Week Ahead FX outlook:

The Dollar index continued to strengthen over the past week, with EUR/USD breaking below the 1.0500 levels, although this had a mixed impact on Asian currencies over the week. Chinese authorities pushed back to some extent on the pace of CNY weakness by keeping a relatively stable USD/CNY onshore fixing. Meanwhile, Thailand and Singapore’s 3Q GDP both came in stronger than expected, with stronger fiscal disbursement helping to boost economic activity. This may also partly help to explain why the Thai Baht strengthened and outperformed during the week.

Overall from a global perspective, a stronger Dollar remains the path of least resistance with Trump becoming the President with a Red Sweep, and the prospects and expectations of tariffs have also negatively impacted Asian currencies. The key global developments over the past week include continued appointments of Trump’s cabinet. Howard Lutnik has now been nominated as Commerce Secretary with additional direct responsibilities over the US Trade Representative Office, and as such will have an important say on tariff policy. Lutnik has mentioned using tariffs as a strategic tool to achieve the US’s economic and trade aims. While Robert Lighthizer has not been officially appointed to any role, he will likely remain a key advisor to the President and the current administration on trade and tariff policies. Meanwhile, the Treasury Secretary position remains open for now with key additional contenders reported to include Kevin Warsh and Marc Rowan.

Over in Asia, central banks are likely to slow their pace of rate cuts accounting for both a stronger Dollar and possible left tail risks from higher geopolitical risks. Bank Indonesia kept its policy rate unchanged at 6% this week. While we look for BI to cut rates again by 25bps to 5.75% in December, this is predicated on the Fed cutting and USD/IDR stabilising (see Slower pace of BI rate cuts).

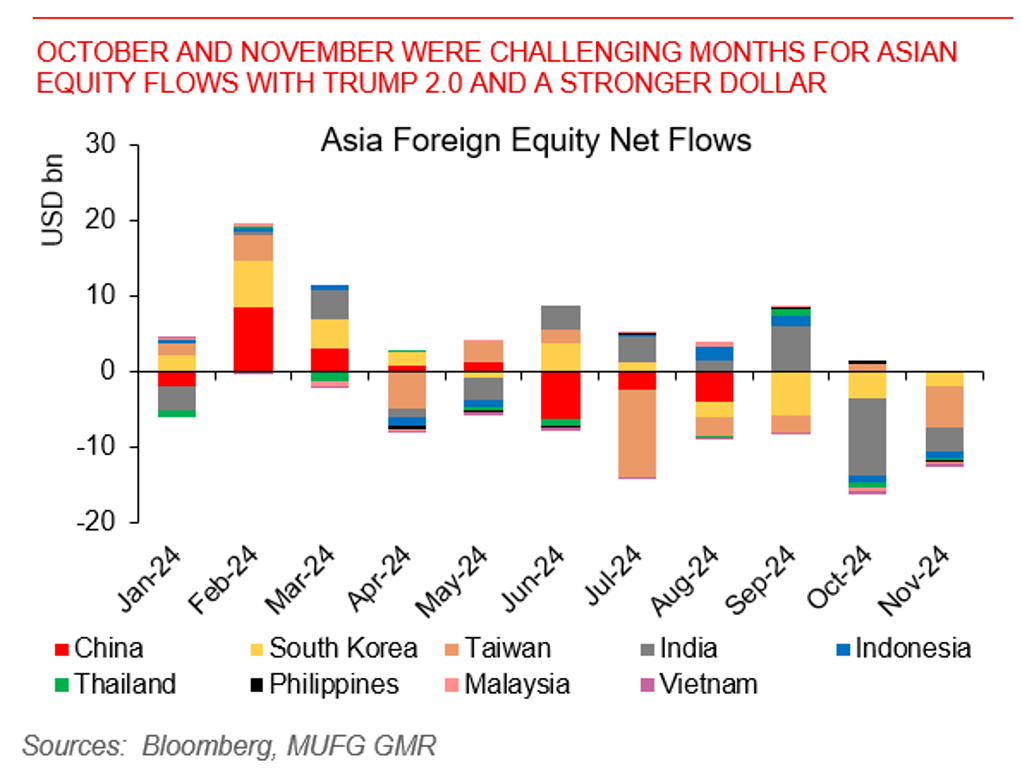

October and November were challenging months for Asian equity flows