Week Ahead FX outlook:

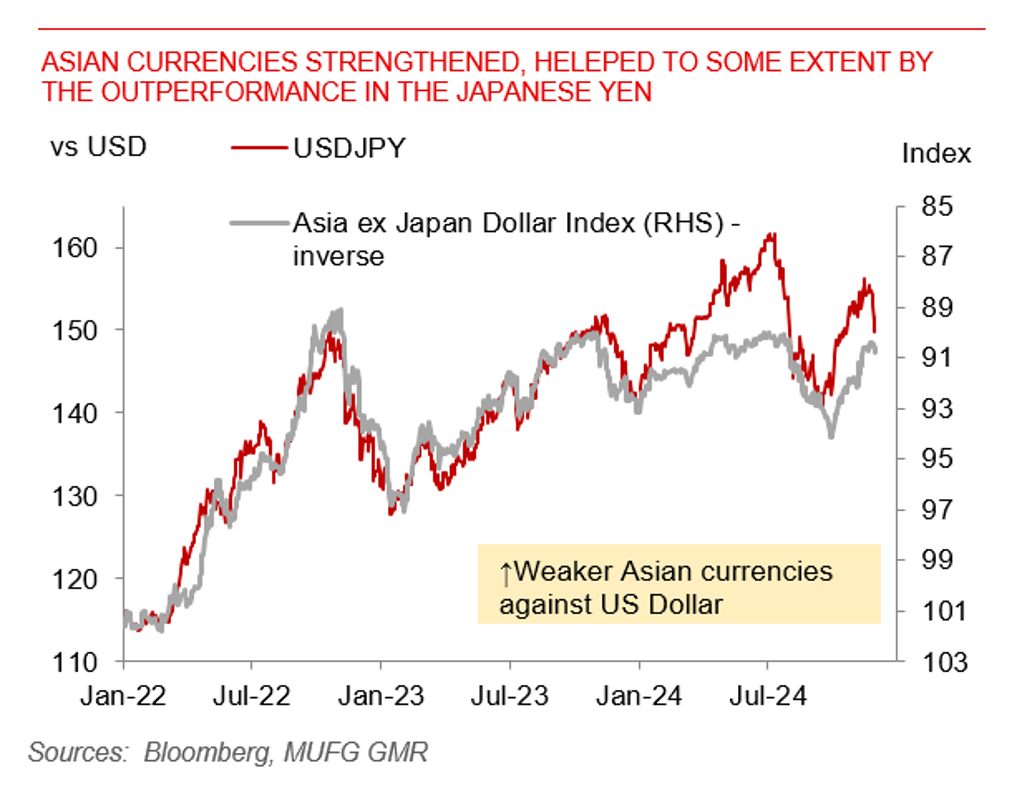

The Dollar index reversed its strength over the past week and this correspondingly had an impact on Asian currencies. In particular, JPY was the clear outperformer with rising market expectations for a December Bank of Japan rate hike and USD/JPY dropping to around 150 levels. This also had spillover impact to the rest of the Asian FX complex with USD/CNH moving towards 7.23.

Overall, the fundamentals and the likelihood of Trump’s policy priorities including on tariffs point towards weaker Asian currencies moving into 2025 in our view. It’s interesting to note from a cross-asset perspective the weaker Dollar this week was not accompanied by a broad improvement in risk sentiment in Asian equity markets. We continued to see net selling in the local equity markets especially Taiwan and South Korea, although we did some improvement in Chinese onshore A shares markets. Growth sensitive commodities were mixed with a pick-up in iron ore prices but with declines in copper. The incremental newsflow from Trump’s nominations and announcements likely imply a faster and broad-based start to tariff implementation, and we think that the path of least resistance is still for Asian FX to weaken moving forward.

For Asian policymakers, balancing the various priorities on growth vs inflation is compounded by the fogginess of Trump’s policies in 2025. This was emblematic in this week’s Bank of Korea decision to cut rates by 25bps in a surprise decision. BOK Governor Rhee Chang-yong said in the post policy meeting that the decision can be interpreted as an “acceleration of easing to deal with downward economic risks that are growing larger than expected…”, and “among the biggest changes since August is the ‘red sweep’ in the US”. We think that Asian central banks are overall still likely to cut rates in 2025 but likely at a more gradual pace now.

Asian currencies strengthened, helped to some extent by the outperformance in the Japanese Yen