Week Ahead FX outlook:

Trump has just won a 2nd term as US President and at the time of writing the Republican Party may also win the House together with the Senate leading to a Red Sweep. This was a race which saw almost all demographic groups increase their vote share for Trump, with more than 80% of voters who place importance on immigration and the economy voting for Trump, based on latest exit polls.

With such a resounding victory, President-Elect Trump together with a possible Republican Congress will likely be confident in pushing through his gamut of proposed policies, all which could have important spillover impacts to Asia. These stated policies include 60% tariffs on imports from China, 10-20% tariffs on imports from all countries, greater scrutiny on manufacturing supply chains, stricter immigration policies, together with tax cuts and expansionary fiscal policy. Nonetheless, it’s important to note that there are various shades of grey here, and not one version of Trump. The composition, sequencing and magnitude of his policies will matter greatly for market reaction including to Asian FX and rates.

We did a preliminary analysis of the possible impact of Trump’s tariffs on Asian FX, with the assumption that Trump moves faster on tariffs compared with his first term but is unlikely to go the full extent of what he has said publicly (see Asia FX – The impact of Trump’s potential tariffs). For CNY in particular, our key conclusion is that 60% tariffs would require a 10-12% depreciation of CNY. We estimate that direct fiscal injection and stimulus of RMB2.5 to 3 trillion could offset this 60% tariff all else equal, and that the likes of SGD, MYR, KRW and THB are likely more vulnerable to the combined impact of tariffs. Our global team’s scenario for Trump + Red Sweep is for the Dollar to be roughly 7-8% stronger, and for the Fed funds rate to be around 100bps higher relative to our baseline forecasts. In general, we would expect continued Dollar strength, somewhat higher US yields, and weaker Asian currencies heading into 2025.

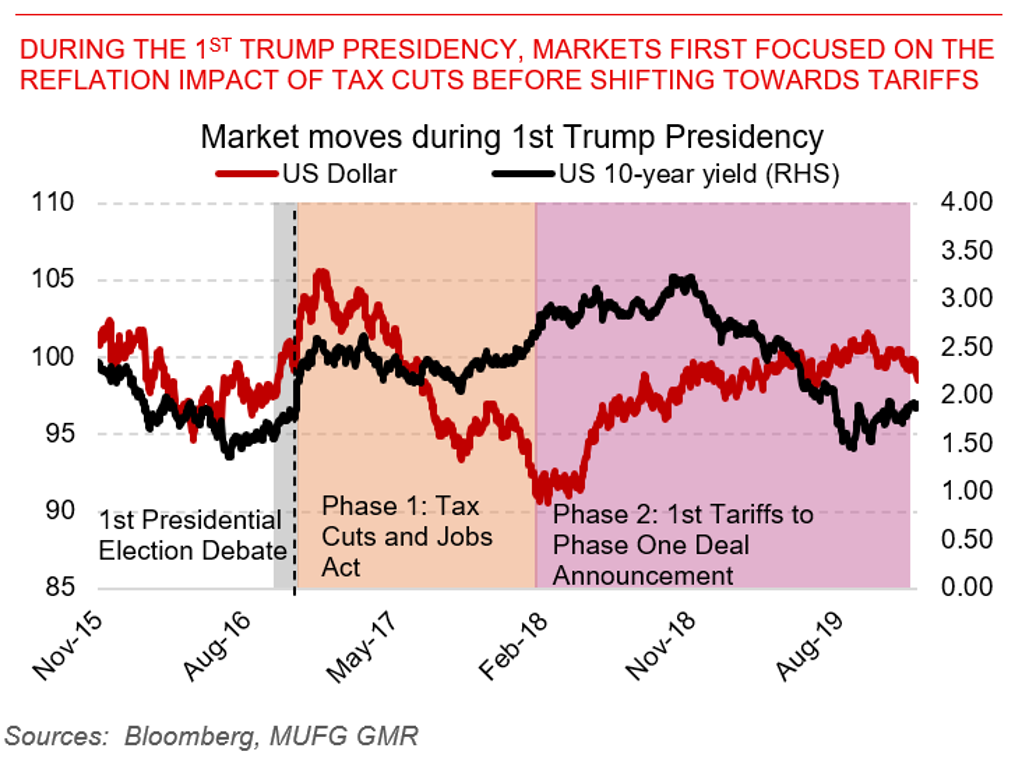

During the 1st Trump presidency, markets first focused on the reflation impact of tax cuts before shifting towards tariffs