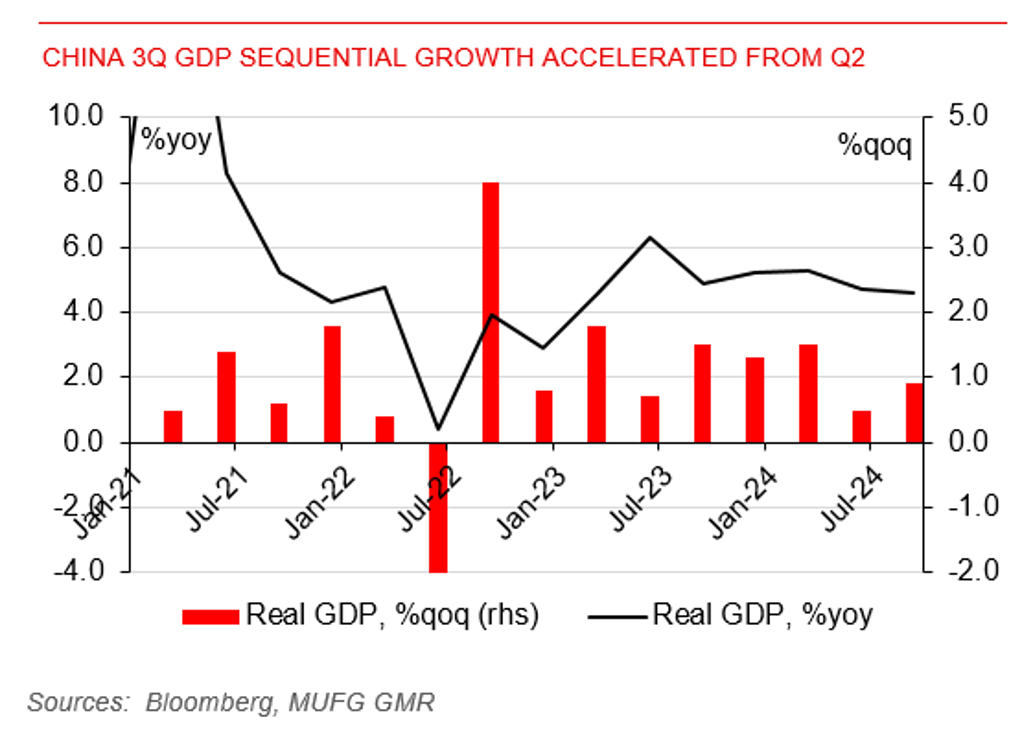

Several factors are working on global markets. In addition to traders’ dial back on the size of Fed’s potential rate cut, Trump trade, geopolitical risks, the newly announced better-than-expected China September and slightly stronger sequential GDP growth in Q3 added some positiveness to the market. Shanghai Shenzhen CSI 300 index once went up by 5.5% in a single day this Friday and ended the day with a 3.6% gain. This week, government bond yield spreads went lower as US yields rose, and the outflows of foreign investors from Asia equity markets were seen too, pressuring on Asian currencies. USD/CNY went up by 0.6% this week, reflecting market participants’ disappointment over the lack of size of fiscal stimulus out of recent high level policy meetings, as well as US dollar’s strength.

Next week, these global factors likely continue to impact Asian FX pairs, along with some key data releases like advance estimates for South Korea’s Q3 GDP, inflation data from Singapore and Malaysia, and industrial production data from Taiwan and Singapore. We expect some mild sequential pick up in South Korea’s Q3 GDP after a 0.2%qoq drop in Q2. Singapore’s headline inflation is set to slow further to 2%yoy in September from 2.2% in August, given high base effects for prices of fuel-sensitive goods and services. Core inflation is also likely to step down towards 2%. We look for the MAS to start loosening its exchange rate policy setting in January 2025. Non-Asia key data releases include US initial jobless claims, and PMIs for major economies.

China 3Q GDP sequential growth accelerated from Q2