Week Ahead FX outlook:

As we emerge from the shadows of 2024 and enter into the dawn of 2025, Asian currencies and risk assets generally have started off the year on a weaker footing. Our forecasts for weaker Asian currencies in 1H2025 with the spectre of tariffs from Trump 2.0 are starting to play out, even if there are importantly country specific idiosyncrasies at play as well.

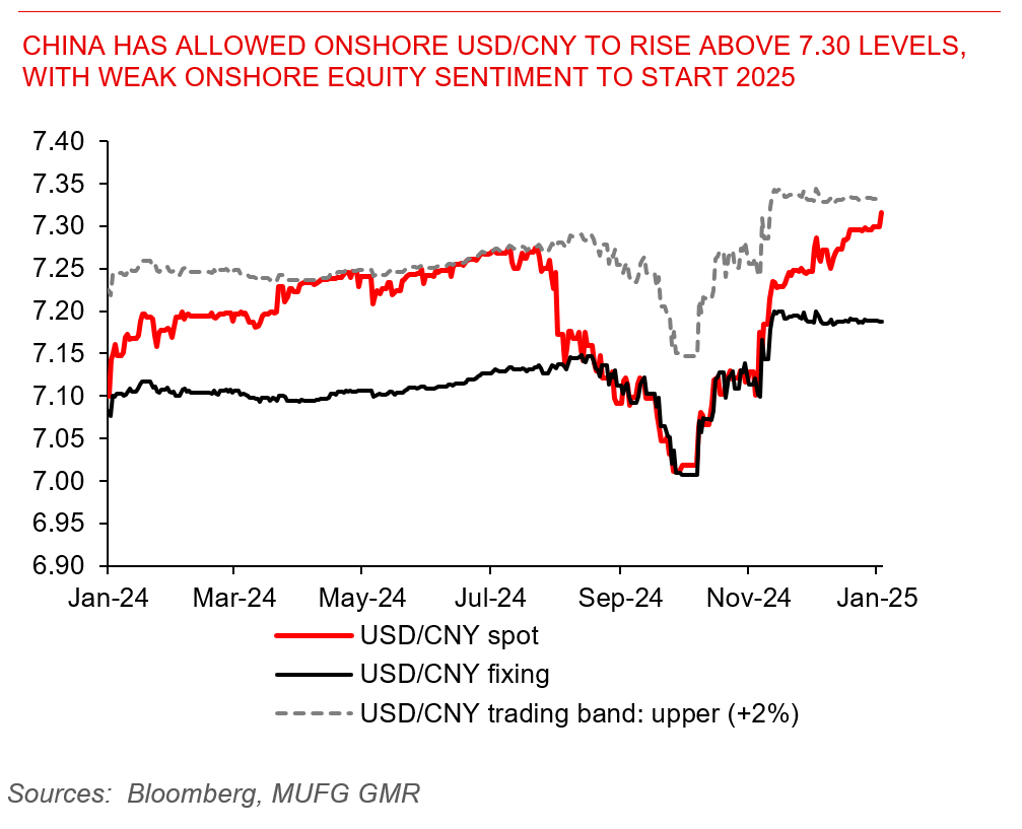

In particular, markets very much focused on China. Onshore Chinese equity markets fell more than 5% to start 2025, while authorities allowed USD/CNY to break past the psychological 7.300 level after defending it for some time through its arsenal of tools. Meanwhile, China’s 10-year bond yields fell further to 1.60%. Chinese markets seemed trading consistently lately on a risk aversion sentiment. Lower government bonds yields may be pushed by the comments of PBOC to the Financial Times that it is likely to cut interest rates further at an “appropriate time” coupled with some mixed data from China’s manufacturing PMI numbers.

With USD/CNH breaking above 7.35 and USD/CNY above 7.31, these moves spilled over into other Asian FX markets as well. Asian currencies with high beta to renminbi moves understandably weakened more over the past week including SGD, MYR, and THB. Despite the ongoing political uncertainty the South Korea won saw some modest outperformance, with acting-President Choi Sang Mok appointing two judges to the Constitutional Court. Meanwhile, weakness in IDR and INR were likely capped by intervention from respective central banks.

Looking ahead, markets will focus closely on the US non-farm payrolls print to gauge the future path of the US Dollar and Fed policy, together with any further updates on Trump’s policies ahead of his inauguration later this month.

China has allowed onshore USD/CNY to rise above 7.30 levels, with weak onshore equity sentiment to start 2025